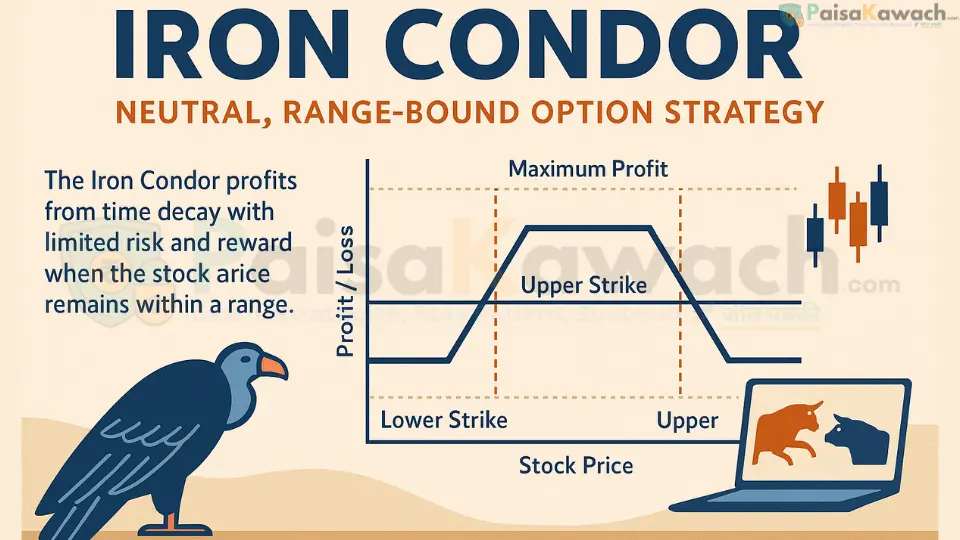

Iron Condor – Neutral, Range-Bound Option Strategy

A non-directional strategy that profits from time decay if the market stays within a range, ideal for neutral outlooks.

Iron Condor: The Defined-Risk, Premium Harvesting Strategy

An Iron Condor is a sophisticated, non-directional options strategy meticulously designed to profit from periods of low volatility and sideways price action. It is constructed by selling one Out-of-The-Money (OTM) call spread and one OTM put spread on the same underlying asset with the same expiration date. This four-legged structure allows traders to collect premium upfront while strictly defining and capping the maximum potential loss on both the upside and the downside.

The Iron Condor is a cornerstone strategy for intermediate and advanced traders focused on generating consistent income through theta decay (time erosion) and vega decay (volatility contraction). It achieves its maximum profit if the underlying asset closes between the two short strike prices at expiration, allowing all options to expire worthless and the trader to keep the entire net premium received.

- Risk is Precisely Defined: The long "wing" options (further OTM calls and puts) act as insurance policies, capping the maximum loss on both sides of the trade. There is no scenario for unlimited loss.

- Profit is Capped but Favorable: Maximum profit is limited to the net premium collected when initiating the position. This premium is the target return for successful trades.

- A Premium Harvesting Strategy: The strategy's profitability is driven by the relentless decay of time value in the sold options, making it ideal for stagnant or range-bound markets.

When to Deploy an Iron Condor

This strategy is strategically optimal in environments characterized by low realized volatility and a clear technical trading range. It is deliberately avoided during periods of high uncertainty or ahead of major market-moving events.

- When technical analysis indicates strong support and resistance levels, creating a well-defined trading range.

- During periods of low historical and implied volatility, or when you expect volatility to compress further.

- When you have a neutral to slightly bearish outlook on volatility itself (you are a net seller of volatility).

- As a core income-generation strategy within a larger portfolio, aiming for consistent, risk-defined returns.

- When the premium available from selling options is attractive relative to the risk taken (i.e., high implied volatility rank).

Strategic Setup Checklist

- Underlying Asset: Select highly liquid underlyings with high options volume to ensure tight bid-ask spreads. Major indices like NIFTY 50 and Bank NIFTY are ideal candidates.

- Strike Selection: Choose short strikes that are outside the expected price range but still offer attractive premium. The long strikes should be placed further out to define risk. The distance between short and long strikes (the "wing width") determines your risk-reward ratio.

- Expiry Cycle: Can be used with weekly, monthly, or longer-dated expiries. Shorter expiries benefit from faster time decay but offer less premium and require more active management.

- Volatility Context: The strategy is most effective when initiated during periods of elevated implied volatility (IV), as this inflates the premium collected. A subsequent drop in IV (vega decay) will increase the position's value.

