Long Strangle Options Strategy: Low-Cost Bet on Big Market Moves

The Long Strangle is a volatility strategy where you buy an out-of-the-money Call and Put with the same expiry. It costs less than a Long Straddle and profits if the market makes a big move in either direction.

Long Strangle Options Strategy: A Defined-Risk Bet on Explosive Volatility

The Long Strangle is a sophisticated, non-directional options strategy designed to profit from significant price movements in the underlying asset, regardless of the direction. It involves the simultaneous purchase of one Out-of-the-Money (OTM) Call option and one Out-of-the-Money (OTM) Put option on the same underlying asset with the same expiration date. By selecting strikes that are out-of-the-money, the strategy is constructed at a lower net debit than a Long Straddle, making it a more cost-effective vehicle for speculating on high volatility when the magnitude of the expected move is large, but the direction is entirely uncertain.

- Max Loss: Strictly limited to the total net premium paid to establish the strangle.

- Max Profit (Upside): Theoretically unlimited if the underlying price rallies dramatically.

- Max Profit (Downside): Very large, though finite, limited to the strike price of the put minus the net premium paid (as the underlying asset cannot fall below zero).

- Market View: You anticipate a period of extremely high volatility that will cause a major price breakout, but you are agnostic to whether that breakout is to the upside or downside.

When to Use a Long Strangle

This strategy is a tactical play for specific, high-conviction scenarios. It is not a buy-and-hold strategy.

- Major binary events are imminent where the outcome is expected to cause a large price swing, but the result is a coin toss. Examples: Earnings reports for a volatile stock, central bank interest rate decisions (RBI, Fed), national election results, union budgets, or key economic data releases (GDP, CPI).

- Technical analysis suggests the underlying asset is in a severe consolidation or compression pattern (like a very tight squeeze), which historically precedes explosive breakouts.

- You seek a lower-cost alternative to a Long Straddle and are willing to accept that the underlying must move farther to reach profitability.

- Implied Volatility (IV) is relatively low or expected to rise sharply due to an upcoming event, making the options cheaper to buy before the volatility spike.

Setup Checklist: Constructing the Strangle

- Underlying Selection: Choose highly liquid underlying assets with rich options markets to ensure tight bid-ask spreads. Broad market indices like NIFTY or BankNIFTY in India, or SPX/SPY in the US, are ideal due to their high volatility during events.

- Strike Selection: The core of the strategy. Choose calls and puts that are out-of-the-money. The distance of the strikes from the current spot price is a trade-off: wider strikes are cheaper but require a larger move to become profitable; narrower strikes are more expensive but have lower breakevens. A common approach is to choose strikes with a similar Delta (e.g., 0.16 Delta for both the call and put).

- Expiry Selection: Use short-term expirations (1-4 weeks) that encompass the anticipated high-volatility event. This minimizes the negative effect of time decay (Theta). Avoid long-dated expiries as the constant decay will work against you.

- Cost Calculation: The total cost is the sum of the call premium and the put premium. This net debit is your maximum possible loss and must be justified by the probability and potential size of the expected move.

Entry Rules: Executing the Trade

- Buy the OTM Call: Buy to Open (BTO) one out-of-the-money call option. The strike should be above the current market price.

- Buy the OTM Put: Buy to Open (BTO) one out-of-the-money put option with the same expiration date. The strike should be below the current market price.

- Record the Trade Parameters: Note the net debit paid (max loss), calculate both breakeven points, and set alerts for these price levels.

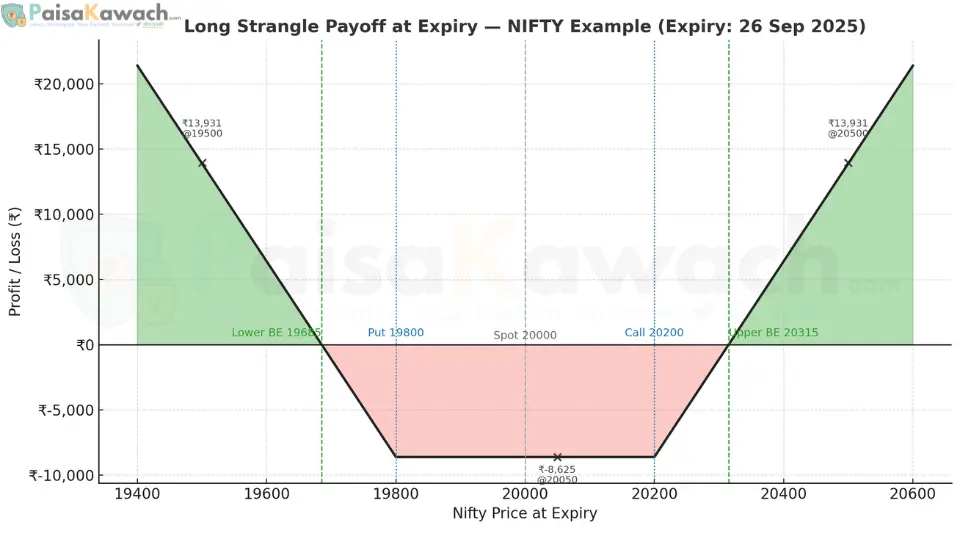

Detailed Example: NIFTY Long Strangle

Assume NIFTY is trading at 20,000. A major economic event is scheduled before the monthly expiry on September 26th, 2025.

