Iron Butterfly Options Strategy: Low-Risk Range-Bound Income

The Iron Butterfly is a defined-risk options strategy that combines a Short Straddle with protective wings. It profits when the market stays near the strike price and limits risk with hedging, making it safer than a naked Short Straddle.

Iron Butterfly Options Strategy: Precision Income in Range-Bound Markets

The Iron Butterfly is an advanced, defined-risk options strategy engineered to generate premium income from assets expected to exhibit low volatility and trade within a well-defined range until expiration. It is constructed by combining a Short Straddle (selling an at-the-money call and put) with a Long Strangle (buying a further out-of-the-money call and put) as protective "wings." This structure caps the theoretically unlimited risk of a naked short straddle, transforming it into a disciplined, capital-efficient trade with a known maximum loss. The strategy profits from time decay and falling implied volatility, making it a cornerstone of neutral market outlooks.

- Max Profit: Limited to the net premium received upon trade initiation. This maximum gain is achieved if the underlying asset closes exactly at the short strike price at expiration.

- Max Loss: Strictly limited and predefined. It is calculated as the difference between the wing strikes and the short strike, minus the net premium received.

- Market View: Extremely neutral. You expect the underlying to experience very low volatility and pin itself close to the short strike until expiry, with no significant directional moves.

When to Use an Iron Butterfly

- When technical analysis indicates the underlying asset is entering a period of consolidation within a strong support and resistance range, often after a significant move.

- When Implied Volatility (IV) is high—typically before major events like earnings or Fed meetings—and you expect it to collapse ("IV Crush") after the event, regardless of the price move. This volatility drop will rapidly erode the value of all options in the fly, benefiting the net seller.

- When you desire the premium collection profile of a short straddle but require the safety of a defined, limited risk profile and cannot tolerate uncapped losses.

- In the week of expiration, when time decay (Theta) is most accelerated, maximizing the premium harvest for range-bound price action.

Setup Checklist: Constructing the Fly

- Underlying Selection: Choose highly liquid underlyings with rich options markets to ensure tight bid-ask spreads. Index ETFs like NIFTY or BankNIFTY are ideal due to their high notional value and liquidity.

- Strike Selection:

- Short Strikes: Sell one ATM call and one ATM put at the same strike price. This is the body of the butterfly.

- Long Strikes (Wings): Buy one OTM call (strike above short call) and one OTM put (strike below short put). The distance of these wings from the short strike defines your risk zone. Wider wings are cheaper but offer less protection; narrower wings are more expensive but provide a wider profit range.

- Expiry Selection: Short-term expiries (0-21 days to expiration, DTE) are most effective. Time decay accelerates in the final weeks, working powerfully in your favor.

- Net Credit: The trade must be entered for a net credit. The total premium received from selling the straddle must be greater than the total premium paid for the strangle wings.

Entry Rules: Executing the Four-Legged Trade

- Sell 1 ATM Call: Sell to Open (STO) one at-the-money call option.

- Sell 1 ATM Put: Sell to Open (STO) one at-the-money put option at the same strike as the call.

- Buy 1 OTM Call (Higher Strike): Buy to Open (BTO) one out-of-the-money call option at a strike above the short call. This wing defines your maximum loss on the upside.

- Buy 1 OTM Put (Lower Strike): Buy to Open (BTO) one out-of-the-money put option at a strike below the short put. This wing defines your maximum loss on the downside.

All four legs must share the same expiration date.

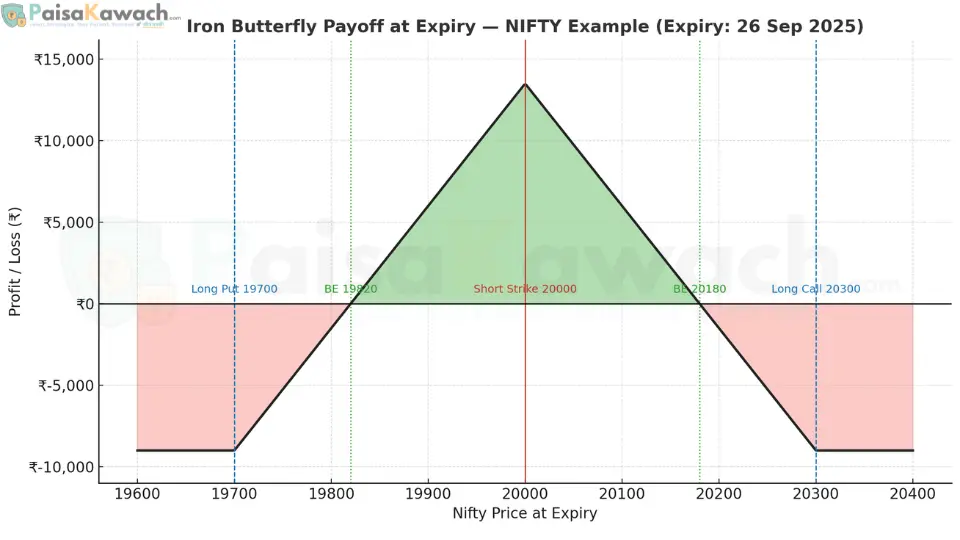

Detailed Example: NIFTY Iron Butterfly

Assume NIFTY is trading at 20,000. You initiate the trade with 7 days until the monthly expiry on September 26th, 2025. The lot size is 75.

