Bull Put Spread Options Strategy: Defined-Risk Bullish Trade

The Bull Put Spread is a moderately bullish options strategy where you sell a Put at a higher strike and buy another Put at a lower strike. It profits when the market stays above the short Put strike, with risk capped by the protective long Put.

Bull Put Spread Options Strategy: Defined-Risk Income in a Bullish or Stable Market

The Bull Put Spread is a defined-risk, credit-based options strategy employed when a trader holds a neutral to moderately bullish outlook on the underlying asset. It is constructed by selling one Put option at a specific strike price and simultaneously buying another Put option at a lower strike price, both with the same expiration date. The sale of the closer-to-the-money put generates immediate premium income, while the purchase of the further out-of-the-money put acts as a hedge, capping the trader's maximum potential loss. This structure is functionally equivalent to a Bull Call Spread but is initiated for a credit instead of a debit, making it ideal for generating income in sideways or upwardly drifting markets.

- Max Profit: Limited to the net premium received when entering the trade. This maximum gain is realized if the underlying asset closes at or above the strike price of the short put at expiration.

- Max Loss: Strictly limited and predefined. It is calculated as the difference between the two strike prices, minus the net premium received.

- Market View: Neutral to moderately bullish. The ideal scenario is for the underlying to rise or trade sideways above the short put strike, allowing both options to expire worthless so the trader keeps the entire credit.

When to Use a Bull Put Spread

- When you believe the underlying asset has strong support at a certain level and will trade flat or move higher until expiration.

- When Implied Volatility (IV) is elevated, making option premiums rich. This allows you to sell expensive premium with the expectation that it will decay over time (benefiting from Theta and potentially falling IV).

- When you want to express a bullish opinion with limited, predefined risk, making it a safer alternative to cash-secured put writing or naked put selling.

- When the risk-to-reward ratio is favorable—typically when the net credit represents a significant portion of the maximum risk.

Setup Checklist: Building the Spread

- Underlying Selection: Choose liquid underlyings with active options chains to ensure tight bid-ask spreads and ease of entry/exit. NIFTY, BankNIFTY, and high-quality large-cap stocks are excellent choices.

- Strike Selection:

- Short Put: Sell an At-The-Money (ATM) or slightly Out-of-The-Money (OTM) put option. This strike should align with a key technical support level you believe the price will not break.

- Long Put (Hedge): Buy a further OTM put option. The distance between the short and long strikes defines your risk zone. A wider spread yields a smaller net credit but also a larger maximum loss. A narrower spread yields a larger net credit but less downside protection.

- Expiry Selection: Typically 3-6 weeks to expiration. This provides sufficient time for Theta decay to work in your favor while avoiding the extreme gamma risk of the final week before expiration.

- Net Credit: The trade must be entered for a net credit. The premium received for the short put must be greater than the premium paid for the long put.

Entry Rules: Executing the Two-Legged Trade

- Sell the Higher Strike Put: Sell to Open (STO) one put option at your chosen support level (e.g., 19,800 PE).

- Buy the Lower Strike Put: Buy to Open (BTO) one put option at a strike below the short put (e.g., 19,600 PE). This is your protective hedge.

- Ensure Net Credit: Confirm that the credit from the sale is greater than the debit from the purchase.

- Record Trade Details: Document the net credit received, the short and long strike prices, expiration date, maximum profit, maximum loss, and breakeven point.

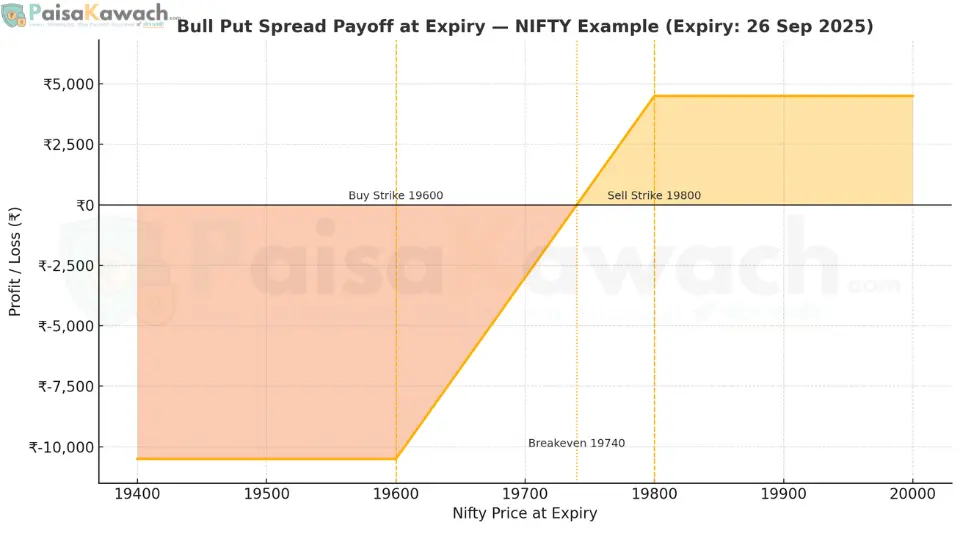

Detailed Example: NIFTY Bull Put Spread

Assume NIFTY is trading at 20,000. You identify 19,800 as a strong support level and initiate a spread for the September 26th, 2025 expiry. The standard lot size is 75.

