Long Call — Leverage with Limited Risk

A Long Call is the simplest bullish options strategy where you buy a call option to profit from rising stock prices. Risk is limited to the premium paid, while the potential reward is unlimited.

A Long Call is the foundational and most quintessential bullish options strategy, serving as the entry point for countless traders into the world of derivatives. It involves the outright purchase of a call option contract, which confers upon the buyer the right, but not the obligation, to purchase a specified quantity of an underlying asset—be it a stock, index, ETF, or commodity—at a predetermined strike price on or before a fixed expiration date. The allure of this strategy is its elegant asymmetry: it offers theoretically unlimited profit potential while strictly limiting the maximum loss to the initial premium paid, providing powerful leverage without the commensurate risk of a outright short position or the full capital outlay of owning the asset itself.

When to Deploy a Long Call Strategy

The Long Call is a precision tool designed for specific, high-conviction market environments. It is not a passive investment but a tactical trade that capitalizes on anticipated price appreciation within a defined timeframe. Its efficacy is highest under the following conditions:

- Strong Bullish Conviction: You possess a well-researched expectation of a significant upward move in the underlying asset's price, driven by technical breakouts, positive earnings surprises, favorable sector rotation, or impactful macroeconomic news.

- Defined Time Horizon: The anticipated price move is expected to occur within the lifespan of the option contract, typically within a few weeks to a couple of months, allowing you to harness the leverage of options without succumbing entirely to time decay.

- Leverage Requirement: You seek to control a large notional value of the underlying asset with a relatively small amount of capital, thereby magnifying potential returns on invested capital (though losses are 100% of the premium).

- Volatility Expectations: You anticipate an increase in implied volatility (IV), which will inflate the option's premium, or you are entering during a period of relatively low IV, obtaining cheaper "insurance" for your bullish view.

- Risk-Defined Speculation: You wish to speculate on a directional move with a completely known and acceptable worst-case scenario—the total loss of the premium paid.

The Strategic Setup: A Trader's Checklist

Success with long calls is not accidental; it is a product of meticulous preparation and disciplined execution. Before entering a trade, a systematic approach to setup is non-negotiable.

- Underlying Asset Selection:

- Choose highly liquid underlying assets with active options markets. This ensures tight bid-ask spreads, reducing entry and exit friction.

- Prefer assets with a historical tendency for strong trending behavior rather than those that are perpetually range-bound. - Expiration Date Selection:

- 30-60 Days to Expiration (DTE): This is often the "sweet spot." It provides sufficient time for the thesis to play out while avoiding the extreme time decay (Theta) that ravages very short-dated options.

- Avoid weekly expiries unless you are trading a very near-term, event-driven catalyst (e.g., earnings) and are an experienced trader. - Strike Price Selection:

- At-The-Money (ATM): Offers the best balance between cost, delta sensitivity, and probability of profit. The option has a delta of ~0.50, meaning it will act like 50 shares of stock for every contract owned.

- Out-of-The-Money (OTM): Cheaper entry, offering higher leverage. However, it requires a larger percentage move in the underlying to become profitable and has a lower probability of expiring in-the-money. Suitable for higher-conviction, higher-move expectations.

- In-The-Money (ITM): More expensive, but has intrinsic value and a higher delta, behaving more like the stock itself. It is less susceptible to time decay as a percentage of its value but requires more capital. - Premium and Budgeting:

- The premium paid is your maximum loss. Define this amount clearly before the trade.

