Long Put — Profit from Falling Prices

A Long Put is a simple bearish options strategy where you buy a put option to profit from falling stock prices. Risk is limited to the premium, while downside profit potential is large.

A Long Put is a foundational and powerfully asymmetric bearish options strategy that grants the holder the right to sell an underlying asset at a predetermined strike price before a specified expiration date. It is the definitive tool for traders anticipating a significant decline in the price of a stock, index, or ETF. Unlike short selling the underlying asset—which exposes the trader to theoretically unlimited losses—the long put strategy strictly confines the maximum risk to the initial premium paid, while offering substantial, albeit capped, profit potential should the asset's price fall dramatically. This combination of defined risk and leveraged bearish exposure makes it an indispensable instrument for hedging portfolios, speculating on downturns, and capitalizing on event-driven volatility.

Strategic Application: When to Deploy a Long Put

The Long Put is a tactical, not a passive, strategy. It is most effective when deployed in specific market conditions that align with its characteristics of time sensitivity and volatility dependence.

- High-Conviction Bearish Outlook: You have a well-researched expectation of a substantial downward move, supported by technical breakdowns (e.g., breaking key support levels, bearish chart patterns like head and shoulders), deteriorating fundamentals, negative sector news, or adverse macroeconomic developments.

- Event-Driven Downside Plays: Ideal for positioning ahead of potential catalysts such as earnings reports expected to disappoint, FDA drug approval decisions, negative legal rulings, or macroeconomic data releases (e.g., high CPI prints) that could spark a sell-off.

- Portfolio Hedging: An investor holding a long stock portfolio can purchase puts as insurance against a broad market correction or sector-specific decline. The premium paid is the cost of this protection, limiting downside in the portfolio while allowing full participation in any upside.

- Rising Volatility Environment: The strategy benefits from an increase in Implied Volatility (IV). Entering a long put when IV is relatively low (e.g., before a high-impact event) allows you to "buy cheap volatility," which can amplify profits if the expected drop occurs and IV expands.

- Leveraged Bearish Speculation without Unlimited Risk: For traders who want the profit potential of shorting stock but are wary of the uncapped risk, the long put provides a perfect alternative. The maximum loss is known from the outset.

The Pre-Trade Checklist: A Disciplined Setup

Success with long puts hinges on meticulous preparation. A systematic approach to trade construction is critical for optimizing the risk-reward profile.

- Underlying Selection:

- Choose liquid assets with active options markets to ensure narrow bid-ask spreads and ease of entry/exit.

- Prefer assets with a propensity for strong directional moves and clear, identifiable catalysts for the bearish view. - Expiration Selection (Time Horizon):

- 30-60 Days to Expiration (DTE): This timeframe is generally optimal. It provides enough time for the bearish thesis to unfold without subjecting the position to the extreme time decay that ravages very short-dated options.

- For known event catalysts (e.g., earnings the next week), a shorter-dated put can be used, but this is higher risk due to accelerated theta. - Strike Price Selection:

- At-The-Money (ATM): Offers the best balance of cost, sensitivity (Delta ~ -0.50), and probability of profit. It will respond almost point-for-point to moves in the underlying below the strike.

- Out-of-The-Money (OTM): Cheaper and offers higher leverage, but requires a larger downward move to become profitable. Suitable for very high-conviction, high-magnitude bearish forecasts.

- In-The-Money (ITM): More expensive but has intrinsic value and a higher delta (closer to -1.00), behaving more like a short stock position. It is less sensitive to time decay as a percentage of its value. - Premium and Risk Budgeting:

- The premium paid is your maximum loss. This amount must be predefined and acceptable.