- Sell 20,000 CE @ ₹150

- Sell 20,000 PE @ ₹140

- Buy 20,300 CE @ ₹60 (Protective Wing)

- Buy 19,700 PE @ ₹50 (Protective Wing)

Net Credit Received: (150 + 140) - (60 + 50) = ₹180 per share.

Total Max Profit: ₹180 * 75 = ₹13,500.

Max Loss Calculation:

The difference between the short and long strikes is 300 points (20,300 - 20,000).

Max Loss per share: (Strike Width - Net Credit) = (300 - 180) = ₹120.

Total Max Loss: ₹120 * 75 = ₹9,000.

This loss occurs if NIFTY closes at or beyond either wing strike (≤ 19,700 or ≥ 20,300) at expiration.

Breakeven Points Calculation:

These are the points where the trade transitions from profit to loss.

- Upper Breakeven: Short Strike + Net Credit = 20,000 + 180 = 20,180

- Lower Breakeven: Short Strike - Net Credit = 20,000 - 180 = 19,820

The trade is profitable at expiration if NIFTY closes between 19,820 and 20,180.

Payoff Scenarios at Expiry:

- Scenario 1: Perfectly Neutral (NIFTY at 20,000)

All options expire worthless.

Net Profit = ₹13,500 (Max Profit) - Scenario 2: Moderate Rally (NIFTY at 20,180)

The short call is ITM by ₹180, but this loss is exactly offset by the ₹180 net credit.

Net Profit/Loss = ₹0 (Upper Breakeven) - Scenario 3: Strong Rally (NIFTY at 20,300)

Loss on short call: -₹300. Value of long call: ₹0. Net Credit: +₹180.

Net Loss per share: -300 + 180 = -₹120.

Total Net Loss: ₹120 * 75 = ₹9,000 (Max Loss) - Scenario 4: Strong Crash (NIFTY at 19,700)

Loss on short put: -₹300. Value of long put: ₹0. Net Credit: +₹180.

Net Loss per share: -300 + 180 = -₹120.

Total Net Loss: ₹120 * 75 = ₹9,000 (Max Loss)

Risk & Management: The Greeks

- Max Loss & Profit: Both are predefined and known at entry, making risk management straightforward.

- Theta (Time Decay): Positive. This is the primary driver of profit. The strategy benefits significantly from the passage of time, especially in the final week before expiration.

- Vega (Volatility Risk): Negative. The strategy is a net seller of volatility. An increase in Implied Volatility (IV) will hurt the position's value, while a decrease in IV (IV Crush) will benefit it dramatically.

- Delta (Directional Risk): Initially near zero. The position becomes negatively delta (bearish) if the price rallies above the short strike and positively delta (bullish) if the price falls below it. This often requires dynamic hedging.

Exit Rules: Active Management for Optimal Outcomes

- Profit Target: Close the entire position once 50-80% of the maximum profit has been realized. Don't greedily hold until expiry; lock in gains to avoid gamma risk near expiration.

- Stop-Loss (Volatility): Exit the trade if Implied Volatility spikes significantly against you, increasing the potential loss beyond your predefined risk tolerance.

- Stop-Loss (Price): If the underlying price approaches one of the breakeven points, consider adjusting or closing the trade to prevent a full max loss. A common adjustment is to "roll" the entire fly to a future expiration or a different strike set.

- Expiration: Actively manage positions in the week of expiration. Do not let pin risk cause unexpected assignments; close or roll the position before the market closes on expiration Friday.

Advantages

- Defined Risk: The maximum possible loss is known and capped, unlike a naked short straddle.

- Premium Income: Generates income from time decay and volatility contraction.

- Higher Probability of Profit: Has a wider profitable range at expiration compared to an iron condor.

- Capital Efficiency: Defined risk often requires less margin capital than undefined risk strategies.

Disadvantages

- Limited Profit Potential: The gains are capped at the net credit received.

- Commission Costs: Being a four-legged trade, commissions and slippage can be higher, eating into the net credit.

- Active Management: Requires monitoring and potential adjustment if the market begins to trend.

- Vega Risk: Can incur losses from a sharp rise in implied volatility, even without a large price move.

Comparison: Iron Butterfly vs. Short Straddle

| Factor | Iron Butterfly | Short Straddle |

|---|---|---|

| Risk Profile | Defined and Limited | Unlimited |

| Max Profit | Net Credit Received | Net Credit Received |

| Breakeven Range | Wider (due to cost of protective wings) | Narrower |

| Capital Requirement | Lower (due to defined risk) | Very High (due to unlimited risk) |

| Ideal For | Risk-averse traders in neutral, high-IV markets | Very experienced traders with high risk tolerance |

The Iron Butterfly is a strategic, self-insured approach to generating income in stagnant markets. It offers a compelling balance between the high-income potential of short premium strategies and the capital preservation of defined-risk trades. Mastery of the Iron Butterfly requires a disciplined approach to trade selection, precise execution, and active position management to navigate the risks of changing volatility and sudden directional moves.