- Sell 19,800 PE @ ₹110

- Buy 19,600 PE @ ₹50

Net Credit Received: ₹110 - ₹50 = ₹60 per share.

Total Max Profit: ₹60 * 75 = ₹4,500.

Max Loss Calculation:

The difference between the strike prices is 200 points (19,800 - 19,600).

Max Loss per share: (Strike Difference - Net Credit) = (200 - 60) = ₹140.

Total Max Loss: ₹140 * 75 = ₹10,500.

This maximum loss occurs if NIFTY closes at or below the long put strike (19,600) at expiration.

Breakeven Point Calculation:

This is the point where the trade transitions from profit to loss at expiration.

Breakeven: Short Strike - Net Credit = 19,800 - 60 = 19,740.

The trade is profitable at expiration if NIFTY closes above 19,740.

Payoff Scenarios at Expiry:

- Scenario 1: Ideal Outcome (NIFTY ≥ 19,800)

Both puts expire worthless.

Net Profit = ₹4,500 (Max Profit) - Scenario 2: At Breakeven (NIFTY = 19,740)

The short put is ITM by ₹60. This loss exactly equals the net credit received.

Net Profit/Loss = ₹0 - Scenario 3: Worst-Case Outcome (NIFTY ≤ 19,600)

Loss on short put: -₹200 (intrinsic value at 19,600).

Gain on long put: +₹200 (intrinsic value at 19,600).

The intrinsic values cancel each other out. The net loss is the initial credit received minus the cost of the hedge, which is the predefined max loss.

Net Loss = ₹10,500 (Max Loss)

Risk & Management: The Greeks

- Max Loss & Profit: Both are predefined and known at trade initiation, enabling precise risk management.

- Theta (Time Decay): Positive. This is the primary driver of profit. As time passes, the value of the spread erodes (if the price stays above the short put), allowing the trader to keep the credit or buy back the spread for less.

- Vega (Volatility Risk): Negative. The strategy is a net seller of volatility. An increase in Implied Volatility will hurt the position's value, while a decrease in IV will benefit it.

- Delta (Directional Risk): Initially positive (bullish). The delta becomes more positive if the price falls toward the short strike, and approaches zero if the price crashes past the long put strike (as the spread reaches its max loss).

Exit Rules: Active Management for Optimal Outcomes

- Profit Target: Close the spread early by buying it back once a substantial portion (e.g., 50-80%) of the max profit has been realized. This locks in gains and eliminates gamma risk as expiration approaches.

- Stop-Loss (Price): If the underlying price breaks decisively below your short strike and approaches the breakeven point, consider closing the trade to prevent further losses. While the max loss is defined, managing losses early can preserve capital for better opportunities.

- Stop-Loss (Volatility): Exit the trade if Implied Volatility spikes significantly higher, as this will increase the mark-to-market loss of the position.

- Rolling: If the bullish thesis remains intact but the market has moved against you, you can "roll" the spread down and out (to a lower strike and a later expiration) for a new credit. This adjusts your position and gives the trade more time to work.

Advantages

- Defined Risk: Maximum possible loss is known, capped, and cannot exceed the calculated amount.

- Lower Margin Requirement: Requires significantly less capital than cash-secured put writing or naked put selling.

- Positive Theta: Benefits directly from time decay, which works to erode the value of the short option.

- Income Generation: Provides a mechanism to generate premium income in neutral or bullish market conditions.

Disadvantages

- Capped Profit Potential: Gains are limited to the initial credit received, regardless of how high the underlying price rallies.

- Risk/Reward Ratio: Often, the maximum loss is a multiple of the maximum gain (e.g., risking ₹10,500 to make ₹4,500), necessitating a high probability of success for the trade to be profitable over time.

- Opportunity Cost: If the underlying surges dramatically, the profit is still limited to the credit, whereas a long call or bull call spread would have yielded significantly higher returns.

Comparison: Bull Put Spread vs. Naked Put Writing

| Factor | Bull Put Spread | Naked Put |

|---|---|---|

| Risk Profile | Defined and Limited | Large (Theoretical max loss = Strike Price - Premium) |

| Max Profit | Net Credit Received | Net Premium Received |

| Margin Requirement | Lower (Defined Risk) | Very High (Often ~20% of Notional Value) |

| Capital Efficiency | High | Low |

| Ideal For | Traders seeking defined-risk bullish/neutral income | Investors willing to acquire the stock at the strike price |

The Bull Put Spread is a cornerstone strategy for the prudent options trader. It offers a methodical and capital-efficient approach to profiting from a stable or bullish market outlook while strictly limiting downside exposure. Its defined-risk nature fosters disciplined trading and sound risk management, making it a superior alternative to naked put selling for traders who prioritize capital preservation.