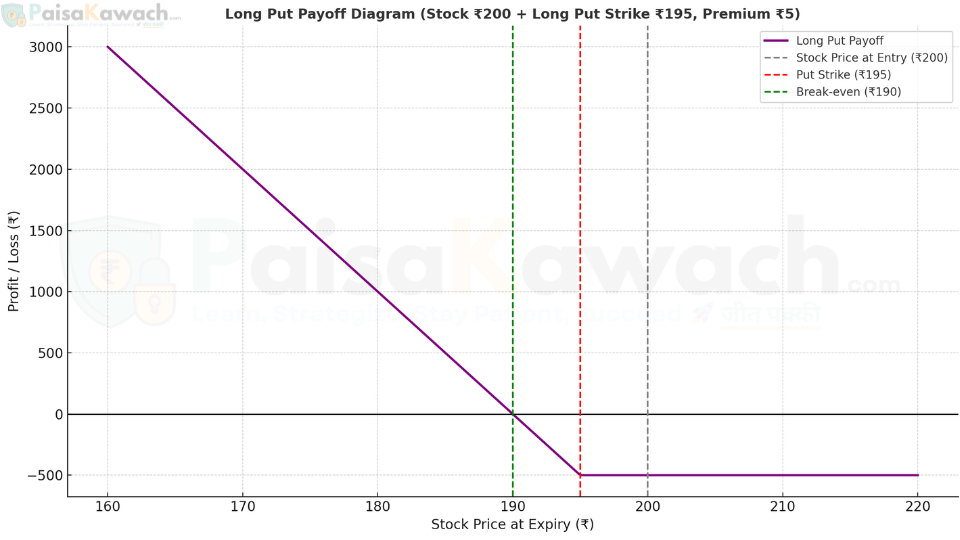

- Calculate the Breakeven (BE) point immediately: BE = Strike Price - Premium Paid. Ensure your downside price target is sufficiently below this level to justify the trade's risk.

Execution Protocol: Entering the Trade

- Signal Generation: Your entry should be triggered by a specific technical breakdown (e.g., break below a 50-day MA with volume) or a fundamental catalyst.

- Contract Selection: Based on your checklist, select the specific put option (symbol, expiration, strike).

- Order Placement: Always use a limit order to specify the maximum premium you are willing to pay. Avoid market orders to prevent costly slippage.

- Trade Journaling: Before execution, record all details: entry price, strike, expiration, underlying price, current IV, and your predefined profit target and stop-loss levels.

Comprehensive Risk and Greek Exposure Analysis

Managing a long put requires an understanding of the "Greeks," which quantify the various risks affecting the option's price.

- Delta (Δ) - Directional Risk:

- Definition: Sensitivity of the option's price to a ₹1 change in the underlying. For puts, Delta is negative (between 0 and -1).

- Management: A Delta of -0.60 means the put's price will increase by approximately ₹0.60 for every ₹1.00 drop in the underlying. - Theta (Θ) - Time Decay Risk:

- Definition: The daily erosion of the option's value due to the passage of time.

- Management: This is your adversary. Theta decay accelerates in the final 30 days. Your trade must overcome this constant drag through a timely price move. - Vega (ν) - Volatility Risk:

- Definition: Sensitivity of the option's price to a 1% change in Implied Volatility.

- Management: You are long Vega. An increase in IV will increase the put's value, aiding your trade. A decrease in IV will harm it, even if the stock price falls. Avoid buying puts when IV is at extreme highs unless you expect it to go even higher. - Maximum Loss: Strictly limited to 100% of the premium paid. This occurs if the option expires Out-of-The-Money or At-The-Money.

- Maximum Profit: Capped but substantial. The maximum profit occurs if the underlying price falls to zero. Max Profit = (Strike Price - 0) - Premium Paid.

Disciplined Exit Framework

A predetermined exit plan is essential to capture profits and manage losses effectively.

- Profit-Taking Exits:

- Percentage Gain Rule: Consider taking profits if the option value increases by 50-100%. You can sell a portion to bank gains and let the remainder run.

- Technical Exit: Exit if the underlying asset hits a major historical support level or shows signs of a reversal (bullish hammer, positive divergence on RSI).

- Time-Based Exit: With 7-14 days until expiration and a profit, strongly consider closing the position to avoid the gravitational pull of time decay. - Stop-Loss Exits:

- Exit if the underlying asset breaks back above a key resistance level, invalidating your bearish thesis.

- If the option's value decays by 50% or more due to time passage or IV crush, cut the position to preserve remaining capital. - Expiration: Do not hold a long put until expiration if it is near-the-money. Close the position beforehand to avoid pin risk and assignment complexities.

Prudent Position Sizing and Capital Allocation

The defined risk of a long put does not excuse reckless position sizing.

- The 1-2% Rule: Never risk more than 1-2% of your total trading capital on a single long put trade.