Step-by-Step Entry Rules

- Sell 1 OTM Call Option at a strike price above the current underlying price.

- Buy 1 Further OTM Call Option at a higher strike price to hedge the short call. This defines the upside risk.

- Sell 1 OTM Put Option at a strike price below the current underlying price.

- Buy 1 Further OTM Put Option at a lower strike price to hedge the short put. This defines the downside risk.

- All options must share the same expiration date.

- Net Credit = (Premium from Short Options) - (Premium for Long Options). This is your maximum potential profit.

Risk & Position Management Profile

The Iron Condor's risk profile is its greatest strength, offering complete clarity on potential outcomes.

- Maximum Profit: Limited to the net premium received when opening the trade. This is achieved if the underlying closes between the two short strikes at expiration.

- Maximum Loss: Limited and predefined. It is calculated as (Width of One Spread - Net Credit) * Lot Size. For example, if the call spread width is 200 points and you collected a 50-point net credit, your max loss on that side is 150 points per share.

- Theta (Time Decay): This is the engine of the strategy. The position has positive theta, meaning it makes money with each passing day—as long as the price stays within the profit range—due to the erosion of time value on the short options.

- Vega (Volatility Risk): The position is short vega. A decrease in implied volatility (IV) after entry is highly beneficial, as it reduces the value of the short options faster. An increase in IV is harmful, as it increases the value of the short options and creates paper losses.

- Adjustments: Active management is often required. If the underlying price approaches one of the short strikes, traders may "roll" the entire position out to a further expiration date and/or to different strikes to avoid a breach, often for a additional credit.

Exit Rules and Trade Management

- Profit Target: Exit the trade for a gain if 50-80% of the maximum potential profit is realized before expiration, rather than holding through expiration pin risk.

- Stop-Loss (Monetary or Delta-Based): Exit the trade for a loss if the loss reaches a predetermined amount (e.g., 1.5x the credit received) or if the delta of the position becomes too skewed, indicating one side is under heavy pressure.

- Rolling: If the underlying tests a short strike but your outlook remains range-bound, you can "roll" the threatened side of the condor. For example, if the put side is tested, you would buy to close the current put spread and sell a new put spread at lower strikes, ideally for a net credit.

Position Sizing & Prudent Money Management

- The maximum loss per condor must be a small fraction of your total trading capital (e.g., 1-2%). This is non-negotiable.

- Diversify across different underlyings and expirations to avoid a single event causing multiple losses.

- Understand that this is a probabilistic strategy; not all trades will be winners. The goal is to have the average winner outweigh the average loser over a series of trades.

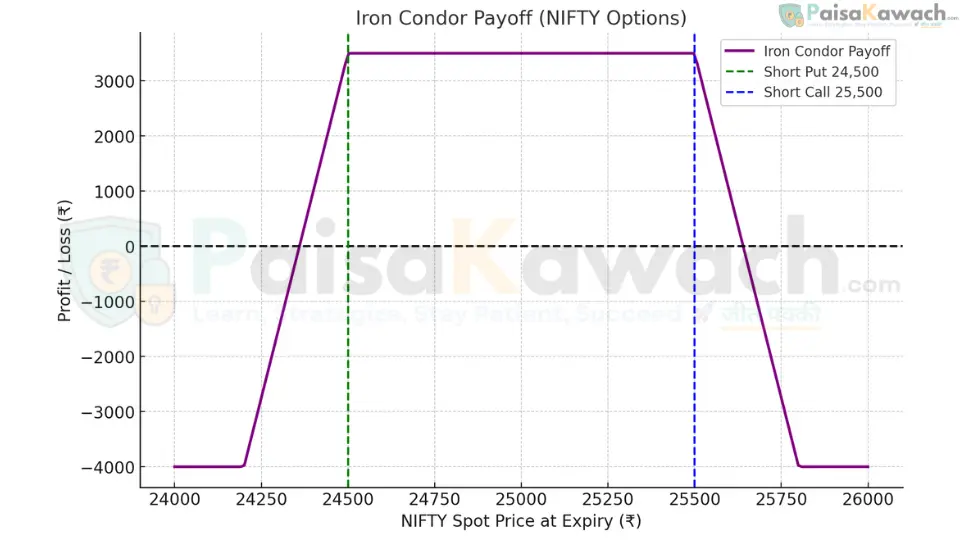

Detailed Example: NIFTY Iron Condor

Assume NIFTY is trading at ₹25,000. You identify a range between 24,500 and 25,500 and expect it to hold for the next 30 days. Implied Volatility is at the higher end of its range.

