Short Straddle Options Strategy: Profit from Range-Bound Markets

The Short Straddle is a premium-collecting options strategy where traders sell both a Call and a Put at the same strike. It profits in range-bound, low-volatility markets but carries unlimited risk if the underlying makes a big move.

Short Straddle Options Strategy: Generating Premium Income in Range-Bound Markets

The Short Straddle is a premium, non-directional, income-generating options strategy employed by advanced traders who anticipate a period of exceptionally low volatility and a range-bound market. It involves simultaneously selling one Call option and one Put option on the same underlying asset, with identical strike prices (At-the-Money) and identical expiration dates. Crucially, unlike the Long Straddle where you pay a net debit, the Short Straddle results in a net credit—you collect premiums upfront, which represents your maximum potential profit.

However, this strategy carries a significantly high-risk profile. If the underlying asset experiences a substantial price movement in either direction, beyond the breakeven points, the resulting losses can be theoretically unlimited on the upside and substantial (though limited to the strike price minus the premium, which can be severe) on the downside. Consequently, the Short Straddle is suitable only for highly experienced traders with robust risk management protocols, substantial margin capacity, and the ability to monitor positions actively.

- Max Profit: Limited to the total net premium received from selling both options.

- Max Loss: Unlimited on the upside (as the underlying price can rise infinitely). On the downside, while theoretically limited (the underlying can only fall to zero), the maximum loss is (Strike Price - Net Premium Received), which can be devastatingly large.

- Market View: Extremely Neutral. The trader expects absolute stagnation, with the underlying price closing exactly at the strike price at expiration for maximum profit. The view is also bearish on future implied volatility (IV), expecting it to decrease.

When to Use a Short Straddle: Ideal Market Conditions

The Short Straddle is a strategic play on collapsing volatility and is best deployed under very specific conditions:

- Post-Event Stagnation: After a major earnings announcement, product launch, or macroeconomic event (like a central bank decision) has passed, and the market is expected to enter a consolidation phase with significantly reduced price swings.

- Technical Consolidation: When the underlying asset is trading within a well-defined, narrow range between strong support and resistance levels, with oscillators like RSI or Stochastics showing neutral readings.

- High Implied Volatility (IV) Environment: When IV is historically high, inflating option premiums, and the trader expects volatility to mean-revert and decline sharply ("volatility crush"). Selling high IV provides a larger credit and a wider profit range.

- Calendar-Based Plays: During holiday-thinned trading periods or seasonally quiet market phases where large moves are statistically less likely.

Setup Checklist: Prerequisites for Execution

- Underlying Asset: Select highly liquid instruments with tight bid-ask spreads to ensure easy entry and exit. Ideal candidates are major indices like NIFTY 50 or Bank NIFTY in India, or SPY, QQQ in the US.

- Strike Selection: Strictly At-the-Money (ATM). This is where the options have the highest time value (theta) and are most sensitive to changes in implied volatility (vega), maximizing the premium collected.

- Expiry Cycle: Prefer short-dated, weekly, or monthly options. The goal is to capitalize on rapid time decay (theta decay) during the final weeks before expiration, which erodes the value of the sold options.

- Risk Control Mandatory: Before entering the trade, have a definitive plan for stop-loss triggers, delta hedging, or rolling strategies. Consider defining your maximum acceptable loss upfront.

Entry Rules: Executing the Trade

- Identify an underlying asset trading at a specific price (e.g., NIFTY at 20,000).

- Sell 1 ATM Call Option: Strike price = 20,000.

- Sell 1 ATM Put Option: Strike price = 20,000, with the same expiration date.

- Net Credit: (Premium of Call + Premium of Put). This is the maximum profit potential and is received into your account upon execution.

