Long Call Butterfly – Range-Bound Precision Strategy

A precision expiry strategy with very low risk, where max profit occurs if the stock closes near the middle strike.

Long Call Butterfly Spread: The Precision Range-Bound Strategy

A Long Call Butterfly is an advanced, defined-risk options strategy designed for traders who anticipate minimal movement in the underlying asset, with a specific forecast that it will expire precisely at or very near a predetermined strike price. This strategy is constructed by combining multiple call options across three consecutive strike prices, creating a distinctive "tent-shaped" profit and loss diagram. The goal is to achieve maximum profit if the underlying asset closes exactly at the middle strike price at expiration.

The Long Call Butterfly is particularly favored for its exceptionally favorable risk-reward ratio. It requires a very small initial capital outlay (net debit) while offering potential returns that are multiples of the risk taken. This makes it an ideal strategic choice for traders focusing on expiration week dynamics, where markets frequently exhibit "pinning" behavior around key psychological or options-heavy strike levels.

- Risk is Strictly Limited: The maximum loss is confined exclusively to the total net premium paid to establish the spread.

- High Reward Potential: Maximum profit is achieved if the underlying closes exactly at the middle strike at expiration, offering a high return on investment relative to the capital risked.

- Low Capital Requirement: The structure is designed to be very inexpensive compared to outright long calls or other directional strategies, as the cost of the long options is partially financed by the sale of the middle strikes.

When to Deploy a Long Call Butterfly

This strategy is strategically optimal in low-volatility, range-bound environments where you have a strong conviction that the underlying will settle at a specific price at expiration. It is not suitable for trending or high-volatility markets.

- During expiration week, when markets often gravitate toward and get "pinned" at high-open-interest strike prices.

- When implied volatility is expected to remain stable or decline, reducing the chance of a large, disruptive price move.

- When you seek a high-probability, defined-risk trade with a favorable risk-reward ratio, accepting the possibility of a 100% loss of the premium if the forecast is incorrect.

- Around events where a "non-move" is expected, such as after a major news event has passed without significant impact.

Strategic Setup Checklist

- Underlying Asset: Use highly liquid underlyings with tight bid-ask spreads, such as NIFTY 50, Bank NIFTY, or large-cap stocks.

- Strike Selection: Choose three consecutive strike prices. The middle strike should be At-The-Money (ATM) or very near the current price and align with your expiry price target.

- Expiry Cycle: Best deployed in the final 5-7 days before expiration (weekly expiries in India) to maximize the effects of time decay on the profitable outcome.

- Cost Analysis: Calculate the net debit (premium paid) carefully, as this is your maximum loss. Ensure the distance between strikes justifies the potential reward.

Step-by-Step Entry Rules

- Buy 1 In-The-Money (ITM) or Out-of-The-Money (OTM) Call option at the lower strike price.

- Sell 2 At-The-Money (ATM) Call options at the middle strike price.

- Buy 1 Out-of-The-Money (OTM) Call option at the higher strike price.

- All options must share the same expiration date.

- Net Debit = (Premium of Long Calls) - (Premium from Short Calls). This is your total cost and maximum loss.

Risk & Position Management Profile

The Long Call Butterfly has a perfectly defined risk profile, making it manageable for traders who prefer certainty.

- Maximum Loss: Limited to the net premium paid to enter the trade. This occurs if the underlying price at expiration is at or below the lower strike, or at or above the higher strike.

- Maximum Profit: Achieved only if the underlying closes exactly at the middle strike price at expiration. The formula is: (Width between strikes - Net Debit) * Lot Size.

- Theta (Time Decay): This is a critical Greek for this strategy. The position is initially long theta, meaning it benefits from time decay—especially in the final days before expiry—as long as the price remains near the middle strike. However, if the price moves away, the relationship can change.

- Vega (Volatility Risk): The position is generally short vega. A decrease in implied volatility (IV) is beneficial, as it increases the probability of the price staying range-bound. A sharp increase in IV is harmful, as it raises the probability of a large price move outside the profitable range.

- Adjustments: Typically, this is not an adjustable strategy. It is usually held to expiration or exited early for a partial profit/loss. Adjusting the strikes often negates the favorable risk-reward ratio that makes the trade attractive.

Exit Rules and Trade Management

- Profit Taking: If the underlying price is near the middle strike as expiration approaches, you can hold for maximum profit or exit early to lock in a gain (though it will be less than the max profit) and avoid last-minute pin risk.

- Stop-Loss (Monetary): Since the maximum loss is predefined, a traditional stop-loss is not used. However, if the underlying price moves significantly away from the middle strike early on, you may choose to exit to salvage some remaining premium (time value) instead of waiting for a total loss.

- Volatility Trigger: If implied volatility spikes unexpectedly, increasing the chance of a large breakout, consider exiting the position early to avoid the increased risk of max loss.

Position Sizing & Prudent Money Management

- Despite the low cost, always size positions appropriately. The maximum loss, while small, should still be a small fraction of your total risk capital (e.g., 1-2% per trade).

- Do not overleverage by putting on too many butterfly positions simply because they are "cheap." A series of total losses can still erode capital.

- Use this strategy tactically for specific expiry scenarios rather than as a core, always-on strategy.