- Bear Call Spread (Upper Wing):

Sell 1 NIFTY 25,500 CE @ ₹110

Buy 1 NIFTY 25,800 CE @ ₹40

Net Credit on Call Side: ₹70 - Bull Put Spread (Lower Wing):

Sell 1 NIFTY 24,500 PE @ ₹120

Buy 1 NIFTY 24,200 PE @ ₹50

Net Credit on Put Side: ₹70

Total Net Credit (per share): ₹70 + ₹70 = ₹140

Lot Size: 25 units (Standard for NIFTY options; note: lot size can change, 25 is used here for example)

Total Maximum Profit: ₹140 * 25 = ₹3,500 (approx. $42)

Maximum Loss Calculation (per side, per share):

Call Spread Width = 25,800 - 25,500 = 300 points.

Max Loss on Calls = (300 - 70) = ₹230 per share.

Put Spread Width = 24,500 - 24,200 = 300 points.

Max Loss on Puts = (300 - 70) = ₹230 per share.

Total Maximum Loss: ₹230 * 25 = ₹5,750 (approx. $69) per side. Note: Only one side of the trade can be a max loss at expiry.

Breakeven Points Calculation:

Upper Breakeven: Short Call Strike + Net Credit = 25,500 + 140 = 25,640

Lower Breakeven: Short Put Strike - Net Credit = 24,500 - 140 = 24,360

The trade is profitable at expiry if NIFTY closes between 24,360 and 25,640.

Payoff Scenarios at Expiry:

- Scenario 1 (Max Profit - Within Range): NIFTY expires at 25,200.

All options expire worthless.

Total Profit = ₹3,500 (the entire premium collected) - Scenario 2 (Max Loss - Above Range): NIFTY expires at 26,000.

The put spread expires worthless. The call spread is a max loss.

Loss on Call Spread = (26,000 - 25,500) - ₹140 credit = ₹500 - ₹140 = ₹360 per share? Incorrect. Let's recalc properly:

The value of the call spread at expiry is its width (300 points). You received a net credit of ₹140 for the entire iron condor, but the call spread itself had a ₹70 credit.

Your loss on the call side is: (Spread Width - Call Spread Credit) = (300 - 70) = ₹230 per share.

The put side expires worthless, so you keep its ₹70 credit.

Net Loss per share = -₹230 (call loss) + ₹70 (put credit) = -₹160 per share.

Total Loss = ₹160 * 25 = ₹4,000 (This is the correct max loss, reflecting the net credit of the entire position).

Key Metrics and Greeks to Monitor

- Breakeven Points: The critical boundaries that must hold for profitability.

- Delta: Should be near neutral when entered. Monitor for drift, which indicates the position is becoming directional.

- Theta: Positive. This is your daily income. Track the rate of time decay.

- Vega: Negative. Monitor IV levels. A drop in IV is desired.

- Probability of Profit: The statistical chance of the price expiring between the breakevens. Often above 60-70% for well-structured condors.

Advantages of an Iron Condor

- Defined and limited risk on both the upside and downside.

- Benefits from time decay (theta) and volatility contraction (vega).

- Can generate consistent income in non-trending markets.

- Lower margin requirements compared to naked short strategies.

- Flexible; strikes and expirations can be adjusted to reflect changing market views.

Disadvantages of an Iron Condor

- Profit potential is capped to the premium received.

- Large, sudden price moves (gap risks) can lead to maximum losses quickly.

- Requires active monitoring and potential adjustments.

- Commission and slippage costs from trading four legs can be significant, especially on smaller positions.

- "Picking up pennies in front of a steamroller" – small, frequent gains can be wiped out by one large loss if not managed properly.

Strategic Comparison: Iron Condor vs. Short Strangle

| Factor | Iron Condor | Short Strangle |

|---|---|---|

| Risk | Defined and Capped | Unlimited |

| Profit Potential | Capped (Net Credit) | Capped (Higher Premium) |

| Margin Requirement | Lower (Defined Risk) | Substantially Higher |

| Adjustment Ease | Easier (Can Adjust One Spread) | More Complex |

| Ideal For | Traders Seeking Defined Risk | Experienced Traders Comfortable with Unlimited Risk |

The Iron Condor is a powerful, disciplined approach to generating income in the options market. It appeals to traders who prioritize risk-defined outcomes and possess the patience to manage positions through periods of market stagnation. When executed within a robust risk management framework, it can be a highly effective component of a diversified trading strategy.