By PaisaKawach Team | July 21, 2025

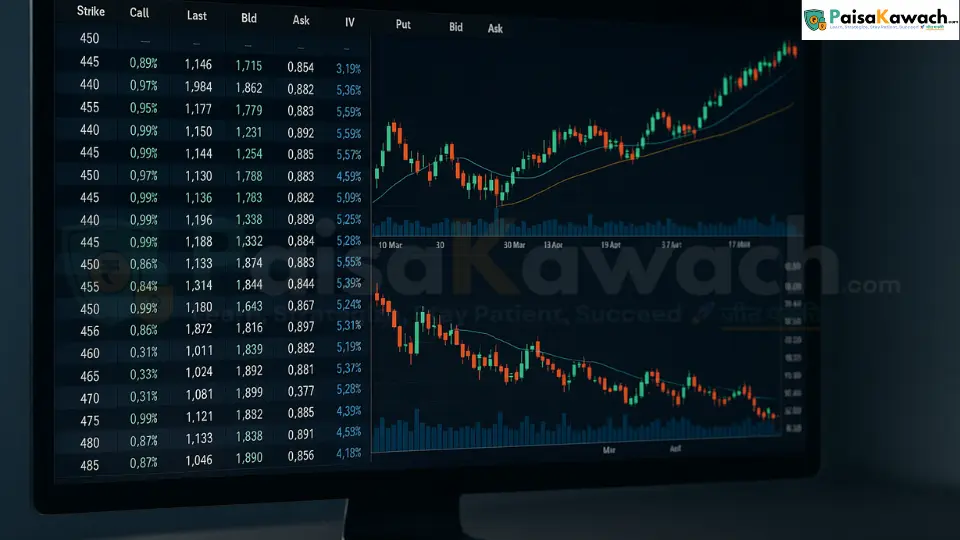

Options trading has become a buzzword among young investors, especially with the rise of online trading platforms and social media hype. But what many fail to understand is that options are not beginner-friendly. They are advanced financial instruments that require a solid understanding of the stock market, investment principles, and risk management. Jumping into options without this foundation is like driving a race car before learning how to drive.

Before you start trading options, you must ask yourself: Do I truly understand how the stock market works? If the answer is anything less than a confident “yes,” stepping into options could lead to devastating financial losses.

Options are high-risk, high-reward contracts. Unlike buying stocks, where you own a share of the company, options give you the right but not the obligation to buy or sell an asset at a set price within a limited time. While this can lead to significant profits, the potential for loss is equally high.

Most beginners fail in options because they:

Options contracts have an expiration date. If the market does not move in your favor quickly, the option’s value can drop to zero. This “time decay” factor alone catches many inexperienced traders off guard. A lack of understanding of the Greeks (Delta, Gamma, Theta, Vega) — which dictate how options react to market changes — can turn what looks like a winning trade into a total loss overnight.

Moreover, the allure of fast profits often blinds beginners to the brutal truth: Options trading is not a shortcut to wealth. It demands discipline, strategy, and the ability to stomach volatility.

If you’re new to investing, the stock market should be your first classroom. Learn how to analyze companies, read charts, understand market cycles, and diversify your portfolio. Options trading should come only after you have at least:

For those who still want to explore options, preparation is key. Here’s how you can build the right foundation:

Before diving into the world of options, take a moment to reflect: Do I truly understand the market? If your knowledge of stocks, market trends, and risk management is shaky, options trading will do more harm than good. Build your foundation first, learn the rules of the game, and then — only when ready — consider using options as part of a broader investment strategy.

Mastering Options Trading: How Global Market Trends Shape Your Strategy

Next →

Mastering Options Trading: How Global Market Trends Shape Your Strategy

Next →

Can You Really Start Investing with Just ₹1,000? Here’s How

Can You Really Start Investing with Just ₹1,000? Here’s How

No comments yet. Be the first to comment!