- Buy 1 LOT of NIFTY 20,200 Call Option (OTM) @ ₹60

- Buy 1 LOT of NIFTY 19,800 Put Option (OTM) @ ₹55

Total Net Debit (Max Loss): ₹60 + ₹55 = ₹115 per share.

Since the NIFTY lot size is 75, total capital at risk = ₹115 * 75 = ₹8,625.

Breakeven Points Calculation:

These are the points where the profit from one leg exactly offsets the total premium paid for the entire strategy.

- Upper Breakeven: Call Strike + Net Premium = 20,200 + 115 = 20,315

- Lower Breakeven: Put Strike - Net Premium = 19,800 - 115 = 19,685

For the trade to be profitable, NIFTY must close above 20,315 or below 19,685 at expiration.

Payoff Scenarios at Expiry:

- Scenario 1: Big Rally (NIFTY at 20,500)

Call Value: (20,500 - 20,200) = ₹300. Put Value: ₹0 (expires worthless).

Gross Profit: ₹300 - ₹115 (net debit) = ₹185 per share.

Total Net Profit: ₹185 * 75 = ₹13,875 - Scenario 2: Big Crash (NIFTY at 19,500)

Put Value: (19,800 - 19,500) = ₹300. Call Value: ₹0 (expires worthless).

Gross Profit: ₹300 - ₹115 (net debit) = ₹185 per share.

Total Net Profit: ₹185 * 75 = ₹13,875 - Scenario 3: No Move (NIFTY at 20,000)

Both options expire worthless.

Total Net Loss: ₹115 * 75 = ₹8,625 (Max Loss)

Risk & Management: The Greeks

- Max Loss: Capped at the total net premium paid (₹8,625 in the example). This occurs if the underlying price at expiration is between the two strike prices.

- Theta (Time Decay): Negative. This is the biggest enemy of the long strangle. The value of both options erodes every day, especially in the final week before expiration. The strategy suffers if the expected move is delayed.

- Vega (Volatility Risk): Positive. The strategy benefits from an increase in Implied Volatility (IV). A rise in IV increases the value of both options, potentially allowing for a profitable exit before the event even occurs.

- Assignment Risk: Minimal. Since both options are out-of-the-money and long, the risk of early assignment is very low.

Exit Rules: Active Management is Key

- Take Profits: If a sharp move occurs quickly, don't greedily wait for expiry. Close the entire position to capture profits once the move has been made, as time decay will accelerate thereafter.

- Cut Losses: If the anticipated event passes without a significant move, and volatility collapses ("IV Crush"), consider closing the position immediately to salvage remaining premium rather than watching it decay to zero.

- Volatility-Based Exit: If Implied Volatility spikes before the event due to market nervousness, you may be able to sell the strangle for a profit without the underlying price having moved at all.

- Rolling: Generally not advised for a long strangle. It is typically better to close the position and re-establish a new one for a future event if the thesis remains intact.

Advantages of a Long Strangle

- Defined and Limited Risk: You know the exact maximum loss before entering the trade.

- Uncapped Profit Potential: Offers significant leverage on large, unexpected moves.

- Non-Directional: Profits from volatility alone, removing the need to predict market direction.

- Lower Cost than a Straddle: Cheaper to implement, allowing for better position sizing.

Disadvantages of a Long Strangle

- Wider Breakevens: Requires a larger price move to become profitable compared to a straddle.

- Significant Time Decay (Theta): The strategy bleeds value every day that passes without a move.

- IV Crush: After a binary event, implied volatility often collapses, rapidly destroying the value of both options even if the price moves somewhat.

- Lower Probability of Profit: Statistically, the odds of the underlying moving beyond the wide breakeven points are lower.

Comparison: Long Straddle vs. Long Strangle

| Factor | Long Straddle | Long Strangle |

|---|---|---|

| Strike Selection | ATM Call + ATM Put | OTM Call + OTM Put |

| Cost | Higher | Lower |

| Breakeven Range | Narrower (ATM Strike ± Premium) | Wider (OTM Strikes ± Premium) |

| Profit Potential | Unlimited | Unlimited |

| Ideal For | Very high volatility expectations; smaller required move | Extremely high volatility expectations; larger required move |

The Long Strangle is a powerful, limited-risk tool for traders who can identify periods of impending turbulence. It allows for strategic speculation on volatility itself, offering asymmetric payoff profiles where the potential reward significantly outweighs the known risk. Success requires precise timing, disciplined risk management, and a clear understanding of the impact of time decay and volatility shifts.