- Example: A ₹1,000,000 portfolio allows a maximum risk of ₹10,000 - ₹20,000 per trade. The premium for your put position must fit within this limit. - No Averaging Down: Never add to a losing long put position. The option is a wasting asset; adding more capital to a wrong thesis magnifies the guaranteed loss of premium.

- Strategic Role: Use long puts for specific tactical bearish bets or hedging. They should not constitute the majority of a portfolio.

Illustrative Example with Real-World Scenarios

Trade Scenario: A leading bank, HDFC Bank, is trading at ₹1,600. Technical analysis indicates a breakdown from a rising wedge pattern, and macroeconomic headwinds suggest a target of ₹1,450.

- Action: Buy 1 HDFC Bank ₹1,600 Put (ATM) option with 40 days to expiration.

- Premium Paid: ₹55 per share.

- Contract Lot Size: 250 shares (equity lot size).

- Total Investment (Max Loss): ₹55 * 250 = ₹13,750.

- Breakeven Point at Expiry: ₹1,600 (Strike) - ₹55 (Premium) = ₹1,545.

- Maximum Profit Potential: (₹1,600 - ₹0) - ₹55 = ₹1,545 per share → ₹386,250 (theoretical max, if HDFC Bank goes to zero).

Scenario Analysis at Expiration:

1. HDFC Bank at ₹1,650 (Adverse Move): Option expires worthless. Loss = ₹13,750 (full premium).

2. HDFC Bank at ₹1,545 (Breakeven): Intrinsic Value = ₹55. Net P&L = ₹55 - ₹55 = ₹0.

3. HDFC Bank at ₹1,450 (Target Hit): Intrinsic Value = ₹150. Net Profit = ₹150 - ₹55 = ₹95 per share → ₹23,750 Total Profit (a 173% return on capital at risk).

4. HDFC Bank at ₹1,300 (Sharp Decline): Intrinsic Value = ₹300. Net Profit = ₹300 - ₹55 = ₹245 per share → ₹61,250 Total Profit.

Key Performance and Monitoring Metrics

- Breakeven (BE): The fundamental hurdle. The underlying must be below BE at expiry for the trade to be profitable.

- Delta (Δ): Initially ~ -0.50 for an ATM put. Becomes more negative (approaches -1.00) as the stock falls and the put goes deeper ITM.

- Theta (Θ): Monitor daily decay. An ATM put might have a Theta of -₹2.00, meaning it loses ₹500 per day per contract (₹2.00 * 250 shares).

- Vega (ν): An ATM put might have a Vega of ₹0.20, meaning its price changes by ₹50 for every 1% change in IV.

Advantages and Disadvantages

Advantages:

- Defined, Limited Risk: Maximum loss is known and capped at the premium paid.

- High Profit Potential: Significant leveraged returns on capital during sharp declines.

- Superior Alternative to Shorting: No margin requirements, no borrowing costs, no risk of a short squeeze, and no unlimited upside risk.

- Effective Hedge: Perfectly insulates a long stock portfolio from downside risk for a known cost.

Disadvantages:

- Time Decay (Theta): The option's value erodes daily, requiring a timely and sufficient price move to be profitable.

- Cost: The premium is a sunk cost if the trade does not work.

- Volatility Risk: A decline in IV can negatively impact the option's price, offsetting some gains from a falling stock price.

- Lower Probability of Profit: Statistically, the odds of expiring ITM are less than 50% for ATM and OTM puts.

Comparative Analysis: Long Put vs. Short Selling Stock

| Parameter | Long Put Option | Short Selling Stock |

|---|---|---|

| Capital Requirement | Low (Only Premium Paid) | High (Margin Required) |

| Maximum Risk | Limited to Premium Paid | Unlimited (Theoretical: Price → ∞) |

| Profit Potential | Large but Capped (up to Strike - Premium) | Large but Capped (up to Entry Price) |

| Time Impact | Negative (Time Decay) | Negative (Borrow Costs, Dividends) |

| Complexity & Risk | Simple, Defined Risk | Complex, Unlimited Risk |

| Additional Risks | None | Short Squeezes, Buy-Ins |

In summary, the Long Put is a versatile, powerful, and risk-defined strategy for capitalizing on bearish market movements. Its effectiveness is maximized through careful strike and expiration selection, disciplined entry and exit protocols, and a thorough understanding of how time and volatility impact its value. Whether used for speculation or protection, it remains a cornerstone strategy for any sophisticated options trader.