Covered Calls 101 — Income Approach

Generate steady income from stocks you already own by selling call options against your position. This beginner-friendly strategy is risk-aware, defines entries and exits, and focuses on monthly income while capping upside beyond the strike price.

What is a Covered Call? The Investor's Income Engine

A Covered Call is a foundational, income-oriented options strategy renowned for its relative simplicity and effectiveness. It involves an investor who holds a long position in a stock (or simultaneously purchases it) and then sells (writes) a call option on that same stock. By selling the call, the investor collects an immediate premium, which serves as income that enhances the overall return on the underlying shares. The strategic trade-off is that the investor's upside potential is capped at the option's strike price. If the stock's price rallies significantly above this strike by expiration, the investor is obligated to sell their shares at that predetermined price, forgoing any further gains.

This strategy is exceptionally popular among long-term, buy-and-hold investors who are bullish on a stock's long-term prospects but anticipate limited near-term price movement or simply wish to generate incremental returns on an otherwise stagnant holding. It is most profitable in sideways (neutral) or mildly bullish market environments, where the steady accumulation of premium can significantly outperform simply holding the stock alone.

- Income generation: The premium received is instant, tangible income that boosts the portfolio's yield and can be reinvested.

- Downside buffer: The premium collected effectively lowers the cost basis of the stock position, providing a partial cushion against a decline in the stock's price.

- Upside cap: Profit above the chosen strike price is surrendered in exchange for the upfront premium. The maximum profit is finite and known at the outset.

When to Use This Strategy

The Covered Call is a strategic choice, not a universal solution. It is optimally deployed when your market outlook for a specific stock is neutral to cautiously optimistic. You believe the stock is unlikely to experience a dramatic surge in the short term, and you are psychologically and strategically prepared to have your shares called away (sold) at the strike price if the market moves against your expectation.

- You maintain a neutral to mildly bullish outlook on the underlying stock for the duration of the option contract.

- You are fully willing to sell your shares at the strike price, viewing it as an acceptable exit point.

- Your primary objective is generating consistent income and enhancing yield, rather than capturing explosive, unlimited upside.

- You seek to reduce the effective cost of your stock ownership over time through premium collection.

Setup Checklist: Laying the Groundwork

Successful implementation of the Covered Call strategy hinges on meticulous preparation. A disciplined, systematic approach to selection and setup minimizes execution risks and aligns the trade with your investment goals.

- Choose liquid underlyings: Select stocks or ETFs with high options trading volumes and narrow bid-ask spreads. This ensures you can enter and exit positions efficiently without significant slippage (e.g., Reliance, Infosys, HDFC Bank in India; Apple, Microsoft, SPY in the US).

- Own sufficient shares: Ensure you own (or buy) at least 100 shares (the standard lot size for most equity options) for every call option contract you intend to sell.

- Select expiry: Shorter-term expiries (2-6 weeks, often aligning with monthly cycles) are common as they allow for more frequent premium collection and adjustment. They also exhibit faster time decay (theta), which benefits the seller.

- Pick strike price: Selling Out-of-The-Money (OTM) calls, typically 1-3% above the current stock price, is standard. This provides a balance between a reasonable premium yield and a higher probability of the option expiring worthless, allowing you to keep the shares and repeat the process.

Entry Rules: Executing the Trade

A precise and disciplined entry is critical for managing risk and setting realistic profit expectations. The process is straightforward but must be followed carefully.

- Establish the Stock Position: Purchase (or already hold) at least 100 shares of the underlying stock per call option contract.

- Sell the Call Option: Sell to open (STO) one call option contract for the same stock. The chosen contract should have an expiry in the near term (e.g., 30-45 days) and a strike price that is slightly OTM (e.g., a delta of 0.20 to 0.40).

- Record the Trade Details: Note the net credit (premium) received, the strike price, the expiration date, and calculate your new effective cost basis (Share Purchase Price - Premium Received) and your maximum profit (Strike Price - Share Purchase Price + Premium Received).

Risk & Management: Navigating the Trade

While often labeled a "conservative" strategy, Covered Calls carry defined risks that must be actively managed. Understanding these dynamics is key to long-term success.

- Downside risk: The strategy does not protect against a significant decline in the stock price. The premium received only provides a partial buffer. The net loss is (Stock Purchase Price - Stock Sale Price - Premium Received).

- Upside cap: The maximum profit is strictly limited to (Strike Price - Stock Purchase Price + Premium Received). Any move in the stock beyond the strike price represents forgone profit.

- Adjustment (Rolling): If the stock price approaches or exceeds the strike price before expiration, you can "roll" the position. This involves buying back the short call and selling a new call with a later expiration and/or a higher strike price. This defers assignment and potentially captures more premium, but it also extends the commitment.

- Assignment risk: If the stock price is above the strike price at expiration, the option will likely be exercised, and your shares will be sold ("called away") at the strike price. This is a defined outcome, not a loss, but it means you no longer own the stock.

Exit Rules: Closing the Position

Proactive management of the exit, rather than passive waiting for expiration, can significantly improve returns and flexibility.

- Profit-taking on the option: If the value of the short call option depreciates to 20–30% of its original premium value (e.g., you sold it for ₹10 and it's now worth ₹2), consider buying it back to lock in the majority of the profit. You can then immediately sell a new call for a subsequent expiry period ("rolling").

