Protective Put 101 — Insurance Approach

Protect your holdings by buying put options as insurance on stocks you own. This beginner-friendly strategy is risk-aware, defines entries and exits, and preserves upside potential while capping downside at the strike (minus the premium paid).

What is a Protective Put? The Investor's Insurance Policy

A Protective Put, also known as a Married Put, is a premier defensive options strategy designed to safeguard an equity investment. It involves holding a long position in a stock while simultaneously purchasing a put option on that same stock. The put option functions as a precise insurance policy; if the stock price declines, the increase in the put's value directly offsets the loss on the underlying shares. Crucially, this protection is achieved while fully preserving the stock's unlimited upside potential—the only cost being the premium paid for the put, which acts as the deductible on this insurance.

This strategy is indispensable for long-term investors and portfolio managers who maintain strong conviction in a stock's future but seek to mitigate short-term, event-driven volatility—such as earnings reports, macroeconomic announcements, or periods of broad market uncertainty. It provides the ultimate peace of mind, allowing you to remain invested with the absolute certainty that your maximum possible loss is defined and capped from the moment the trade is initiated.

- Defined Downside: Maximum loss is strictly limited to (Stock Purchase Price - Put Strike Price + Premium Paid).

- Unlimited Upside: All potential appreciation on the stock is retained; gains are merely reduced by the finite cost of the put premium.

- Insurance Mindset: The premium is not an expense but a calculated cost for guaranteed risk mitigation, much like paying an insurance premium to protect an asset.

When to Use This Strategy

The Protective Put is a strategic tool deployed during specific conditions where the cost of protection is justified by the perceived risk. It is not meant for perpetual use but for targeted risk management.

- You are fundamentally bullish on a stock for the long term but anticipate heightened short-term volatility or a potential corrective phase.

- A known, high-impact event is approaching (e.g., an earnings announcement, an FDA drug approval decision, a central bank policy meeting) that could cause a sharp price move in either direction.

- Implied Volatility (IV) is relatively low, making the cost of put options more affordable. Buying puts when IV is high is significantly more expensive.

- You require absolute capital protection on a core, high-conviction holding and are willing to pay a premium to eliminate tail risk.

Setup Checklist: Prerequisites for Protection

Effective implementation requires careful selection of the underlying and the specific put option contract to ensure the "insurance" is both effective and cost-efficient.

- Choose a Liquid Underlying: Select stocks or ETFs with highly active options markets. This ensures tight bid-ask spreads, allowing you to enter and exit the put position at fair prices (e.g., blue-chip stocks like TCS or HDFC Bank in India; Amazon or Google in the US).

- Own the Underlying Shares: This is a mandatory requirement. You must hold (or purchase) at least 100 shares for every put option contract you buy.

- Select Expiry: Choose an expiration date that aligns with your risk horizon. Typically, this is 2-8 weeks out, covering the period of anticipated uncertainty. Longer-dated puts are more expensive but provide coverage for a greater duration.

- Pick Strike Price: The choice of strike determines your "deductible."

- At-The-Money (ATM): Maximum protection but highest premium. Your floor price is very close to the current stock price.

- Out-of-The-Money (OTM): Lower premium cost but less protection. The stock must fall further before the put provides significant coverage. This is akin to a higher deductible on insurance.

Entry Rules: Executing the Hedge

The setup is a straightforward, two-legged process that can be executed simultaneously or by adding the put to an existing stock position.

- Establish the Stock Position: Purchase (or already hold) 100 shares of the underlying stock per put option contract.

- Buy the Put Option: Buy to open (BTO) one put option contract for the same stock. The contract should have an expiry that covers your risk period and a strike price that reflects your desired level of protection (e.g., 5% OTM for a cheaper hedge, or ATM for maximum safety).

- Record the Trade Details: Note the net debit (premium paid), the strike price, and the expiration date. Calculate your maximum loss and your new upside break-even point (Stock Purchase Price + Premium Paid).

Risk & Management: Understanding the Payoff

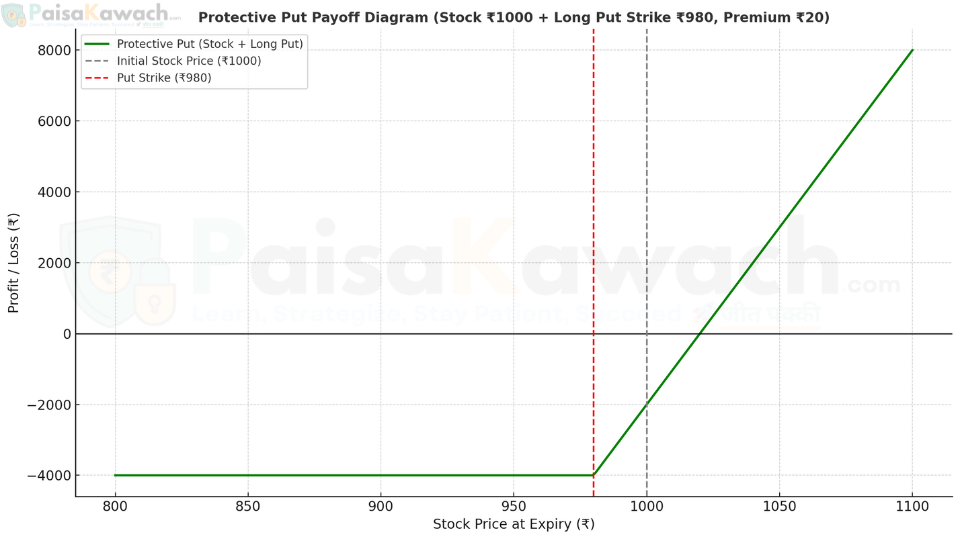

The Protective Put's risk profile is its defining feature, offering a known worst-case scenario.

