Bull Call Spread – Moderately Bullish Option Strategy

A limited-risk bullish strategy created by buying a lower strike Call and selling a higher strike Call, ideal for moderately bullish markets.

What is a Bull Call Spread? The Defined-Risk Bullish Strategy

A Bull Call Spread, also known as a Debit Call Spread, is a moderately bullish, defined-risk options strategy that involves the simultaneous purchase of one call option at a specific strike price and the sale of another call option at a higher strike price. Both options share the same underlying asset and the same expiration date. The primary objective of this combination is to significantly reduce the net upfront cost (debit) of establishing a bullish position compared to buying a naked call option outright. In exchange for this cost reduction, the trader willingly accepts a cap on the strategy's maximum profit potential.

The core appeal of the bull call spread lies in its elegant risk-reward balance. It offers a more affordable entry point, strictly predefined and limited risk, and a reasonable profit potential that aligns with a view of a steady, upward price move rather than a parabolic rally. This makes it an ideal tool for intermediate traders who have a constructive but cautious bullish outlook. While a simple long call requires a substantial move in the underlying asset to become profitable, the bull call spread achieves a lower breakeven point, thereby increasing the statistical probability of a profitable trade.

- Risk is Limited and Known: The maximum possible loss is confined exclusively to the total net premium paid to enter the spread. This amount is known the moment the position is opened.

- Profit is Capped but Favorable: The maximum gain is limited to the difference between the two strike prices, minus the net premium paid. This cap is established at initiation.

- Reduced Net Cost: The premium received from selling the higher strike (out-of-the-money) call option directly offsets a portion of the cost of buying the lower strike (at-the-money or in-the-money) call, resulting in a lower net debit.

When to Use a Bull Call Spread: Ideal Market Conditions

This strategy is most effective when your market outlook is cautiously optimistic. You anticipate a gradual or moderate upward price movement in the underlying asset, but you are either uncertain about the potential for a sharp, explosive rally or you believe such a rally is unlikely. It is perfectly suited for navigating markets that are grinding higher in a controlled manner, allowing you to capture profits efficiently while maintaining a protective risk management structure.

- You hold a moderately bullish view and expect a steady appreciation in price, not a rapid, gap-up explosion.

- Your primary goal is to reduce the initial capital outlay and minimize the negative effects of time decay compared to a standard long call position.

- You are psychologically comfortable with the trade-off of capping your maximum profit in exchange for a higher probability of achieving a gain.

- You expect implied volatility to remain stable or increase slightly, which can help support the value of the long call leg of the spread.

Setup Checklist: Prerequisites for a High-Probability Trade

A successful bull call spread begins with meticulous planning and setup. Before entering the trade, rigorously evaluate these critical factors to ensure the strategy aligns perfectly with your market thesis and risk tolerance.

- Underlying Selection: Choose a highly liquid stock or index (e.g., NIFTY 50, Bank NIFTY, or large-cap stocks like RELIANCE or TCS) with active options markets. This ensures tight bid-ask spreads and ease of entry and exit.

- Strike Selection: Typically, buy an At-The-Money (ATM) or slightly In-The-Money (ITM) call option to give the position immediate intrinsic value. Simultaneously, sell an Out-of-The-Money (OTM) call option to finance the purchase. The distance between the strikes defines your risk-reward parameters.

- Expiry Selection: An expiration timeframe of 2 to 6 weeks is often optimal. This provides sufficient time for the anticipated price move to materialize while avoiding the accelerated time decay (theta) that severely impacts very short-dated options.

- Risk Budgeting: The net premium paid is your maximum risk. Ensure this amount represents only a small, manageable percentage of your total trading capital, adhering to sound position sizing principles.

Entry Rules: Executing the Strategy with Discipline

A disciplined, rule-based entry is fundamental to improving long-term success rates and avoiding emotional decisions.

- Buy 1 ATM or slightly ITM call option (e.g., a 25,000 Call if NIFTY is at 25,000).