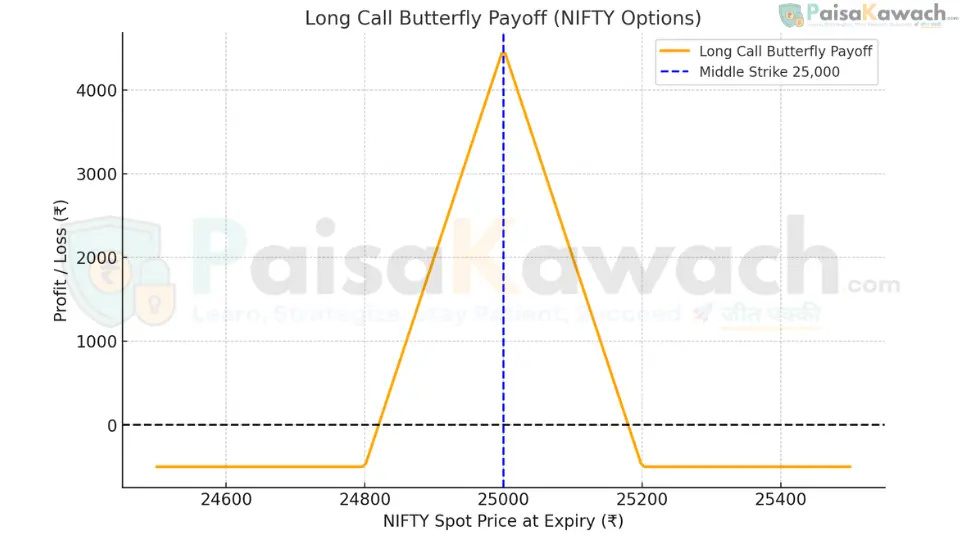

Detailed Example: NIFTY Long Call Butterfly

Assume NIFTY is trading at ₹25,000 with 5 days until monthly expiry. You expect it to expire very near this level.

- Buy 1 NIFTY 24,800 CE (Call) at a premium of ₹350

- Sell 2 NIFTY 25,000 CE (Calls) at a premium of ₹240 each (Credit = ₹480)

- Buy 1 NIFTY 25,200 CE (Call) at a premium of ₹150

Net Debit (per share): (₹350 + ₹150) - (₹240 * 2) = ₹500 - ₹480 = ₹20

Lot Size: 75 units (Standard for NIFTY options)

Total Capital at Risk (Max Loss): ₹20 * 75 = ₹1,500 (approx. $18)

Maximum Profit Calculation:

Width between strikes = 25,000 - 24,800 = 200 points (Note: The width between any two consecutive strikes is the same).

Max Profit (per share) = (Width - Net Debit) = (200 - 20) = ₹180

Total Maximum Profit: ₹180 * 75 = ₹13,500 (approx. $162)

Breakeven Points Calculation:

Lower Breakeven: Lower Strike + Net Debit = 24,800 + 20 = 24,820

Upper Breakeven: Higher Strike - Net Debit = 25,200 - 20 = 25,180

The trade is profitable at expiry if NIFTY closes between 24,820 and 25,180.

Payoff Scenarios at Expiry:

- Scenario 1 (Max Profit - Perfect Pin): NIFTY expires exactly at 25,000.

The two short 25,000 calls expire ATM and worthless. The long 24,800 call is ITM by ₹200. The long 25,200 call is OTM and worthless.

Net Profit = ₹200 (from long call) - ₹20 (net debit) = ₹180 per share.

Total Profit = ₹13,500 - Scenario 2 (Max Loss - Outside Wings): NIFTY expires at 24,700 (or below) or at 25,300 (or above).

All options expire worthless or their values cancel each other out exactly, leaving only the initial net debit as the loss.

Total Loss = ₹1,500 (the initial premium paid) - Scenario 3 (Small Loss - Near Miss): NIFTY expires at 24,810.

The long 24,800 call has ₹10 intrinsic value. All others expire worthless.

Net Loss = ₹10 (value) - ₹20 (debit) = -₹10 per share.

Total Loss = ₹750

Key Metrics and Greeks to Monitor

- Breakeven Points: The critical boundaries for profitability.

- Delta: Should be near zero when the position is established at the middle strike. It becomes positive if the price falls and negative if the price rises, but remains small.

- Gamma: Highest near the middle strike, meaning the delta will change rapidly as the price approaches this point.

- Theta: Positive. Time decay is beneficial if the price is within the profit zone.

- Vega: Negative. A drop in IV is helpful; a rise in IV is harmful.

Advantages of a Long Call Butterfly

- Extremely low cost and defined risk.

- Exceptionally high reward-to-risk ratio (e.g., 13,500/1,500 = 9:1 in the example).

- Clear, predefined profit and loss boundaries.

- Ideal for capitalizing on expiration week "pinning" phenomena.

- Benefits from time decay (positive theta) within the profit range.

Disadvantages of a Long Call Butterfly

- Requires very precise forecasting for maximum profit; even a small move away from the middle strike significantly reduces profits.

- No benefit from strong trending moves; in fact, they result in maximum loss.

- Potentially lower probability of profit compared to simpler spreads, as the price must expire within a specific range.

- Transaction costs (brokerage) can be a higher percentage of the potential profit due to the multi-leg nature.

Strategic Comparison: Long Call Butterfly vs. Bull Call Spread

| Factor | Long Call Butterfly | Bull Call Spread |

|---|---|---|

| Risk | Very Low (Net Premium Paid) | Moderate (Debit Paid for Spread) |

| Profit Potential | High, but requires precise expiry pinning | Capped, easier to achieve in a bullish move |

| Market Outlook | Neutral, Range-Bound (Specific Price Target) | Moderately Bullish |

| Capital Required | Very Low | Higher |

| Best Use Case | Expiration Week Tactical Play | Directional Bullish Move Over Several Weeks |

The Long Call Butterfly is a powerful, precision-based tool for experienced traders who can accurately predict a market's expiration price. Its defined risk and high reward potential make it an intellectually satisfying and strategically sound approach for exploiting market inertia during the crucial expiration period.