By PaisaKawach Team | July 19, 2025

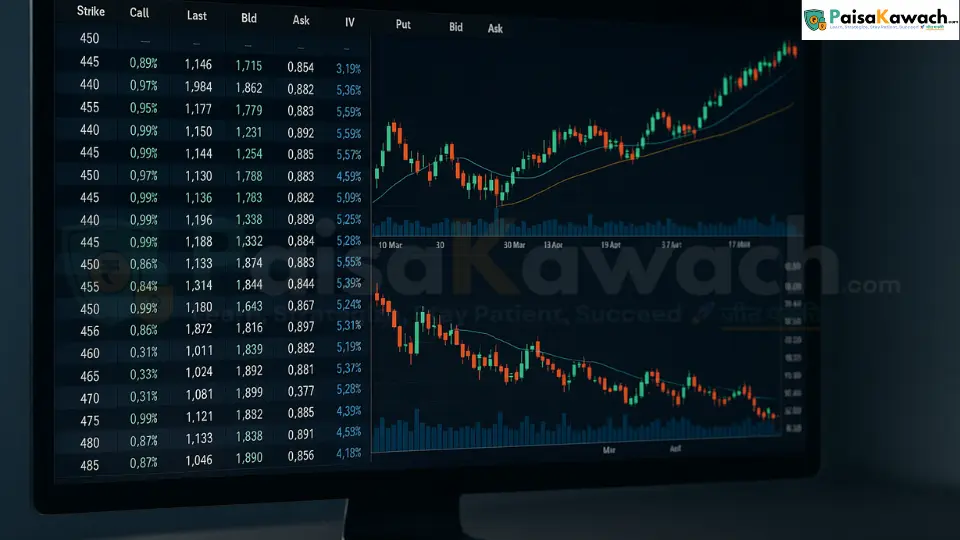

Options trading has evolved far beyond the traditional stock market playbook. Every global headline—whether it’s a U.S.–EU tariff proposal, a surge in energy prices, or corporate earnings in China—can directly affect options premiums and strike price decisions. If you’ve ever wondered why your options trading strategy succeeded or failed overnight, chances are a global event was the trigger.

For traders and investors, mastering options trading isn’t just about knowing what a call or put is. It’s about recognizing how global market trends influence volatility, pricing, and sentiment. In this guide, we’ll explore real-world examples and actionable strategies that help you trade options with confidence.

Before we dive into complex strategies, let’s revisit the fundamentals. A call option gives you the right (but not the obligation) to buy a stock at a specific price before expiry, while a put option gives you the right to sell. These instruments can be used for speculation or hedging.

But what happens when global events disrupt pricing? For example:

Options pricing relies heavily on implied volatility (IV), which tends to spike during global uncertainties. Events such as elections, economic reports, or major mergers can lead to higher premiums and make certain strategies more or less attractive.

Consider the Chevron–Hess merger. When news broke of Chevron’s $53 billion acquisition, traders saw a short-term IV jump in energy stocks. Those who bought call options ahead of the news could lock in profits as premiums soared. This is where following global M&A activity can give options traders a competitive edge.

If global news suggests downside risk—such as tariff hikes—buying a protective put can safeguard your portfolio. For example, if you hold Boeing shares during trade tensions, purchasing puts at a slightly out-of-the-money strike can hedge losses without forcing you to sell the stock.

During calmer global periods with modest upward trends, writing covered calls can help generate steady income. Imagine holding 100 shares of Apple (AAPL) during a tech rally; selling a call option slightly above the current price lets you earn premiums while retaining ownership.

When a global event creates uncertainty—like an upcoming Fed interest rate decision—a straddle (buying both a call and a put at the same strike) can profit from a sharp move in either direction. Traders use these around earnings or major policy announcements.

When volatility is high but expected to settle, credit spreads like the bull put spread or bear call spread can be profitable. These strategies work well when market sentiment is driven by short-term news, such as regulatory changes or supply chain disruptions.

Let’s take the hypothetical scenario of a new U.S.–EU tariff proposal affecting aviation companies. Boeing’s stock starts showing heavy volatility, with rumors circulating of a 20% tariff hike.

A savvy options trader might:

Options trading isn’t just about individual stocks—it’s about sectors. Global events often cause sector rotations. For example, if defense stocks surge due to increased NATO spending, Lockheed Martin (LMT) options may see unusual activity. Traders who catch these trends early can profit with call options or bullish vertical spreads.

Similarly, if energy prices spike due to OPEC announcements, oil ETFs like XLE become fertile ground for short-term options plays.

Global events can cause unexpected volatility, wiping out positions overnight. Smart traders use:

Always remember, options leverage can magnify both gains and losses. A single tariff announcement or unexpected earnings report can shift prices dramatically.

If you’re starting your journey, here are steps to create a sustainable approach:

Options trading isn’t about predicting the future—it’s about preparing for multiple outcomes. By staying attuned to global market trends—tariffs, M&A deals, energy price spikes—you can position yourself to benefit from volatility instead of fearing it.

Whether you’re a beginner learning your first call contract or an advanced trader deploying complex spreads, understanding global catalysts will elevate your strategy and confidence.

This article is for informational purposes only and does not constitute financial or investment advice. Options trading involves significant risk and is not suitable for every investor. Always consult with a certified financial advisor or professional before making any trading decisions.

The Power of Staying Invested: What 10 Years in the Market Really Looks Like

Next →

The Power of Staying Invested: What 10 Years in the Market Really Looks Like

Next →

Before Trading Options, Ask Yourself: Do I Truly Understand the Market?

Before Trading Options, Ask Yourself: Do I Truly Understand the Market?

No comments yet. Be the first to comment!