- Sell 1 OTM call option with a higher strike price (e.g., a 25,500 Call) with the same expiration date.

- Calculate and record the Net Premium Paid (Debit): (Price of Long Call - Price of Short Call). This is your total cost and your maximum possible loss.

- Pre-calculate and note your Maximum Profit, Maximum Loss, and Breakeven Point in your trading journal before placing the order.

Risk & Management: Navigating the Trade Lifecycle

Active management and a deep understanding of the position's behavior under various market conditions are key to maximizing the strategy's effectiveness.

- Downside Risk: Strictly limited to the net premium paid. The loss is maximized if the price of the underlying asset is at or below the lower strike price at expiration.

- Upside Potential: Capped at the difference between the strike prices minus the net premium paid. The profit is maximized if the price of the underlying is at or above the higher strike price at expiration.

- Time Decay (Theta): This is a double-edged sword. It erodes the value of the long call but is partially offset by the decay of the short call you sold. The net effect is typically less damaging than a naked long call if the price stays stagnant.

- Volatility (Vega): An increase in implied volatility generally benefits the long call more than it hurts the short call (which has a lower vega), resulting in a net positive effect on the spread's value. A sharp drop in volatility can hurt the position.

- Adjustments: If the price move stalls or reverses, consider rolling the entire spread to a later expiration (for a debit or credit) or closing the position early to salvage remaining premium. If the price approaches the short strike early, you may consider rolling the short call up to a higher strike for a debit to capture more upside.

Exit Rules: Protecting Capital and Locking in Gains

Disciplined exit rules are crucial for preserving capital and protecting profits. Adhere to these guidelines:

- If the stock/index rises to near the upper strike price: Consider closing the entire position to book profits before expiration. Do not greedily wait for expiry, as time decay or a pullback could erode your gains.

- If the stock/index moves sideways and time passes: The position will lose value due to time decay. Reassess your original thesis. If the bullish outlook has diminished, exit the trade to avoid further decay.

- If the stock/index falls significantly: Accept the predefined, limited loss. You can exit early to recover a small amount of remaining premium or hold until expiry, knowing your maximum loss is already capped.

Position Sizing & Money Management: The Key to Survival

The number one mistake traders make is over-leveraging. Strict money management rules transform a good strategy into a sustainable one.

- Adhere to the 1–2% rule: Never risk more than 1-2% of your total trading capital on a single bull call spread trade.

- Always check the liquidity (open interest and volume) of both option strikes before sizing your position to ensure you can enter and exit easily without significant slippage.

- The defined risk of spreads helps control emotions, as you know your worst-case scenario upfront. Let this mathematical edge guide your decisions, not fear or greed.