- Time-based exit: To avoid the pin risk and uncertainty of assignment on expiration Friday, actively manage or close the position 2–5 days before expiration.

- Stock decline exit: If the underlying stock experiences a fundamental breakdown or severe technical decline, it may be prudent to close the entire position (buy back the call and sell the stock) to reassess the thesis, rather than simply continuing to collect small premiums against a large loss.

Position Sizing: The Prudence of Diversification

The Covered Call strategy should be used as a portfolio enhancement tool, not a concentrated bet. Proper sizing is crucial for risk management.

- Limit Covered Call positions to a small percentage of your total equity portfolio (e.g., 5–10% per underlying stock) to avoid excessive concentration risk.

- Only employ this strategy on stocks you have a genuine long-term conviction in and would be comfortable holding without the options overlay.

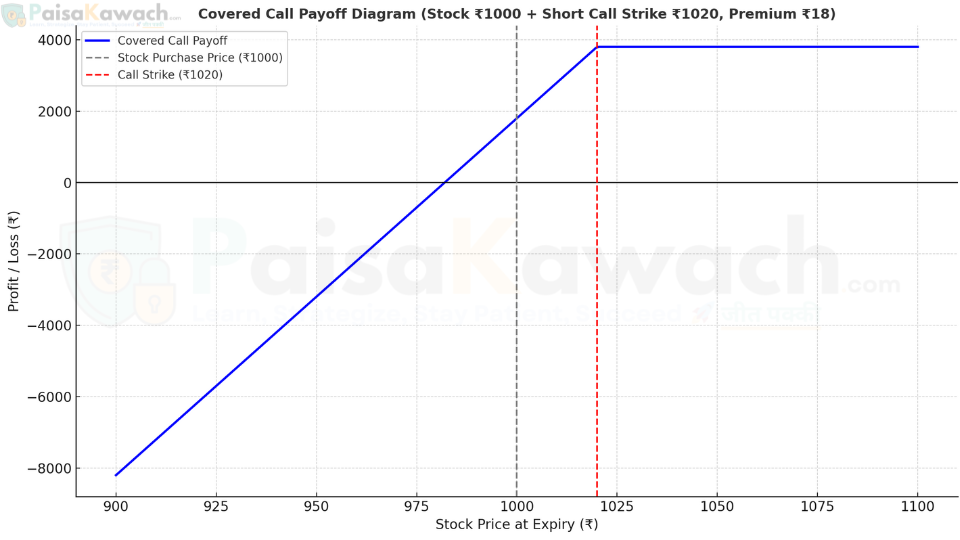

Detailed Example with Calculations

Scenario: Shares of XYZ Ltd. are trading at ₹1,000. You own 100 shares. You decide to sell a one-month (30 DTE) call option with a strike price of ₹1,020 for a premium of ₹18 per share.

- Net Credit Collected: ₹18 * 100 shares = ₹1,800.

- New Cost Basis / Downside Break-Even: ₹1,000 (purchase price) - ₹18 (premium) = ₹982. The stock can fall to ₹982 before you start incurring a net loss on the overall position.

- Maximum Profit (Capped): (₹1,020 - ₹1,000) + ₹18 = ₹38 per share * 100 = ₹3,800. This is achieved at any stock price at or above ₹1,020 at expiry.

- Outcome 1 (Stock ≤ ₹1,020): The call expires worthless. You keep the ₹1,800 premium. You still own the shares and can sell another call next month.

- Outcome 2 (Stock > ₹1,020, e.g., ₹1,050): Your shares are called away and sold for ₹1,020 each. Your total gain is ₹3,800 (₹20 capital gain + ₹18 premium). You miss out on the additional ₹30 per share move above ₹1,020.

Key Metrics to Track for Performance

To refine your Covered Call strategy over time, systematically track these performance metrics:

- Premium Yield: (Premium Received / Stock Price) %. This measures the income generated per trade cycle (e.g., ₹18 / ₹1000 = 1.8% monthly return).

- Annualized Return: Adjust the premium yield for the number of times the strategy can be deployed in a year to compare it with other investments.

- Assignment Rate: The percentage of trades where your shares are called away. A very low rate may indicate you are selling strikes too far OTM and leaving premium on the table.

- Rolling Results: Track the net credit/debit when rolling positions to understand if adjustments are adding value.

Comparison: Covered Call vs. Holding Stock Outright

This side-by-side analysis highlights the strategic trade-offs involved.

| Factor | Covered Call | Holding Stock |

|---|---|---|

| Capital Required | High (cost of 100 shares) | High (cost of shares) |

| Income Generation | Yes (consistent premium income) | Only through dividends (if any) |

| Upside Potential | Capped at (Strike Price - Purchase Price + Premium) | Unlimited |

| Downside Protection | Partial. Lower break-even point (Purchase Price - Premium). | None. Full exposure to the stock's decline. |

| Best Market Condition | Sideways, choppy, or mildly bullish | Strongly bullish |

| Complexity | Moderate (requires options approval and active management) | Low (purely passive) |

In summary, the Covered Call strategy is a powerful and reliable tool for income-focused investors. It systematically converts stagnant capital into a productive asset, providing steady cash flow and a margin of safety against minor pullbacks. While it sacrifices the potential for home-run gains, its defined-risk nature and ability to generate consistent returns in a variety of market conditions make it an indispensable strategy for constructing a resilient and income-generating portfolio.