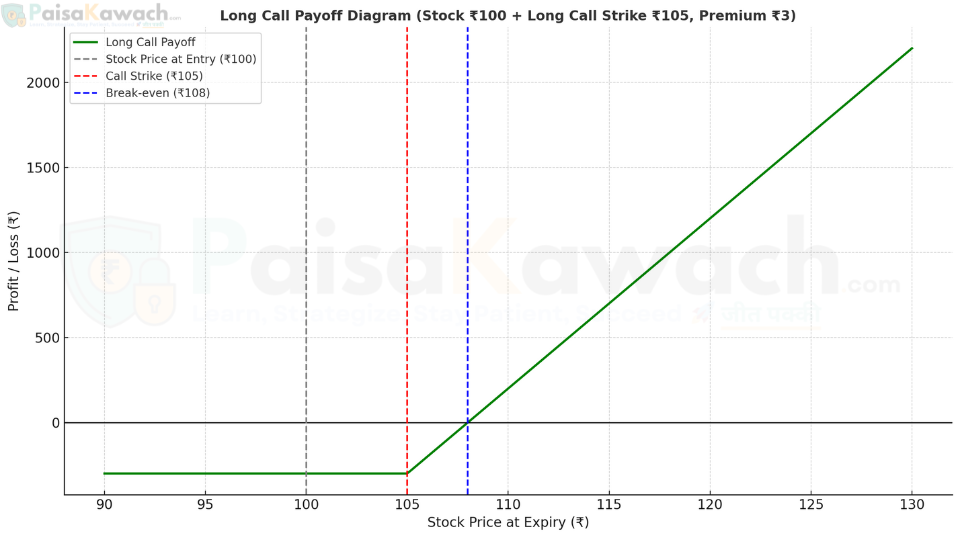

- Calculate the Breakeven (BE) point immediately: BE = Strike Price + Premium Paid. Ensure your price target is sufficiently above this level to justify the trade's risk.

Step-by-Step Entry Protocol

- Identify the Setup: Use your technical or fundamental analysis to identify a high-probability bullish setup with a clear catalyst and price target.

- Select the Instrument: Choose the specific option contract (underlying, expiration date, strike price) that aligns with your thesis and risk parameters.

- Place the Order: Use a limit order to enter the trade. Do not market order options; always specify the price you are willing to pay to avoid slippage.

- Journal the Trade: Before clicking "buy," record all trade details in your journal: entry price, strike, expiration, underlying price, implied volatility, and—most importantly—your rationale and predefined exit plan.

Comprehensive Risk Analysis and position Management

Understanding the Greeks is paramount to managing a long call position effectively, as they describe the various risks to which the position is exposed.

- Delta (Δ) - Directional Risk:

- Definition: Sensitivity of the option's price to a ₹1 change in the underlying asset.

- Management: A positive Delta means you profit if the stock goes up. Monitor to understand how your position behaves relative to the stock. - Theta (Θ) - Time Decay Risk:

- Definition: The amount the option's price decreases each day due to the passage of time.

- Management: This is your enemy. Theta decay accelerates in the final 30 days. Your trade must overcome this constant erosion of value. If the stock stalls, you will lose money daily. - Vega (ν) - Volatility Risk:

- Definition: Sensitivity of the option's price to a 1% change in implied volatility.

- Management: You are long Vega. An increase in IV will increase your option's value, helping your trade. A decrease in IV will hurt it, even if the stock price doesn't move. Avoid buying options when IV is extremely high ("IV Rank" or "IV Percentile"), as you are buying expensive premium that can deflate. - Maximum Loss: Strictly limited to 100% of the premium paid. This occurs if the option expires Out-of-The-Money or At-The-Money.

- Maximum Profit: Theoretically unlimited. The profit increases linearly for every point the underlying asset moves above the breakeven point.

Disciplined Exit Framework

A predefined exit strategy is what separates professionals from amateurs. Do not "hope and hold."

- Profit-Taking Exits:

- Rule of 50-100%: Consider taking profits if the option value doubles (100% gain). You can sell half your position to book gains and let the remainder run risk-free.

- Technical Exits: Exit if the underlying asset hits a major resistance level or shows signs of reversal on the charts.

- Time-Based Exits: If you are 7-14 days from expiration and have a profit, strongly consider closing the position to avoid the accelerated time decay in the final weeks. - Stop-Loss Exits:

- While a long call's loss is capped, it is often wise to exit early if the thesis is broken.

- Exit the trade if the underlying asset breaks below a key technical support level.

- If the option's value decays by 50% or more due to time or falling volatility, consider cutting the position to preserve remaining capital for a better opportunity. - Expiration: Never hold a long call until expiration if it is near or At-The-Money. The pin risk and potential for assignment (for ITM options) are unnecessary complexities. Always close the position before expiry.

Rigorous Position Sizing and Capital Preservation

The leverage of options is a double-edged sword. Prudent position sizing is the cornerstone of long-term survival and success.

- The 1-2% Rule: Never risk more than 1-2% of your total trading capital on any single long call trade. The premium paid for one contract should be within this limit.