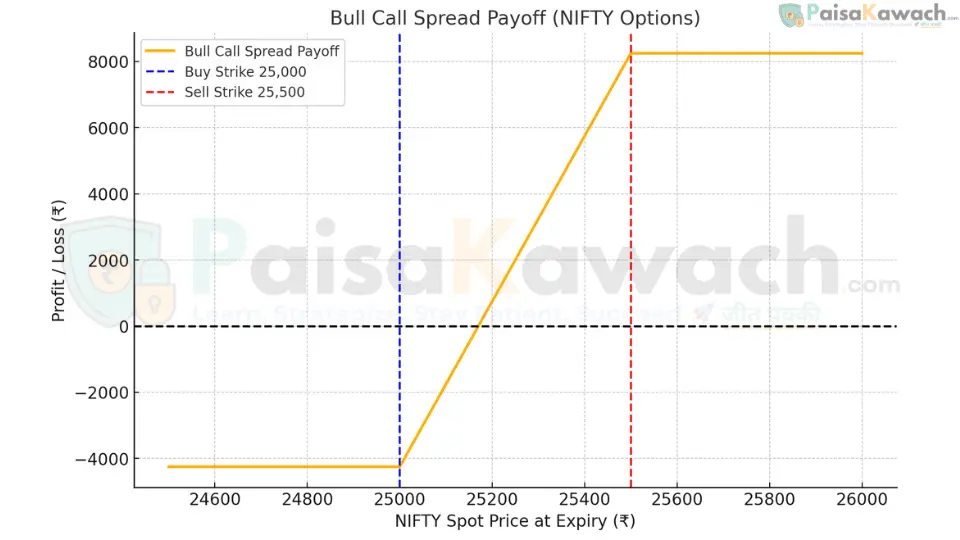

Detailed Example: NIFTY Bull Call Spread

Assume NIFTY is currently trading at ₹25,000. You are moderately bullish, expecting a move towards 25,500 over the next month.

- Buy 1 Lot of NIFTY 25,000 CE (Call Option) at a premium of ₹280.

- Sell 1 Lot of NIFTY 25,500 CE (Call Option) at a premium of ₹110.

Net Premium Paid (Debit): ₹280 - ₹110 = ₹170 per share.

Total Cost (Max Loss): ₹170 * 50 (Lot Size) = ₹8,500.

Maximum Profit: (Difference in Strikes - Net Premium) * Lot Size

= ( (25,500 - 25,000) - 170 ) * 50

= (500 - 170) * 50 = ₹330 * 50 = ₹16,500.

Breakeven Point at Expiry: Lower Strike + Net Premium

= 25,000 + 170 = 25,170.

NIFTY must be above 25,170 at expiry for the trade to be profitable.

Key Metrics to Track and Calculate

- Breakeven Point (BEP): Lower Strike Price + Net Premium Paid.

- Maximum Profit: (Higher Strike - Lower Strike - Net Premium Paid) × Lot Size.

- Maximum Loss: Net Premium Paid × Lot Size.

- Theta (Time Decay): The net rate of time decay on the position. It is negative but less severe than a naked long call.

- Delta (Directional Exposure): The net delta is positive, indicating a bullish bias, but it decreases as the price approaches the short strike.

Advantages of a Bull Call Spread

- Lower Capital Requirement: Significantly cheaper than buying a naked call option.

- Defined and Limited Risk: The maximum loss is known and capped from the moment the trade is placed.

- Higher Probability of Profit: The lower breakeven point compared to a naked call makes it easier to achieve a profitable outcome in moderate bullish scenarios.

- Safer than Long Futures: Offers a leveraged bullish exposure without the unlimited risk associated with a futures contract.

Disadvantages of a Bull Call Spread

- Capped Profit Potential: The primary trade-off. You cannot participate in any gains beyond the upper strike price, even if the underlying asset rallies dramatically.

- Susceptible to Time Decay: If the underlying price fails to move upward, the position will still lose value over time, though at a slower rate than a naked long call.

- Complexity in Strike Selection: Requires careful analysis to choose strikes that offer an optimal balance between cost, risk, and potential reward.

Comparison: Bull Call Spread vs. Long Call

| Factor | Bull Call Spread | Long Call (Naked) |

|---|---|---|

| Cost (Net Debit) | Lower (premium reduced by selling OTM call) | Higher (full premium paid) |

| Risk | Limited to net premium paid | Limited to premium paid |

| Profit Potential | Capped at (Spread Width – Net Premium) | Unlimited in theory |

| Breakeven Point | Lower (Lower Strike + Net Premium) | Higher (Strike Price + Premium Paid) |

| Best Market Outlook | Moderately Bullish | Very Bullish to Explosive |

| Impact of Time Decay | Less Negative (partially offset) | Highly Negative |

The Bull Call Spread is an essential, intermediate-level strategy that empowers traders to participate in bullish trends with precision and capital efficiency. It exemplifies the core principle of options trading: making strategic trade-offs to tailor risk and reward to a specific market view, making it one of the most practical and widely used strategies in the F&O markets.