Long Straddle Options Strategy: Profit from Big Market Moves

The Long Straddle is a volatility strategy where you buy a call and a put with the same strike and expiry. Risk is limited to premiums paid, while profits grow if the market moves sharply in either direction.

Long Straddle Options Strategy: A Sophisticated Play for Capturing Volatility

The Long Straddle is a premier, pure-volatility options strategy designed for traders who anticipate a significant price movement but are agnostic to its direction. It is constructed by simultaneously purchasing both a Call and a Put option on the same underlying asset, with identical strike prices (typically At-The-Money) and the exact same expiry date. This simultaneous long position in both sides of the market creates a truly direction-neutral profile, where substantial profits can be realized from a powerful breakout in either direction—up or down.

The primary allure of the Long Straddle lies in its elegant risk-reward structure: the maximum potential loss is strictly confined to the total net premium paid to establish the position, while the profit potential on either side is theoretically unlimited. This strategy is the quintessential tool for capitalizing on major binary events known to trigger explosive price action, where uncertainty is high and the market's eventual direction is a coin toss.

- Risk is Capped and Predefined: Maximum loss = Total premium paid for the call and the put.

- Profit is Asymmetric and Unlimited: Gains accelerate with the magnitude of the move in the underlying asset, with no upper bound on the upside and very large potential on the downside (capped at the strike price minus zero).

- A Pure Volatility Play: The strategy's profitability is directly tied to an increase in realized volatility. It is most effective when the actual market move exceeds the move already priced in by implied volatility (IV).

When to Deploy a Long Straddle

This strategy is strategically ideal during periods where you forecast a surge in realized volatility that will outpace current implied volatility levels, but you possess no clear directional conviction. Classic catalysts include:

- Monetary policy announcements (e.g., RBI or Fed interest rate decisions).

- Major fiscal events (e.g., Union Budget, Economic Survey).

- High-impact corporate earnings reports for index-heavyweight companies.

- Election results, referendums, or significant geopolitical developments.

- The release of critical macroeconomic data (e.g., CPI, GDP, NFP).

Strategic Setup Checklist

- Underlying Asset: Select highly liquid instruments with high option volumes to ensure tight bid-ask spreads. NIFTY 50, Bank NIFTY, and major index constituents are ideal.

- Strike Selection: Choose the At-The-Money (ATM) strike price. This is where the combined sensitivity (Delta) of the position is closest to zero and where the gamma (rate of change of delta) is highest, maximizing responsiveness to price moves.

- Expiry Cycle: Prefer weekly or monthly expiries that immediately follow the anticipated high-impact event. This minimizes the corrosive effect of time decay (Theta) post-event.

- Cost Analysis: Sum the premiums of the call and put. This total debit is your maximum risk. Calculate your breakeven points immediately: Strike Price ± Total Premium Paid.

Step-by-Step Entry Rules

- Buy 1 ATM Call Option (e.g., NIFTY 20,000 Call)

- Buy 1 ATM Put Option (e.g., NIFTY 20,000 Put) with the same expiry date.

- Net Debit = (Call Premium + Put Premium) * Lot Size. This is the total capital at risk and the maximum possible loss.

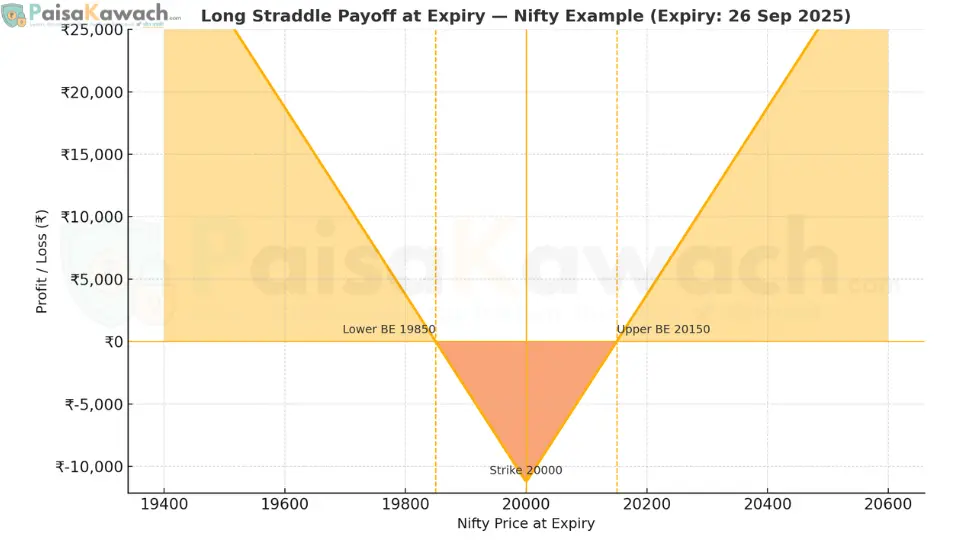

Detailed Example: NIFTY Long Straddle

Assume NIFTY is trading at 20,000 ahead of the RBI policy announcement. The monthly expiry is 26th September 2025.

- Buy NIFTY 26SEP2025 20,000 CE (Call) at a premium of ₹80 per share.

- Buy NIFTY 26SEP2025 20,000 PE (Put) at a premium of ₹70 per share.