- Downside Risk (Capped): Your maximum loss is limited to the difference between your stock's purchase price and the put's strike price, plus the premium paid for the put. Formula: Max Loss = (Stock Price - Strike Price) + Premium Paid.

- Upside Potential (Unlimited): There is no cap on profits from the stock's appreciation. The net profit is simply (Stock Sale Price - Stock Purchase Price - Premium Paid).

- Cost of Carry: The premium paid is a sunk cost. If the stock rises and the put expires worthless, this cost slightly reduces your overall return. This is the direct cost of the insurance.

- Adjustment: If the stock rallies significantly and the perceived risk diminishes, you can choose to sell the put option before expiration to recoup some of its remaining time value, thereby reducing the net cost of the hedge.

Exit Rules: Closing the Position

You have multiple paths for exiting a Protective Put, depending on how the scenario unfolds.

- Stock Rises (Best Case): Let the put option expire worthless. The entire premium paid is lost, but this is more than offset by the gain in the stock position. The cost of the hedge was simply the price for peace of mind.

- Stock Falls (Hedge Activated): You can either: a) Sell the put option before expiration to realize its monetary gain, which offsets the unrealized loss on the stock; or b) Exercise the put to sell your shares at the strike price, thereby locking in the maximum loss and freeing up capital.

- Outlook Changes: If your fundamental thesis on the stock changes entirely, you can close the entire position by selling both the stock and the put option simultaneously.

Position Sizing: Strategic Application

Given its cost, this strategy is best applied selectively rather than across an entire portfolio.

- Use Protective Puts on core, high-value positions that are too large or too important to your portfolio to risk a large, uncapped loss.

- Apply them to positions with high idiosyncratic risk (e.g., a biotech stock awaiting trial results) where the potential for a large gap down exists.

- Balance the cost of the premium against the portfolio's overall risk tolerance. Insuring every position is cost-prohibitive and would drag down performance.

Detailed Example with Calculations

Scenario: You own 100 shares of ABC Ltd., purchased at ₹2,000 per share. Concerned about an upcoming earnings report, you buy a one-month ATM Put option with a strike price of ₹2,000 for a premium of ₹80 per share.

- Net Debit (Cost of Insurance): ₹80 * 100 shares = ₹8,000.

- Maximum Loss (Capped): (₹2,000 - ₹2,000) + ₹80 = ₹80 per share (₹8,000 total). This is the maximum possible loss, no matter how far ABC's stock falls.

- Upside Break-Even: ₹2,000 (purchase price) + ₹80 (premium) = ₹2,080. The stock must rise above this price for the position to be profitable on the upside.

- Outcome 1 (Stock rises to ₹2,200): The put expires worthless (-₹8,000). Stock gain = ₹200 * 100 = ₹20,000. Net Profit = ₹20,000 - ₹8,000 = ₹12,000.

- Outcome 2 (Stock crashes to ₹1,700): Stock loss = ₹300 * 100 = ₹30,000. Put value = ₹300 * 100 = ₹30,000. Net Loss = ₹30,000 (stock loss) - ₹30,000 (put gain) - ₹8,000 (premium) = ₹8,000. The hedge limited the loss to the known maximum of ₹8,000.

Key Metrics to Track

To evaluate the effectiveness and cost of your hedging strategy, monitor these metrics:

- Cost of Protection: (Premium / Stock Price) %. This measures the insurance cost (e.g., ₹80 / ₹2000 = 4%).

- Delta of the Put: This indicates how responsive the put's price is to a drop in the stock. An ATM put has a delta of ~-0.50, meaning it will gain ₹0.50 for every ₹1.00 the stock falls.

- Breakeven Points: Know your exact downside max loss and upside breakeven before entering.

Comparison: Protective Put vs. Stop-Loss Order

This critical comparison highlights why options provide a superior form of protection for strategic investors compared to standard stop-loss orders.

| Factor | Protective Put | Stop-Loss Order |

|---|---|---|

| Risk Limitation | Guaranteed. The strike price is a contractual floor. | Not Guaranteed. Gaps down or slippage can cause execution far below the stop price. |

| Cost | Explicit, known premium paid upfront. | No explicit cost, but potential for significant implicit costs via poor execution. |

| Upside Participation | Unlimited. The stock remains owned; no premature sale. | Limited. A volatile move can trigger the stop, selling the stock and preventing participation in a subsequent rebound. |

| Execution Certainty | Contractual. The option's payoff is mathematically defined. | Market-dependent. Requires a buyer at your stop price, which is not certain during a crash. |

| Psychological Impact | Confidence and peace of mind. Allows you to hold through volatility. | Often leads to stress and "whip-saw" if stopped out only to see the price recover. |

In summary, the Protective Put is a sophisticated and powerful risk management tool that provides absolute certainty in an uncertain market. It is the definitive strategy for investors who refuse to choose between capital preservation and participation in growth. By paying a known, finite premium, you secure a guaranteed floor for your losses while maintaining full exposure to your holdings' unlimited upside potential, allowing you to invest with conviction and composure.