Detailed Example: NIFTY Short Straddle

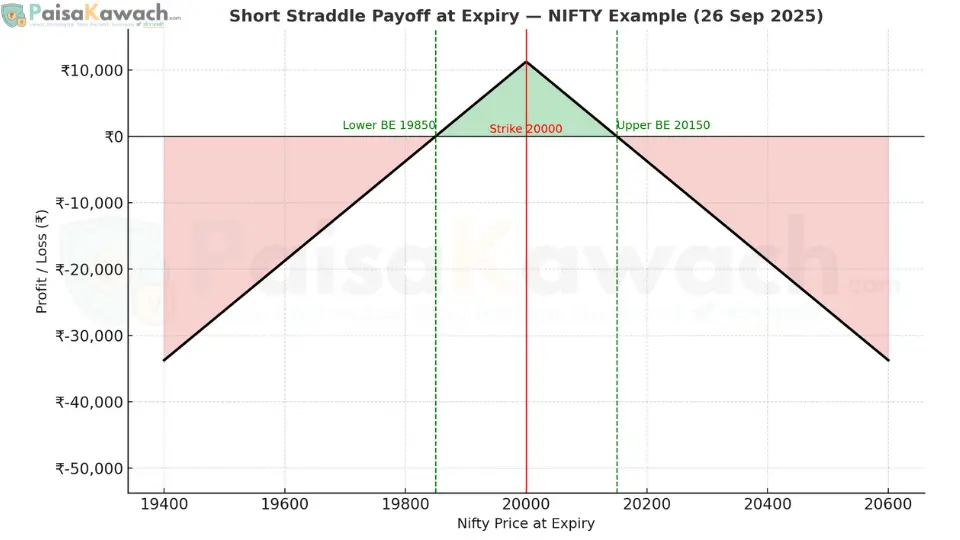

Assume NIFTY is currently trading at 20,000. The weekly expiration is on 26th September 2025.

- Sell NIFTY 26SEP2025 20,000 CE (Call Option) @ ₹80 premium

- Sell NIFTY 26SEP2025 20,000 PE (Put Option) @ ₹70 premium

Total Premium Received (Net Credit): ₹80 + ₹70 = ₹150 per share.

NIFTY lot size is 50 shares.

Total Credit Received: ₹150 * 50 = ₹11,250 (approx. $135). This is your Maximum Profit.

Breakeven Points Calculation:

The position will be profitable at expiration if NIFTY closes between the two breakeven points.

- Upper Breakeven (UBE): Strike Price + Net Premium Received = 20,000 + 150 = 20,150

- Lower Breakeven (LBE): Strike Price - Net Premium Received = 20,000 - 150 = 19,850

Profit Range: 19,850 to 20,150 (A 300-point range)

Payoff Scenarios at Expiry:

- Scenario 1: Maximum Profit (NIFTY closes exactly at 20,000)

Both the call and put options expire worthless (OTM). You keep the entire net credit of ₹11,250. - Scenario 2: Small Move within BEPs (NIFTY closes at 20,100)

The call option has an intrinsic value of 100, but you collected 150. You still have a small profit. The put expires worthless. Net P/L = (150 - 100) * 50 = ₹2,500 profit. - Scenario 3: Large Bullish Move (NIFTY closes at 20,400)

The call option is deeply ITM with an intrinsic value of 400. Your loss on the call is (400 - 80) = ₹320 per share. The put expires worthless. The net premium of ₹150 provides a small buffer.

Net Loss: (400 - 150) * 50 = (250 * 50) = ₹12,500 loss (approx. $150). - Scenario 4: Large Bearish Move (NIFTY closes at 19,600)

The put option is deeply ITM with an intrinsic value of 400. Your loss on the put is (400 - 70) = ₹330 per share. The call expires worthless.

Net Loss: (400 - 150) * 50 = (250 * 50) = ₹12,500 loss (approx. $150).

Risk & Management: The Greek Exposure

Managing a short straddle is an active process of monitoring the "Greeks":

- Delta (Directional Risk): Initially neutral (delta ~0). As the underlying moves, the position becomes directional. A rise in price creates negative delta (bearish), a fall creates positive delta (bullish). This requires constant rebalancing or hedging.