Total Premium Paid per share: ₹80 + ₹70 = ₹150

Lot Size: 75 units (standard for NIFTY)

Total Capital at Risk (Max Loss): ₹150 × 75 = ₹11,250 (approx. $135)

Breakeven Points Calculation:

- Upper Breakeven: Strike Price + Total Premium = 20,000 + 150 = 20,150

- Lower Breakeven: Strike Price - Total Premium = 20,000 - 150 = 19,850

For the trade to be profitable at expiry, NIFTY must close above 20,150 or below 19,850.

Payoff Scenarios at Expiry:

- Scenario 1 (Large Bull Move): NIFTY closes at 20,400.

Call Profit: (20,400 - 20,000) = ₹400. Put expires worthless.

Net Profit per share: ₹400 - ₹150 (premium) = ₹250.

Total Profit: ₹250 × 75 = ₹18,750 (~$225) - Scenario 2 (Large Bear Move): NIFTY closes at 19,600.

Put Profit: (20,000 - 19,600) = ₹400. Call expires worthless.

Net Profit per share: ₹400 - ₹150 (premium) = ₹250.

Total Profit: ₹250 × 75 = ₹18,750 (~$225) - Scenario 3 (Small Move): NIFTY closes at 20,050.

Call Intrinsic Value: ₹50. Put expires worthless.

Net Loss per share: ₹50 - ₹150 = -₹100.

Total Loss: ₹100 × 75 = ₹7,500 (~$90) - Scenario 4 (No Move - Max Loss): NIFTY closes exactly at 20,000.

Both options expire worthless.

Total Loss: ₹150 × 75 = ₹11,250 (approx. $135)

Risk & Position Management

The Long Straddle's risk profile is precisely defined but requires active management of non-directional factors:

- Maximum Loss: Strictly limited to the total net premium paid (₹11,250 in this example).

- Maximum Profit: Unlimited on the upside. Very large on the downside (theoretically, the strike price minus zero, minus the premium paid).

- Theta (Time Decay): This is the strategy's greatest enemy. The position has negative theta, meaning it loses monetary value with each passing day if the underlying price remains static. This decay accelerates rapidly in the final days before expiry.

- Vega (Volatility Risk): This is the strategy's greatest friend. The position has positive vega, meaning its value increases as implied volatility (IV) rises. A critical risk is "IV Crush"—a sharp drop in implied volatility after the anticipated event occurs, which can decimate the position's value even if a move happens.

- Adjustments: The position is typically not adjusted but rather exited. If the market makes a strong directional move, one leg becomes profitable while the other becomes nearly worthless. Traders often take profits by selling the profitable leg and holding the other as a lottery ticket, or close the entire position.

Exit Rules and Trade Management

- Profit Taking: If the underlying makes a strong move towards one breakeven point, consider taking partial or full profits. You do not need to hold until expiry.

- Stop-Loss (Time/Volatility Based): If the anticipated event passes and the market fails to move significantly, exit the trade quickly to avoid further time decay. Similarly, if implied volatility collapses (IV Crush) post-event, exit immediately.

- Rolling: If the event is delayed or volatility remains high but the price is stagnant, you might consider "rolling" the position to a further expiry date, though this involves additional cost.

Position Sizing & Prudent Money Management

- Allocate only a small, risk-defined portion of your trading capital (e.g., 1-5%) to any single straddle trade. The premium paid is a sunk cost and guaranteed loss if the market doesn't move.

- Avoid the temptation to over-leverage. A string of unsuccessful straddle trades can significantly erode capital due to the high premium outlay.

- Employ this strategy tactically, not as a core, always-on strategy. It is designed for specific, high-volatility event windows.

Key Metrics and Greeks to Monitor

- Breakeven Levels: The most critical numbers. Monitor how far the price is from these points.

- Delta: Starts near neutral (0). It will become positive if the price rises and negative if the price falls.

- Gamma: High, meaning the Delta will change rapidly with price moves, which is beneficial for the strategy.

- Theta: Negative. Be aware of the daily time decay cost.

- Vega: Positive. Monitor implied volatility levels entering the event.

Advantages of the Long Straddle

- Unlimited profit potential from volatility in both directions.

- Clearly defined and limited maximum risk, known upfront.

- Simple construction with only two legs.

- Perfectly suited for trading high-impact, binary event risk.

Disadvantages of the Long Straddle

- High initial capital outlay (paying two premiums).

- Significant negative time decay (theta), which erodes value quickly.

- Vulnerability to Implied Volatility Crush (Vega risk), which can cause losses even on a directional move if the move is smaller than expected.

- The underlying must make a very large move to overcome the cost of the premiums and become profitable.

Strategic Comparison: Long Straddle vs. Long Strangle

| Factor | Long Straddle | Long Strangle |

|---|---|---|

| Strike Selection | Same ATM strike | Different OTM strikes (OTM Call + OTM Put) |

| Initial Cost | Higher (uses expensive ATM options) | Lower (uses cheaper OTM options) |

| Breakeven Range | Narrower (closer to strike price) | Wider (further from strike price) |

| Probability of Profit | Lower (requires larger move) | Higher (but requires an even larger move for significant profit) |

| Profit Potential | Unlimited in both directions | Unlimited in both directions |

The Long Straddle remains a favored strategy among sophisticated traders for navigating periods of extreme uncertainty. Its defined-risk, high-reward potential makes it a powerful strategic arrow in the quiver for any options trader looking to profit from market turmoil and event-driven breakouts.