- Example: If your trading account is ₹500,000, your maximum risk per trade is ₹5,000 (1%). Therefore, you can only buy options where the premium * lot size is ≤ ₹5,000. - No Averaging Down: Never add to a losing long call position. If your thesis is wrong, adding more capital only increases your risk of a 100% loss on a larger amount. A long call is a wasting asset; averaging down is typically a disastrous strategy.

- Portfolio Allocation: Long calls should be a part of a diversified options strategy portfolio, not the entire portfolio itself. Allocate only a small portion of your capital to outright directional speculation.

Illustrative Example with Real-World Numbers

Trade Scenario: INFY is trading at ₹1,800. You are bullish due to a strong cup-and-handle breakout on the weekly chart and anticipate a move to ₹1,950 within the next 6 weeks.

- Action: Buy 1 INFY 1,800 Call (ATM) option with 45 days to expiration.

- Premium Paid: ₹65 per share.

- Contract Lot Size: 100 shares.

- Total Investment (Max Loss): ₹65 * 100 = ₹6,500.

- Breakeven Point at Expiry: ₹1,800 (Strike) + ₹65 (Premium) = ₹1,865.

- Maximum Profit Potential: Unlimited above ₹1,865.

Scenario Analysis at Expiration:

1. INFY at ₹1,750 (Bearish): Option expires worthless. Loss = ₹6,500 (full premium).

2. INFY at ₹1,865 (Breakeven): Intrinsic Value = ₹65. Net P&L = ₹65 - ₹65 = ₹0.

3. INFY at ₹1,950 (Target Hit): Intrinsic Value = ₹150. Net Profit = ₹150 - ₹65 = ₹85 per share → ₹8,500 Total Profit (a 131% return on capital at risk).

4. INFY at ₹2,000 (Strong Rally): Intrinsic Value = ₹200. Net Profit = ₹200 - ₹65 = ₹135 per share → ₹13,500 Total Profit.

Key Performance Metrics and Greeks to Monitor

- Breakeven (BE): The fundamental metric. The underlying must be above BE at expiry for the trade to be profitable.

- Delta (Δ): Initially ~0.50 for an ATM call. As the stock rises and the call goes ITM, Delta approaches 1.00. As it falls OTM, Delta approaches 0.

- Theta (Θ): Monitor the daily time decay. An ATM option might have a Theta of -₹2.50, meaning it loses ₹250 per day per contract (₹2.50 * 100 shares).

- Vega (ν): An ATM option might have a Vega of ₹0.25, meaning its price changes by ₹25 for every 1% change in IV.

- Probability of Profit (PoP): Based on the option's Delta and other models, this gives an approximate chance of finishing ITM. For an ATM call, PoP is typically around 50%.

Advantages and Disadvantages: A Balanced View

Advantages:

- Defined, Limited Risk: The maximum possible loss is known and capped at the initial investment.

- Unlimited Profit Potential: Offers participation in upward moves with no upside cap.

- High Leverage: Provides control over a large notional asset value with a small capital outlay.

- Simplicity: Easy to understand, execute, and manage compared to complex multi-leg strategies.

Disadvantages:

- Time Decay (Theta): The option is a wasting asset. Time is a constant headwind that must be overcome by a favorable price move.

- Lower Probability of Profit: Statistically, most options expire worthless. The odds are inherently against the buyer.

- Volatility Risk (Vega): A drop in implied volatility can cause the option's price to fall even if the underlying stock price remains unchanged.

- Requires Precision: The underlying must not only move in the right direction but must do so with enough magnitude and within a specific time window.

Comparative Analysis: Long Call vs. Long Stock

| Parameter | Long Call Option | Long Stock (Shares) |

|---|---|---|

| Capital Requirement | Low (Only Premium Paid) | High (Full Share Price) |

| Maximum Risk | Limited to Premium Paid | Unlimited (Theoretical: Price → 0) |

| Profit Potential | Unlimited | Unlimited |

| Time Impact | Negative (Time Decay) | Neutral (No Expiry) |

| Leverage | Yes (High) | No |

| Income (Dividends) | No | Yes |

| Voting Rights | No | Yes |

In conclusion, the Long Call is a powerful, accessible, and defined-risk strategy for expressing a bullish view. Its mastery requires more than just a bullish outlook; it demands disciplined trade selection, precise timing, rigorous risk management, and an unwavering respect for the erosive effects of time decay. When used judiciously within a well-constructed trading plan, it can be an exceptionally effective tool for capitalizing on anticipated upward movements in the market.