- Theta (Time Decay): Positive. This is your friend. Each day that passes, all else equal, erodes the value of the options you sold, moving you closer to keeping the full premium.

- Vega (Volatility Risk): Negative. This is your enemy. An increase in Implied Volatility (IV) will increase the value of both options you sold, creating an unrealized loss. A decrease in IV (vol crush) will benefit your position.

- Gamma (Acceleration Risk): Negative. Gamma is highest for ATM options. It measures how quickly your delta changes as the underlying moves. High negative gamma means your delta becomes increasingly negative in a rally and increasingly positive in a sell-off, accelerating your losses the further the market moves against you. This is the core risk of the strategy.

- Adjustment: If the underlying starts to move, traders can "add wings" by buying far OTM calls and puts to convert the risky short straddle into a defined-risk strategy like an Iron Butterfly or Iron Condor, capping maximum loss but also reducing potential profit.

Exit Rules: When to Close the Trade

- Profit Target: Many traders aim to close the position after capturing 50-75% of the maximum potential profit (e.g., buy back the straddle for ₹75 if they sold it for ₹150), locking in gains and freeing up capital.

- Stop-Loss (Price Trigger): Exit the entire position immediately if the underlying price breaches a key technical level (e.g., a previous support/resistance) beyond your breakeven points.

- Stop-Loss (Loss Trigger): Exit if the unrealized loss reaches a predetermined percentage of the premium received or a fixed amount of your capital (e.g., 150% of credit received).

- Volatility Spike: If Implied Volatility surges unexpectedly due to a news event, consider exiting. The mark-to-market loss from the vega effect can be severe even before the price moves significantly.

Position Sizing & Money Management: The Golden Rule

- This is a capital-intensive strategy due to the significant margin requirements for selling naked options.

- Allocate minimally: This should be a small position within a diversified portfolio. Never risk a large portion of your account on a single short straddle.

- Always calculate the worst-case scenario loss and ensure it is an amount you are financially and emotionally prepared to lose.

Key Metrics to Track Daily

- Breakeven Range: Monitor how far the underlying is from these critical levels.

- Delta: Watch for the position becoming overly directional.

- IV Rank/IV Percentile: Is implied volatility still high or is it collapsing as expected?

- Gamma Exposure: Be aware of the acceleration risk, especially as expiration nears.

Advantages of the Short Straddle

- High Income Potential: Captures the maximum possible premium from time decay.

- Beneficial Greeks: Profits from time decay (positive theta) and falling volatility (negative vega).

- Simple Structure: Easy to execute as a single trade with two legs.

Disadvantages of the Short Straddle

- Unlimited Risk: The most significant drawback. Losses can multiply rapidly in a trending market.

- High Margin Requirement: Brokers require substantial collateral to hold the position, limiting capital efficiency.

- Stressful to Manage: Requires active monitoring and a strong stomach for large, unrealized losses during market moves.

- Vulnerability to Gaps: The underlying can gap up or down overnight due to news, bypassing your mental stop-loss levels and opening you to immediate, significant loss.

Comparison: Short Straddle vs. Iron Condor

| Factor | Short Straddle | Iron Condor |

|---|---|---|

| Risk Profile | Undefined (Unlimited/Very High) | Defined (Capped Maximum Loss) |

| Profit Potential | Higher (Collects more premium) | Lower (Premium collected is reduced by cost of hedges) |

| Market View | Extremely Neutral, expects very low volatility | Neutral, expects moderate low volatility within a range |

| Capital Requirement | Very High (Naked Option Margin) | Lower (Defined by width of wings) |

| Management Complexity | High (Requires active hedging) | Lower (Can often be held to expiry) |

| Best For | Very experienced, active traders with large accounts | Intermediate traders seeking defined-risk neutral strategies |

The Short Straddle is a premium, advanced strategy for traders with the experience, capital, and discipline to profit from periods of market calm. Its effectiveness is entirely dependent on precise market timing and impeccable risk management. For the vast majority, defined-risk strategies offer a more prudent path to generating income from neutral market views.