By PaisaKawach Team | July 18, 2025

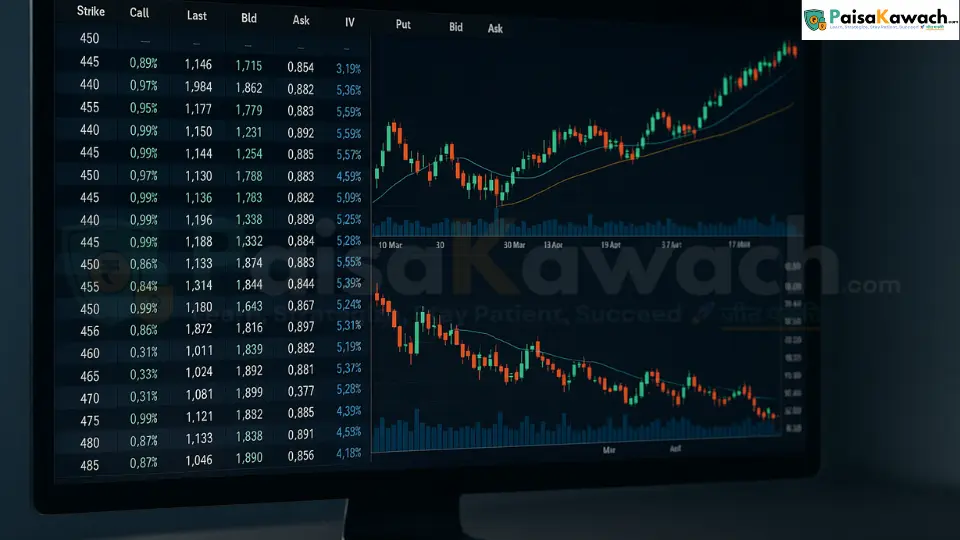

In today’s world of TikTok trends and day trading tips, long-term investing might feel like a relic of the past. But here’s the harsh truth: those who stay invested over time almost always outperform those who try to time the market. Patience isn’t just a virtue in investing — it’s the secret sauce of wealth creation.

While traders chase news cycles and technical indicators, long-term investors let compounding do its quiet magic. Think about this: an investment of ₹1,00,000 ($1,200) in India’s Nifty 50 index or $10,000 in the U.S. S&P 500 in 2014 would have doubled or tripled by mid-2025 — with no active management, no frequent trading, and minimal stress. The path might not have been linear, but the destination is consistently rewarding.

Investing is not just about choosing the right stock — it's about choosing the right horizon. The longer you stay, the more you own of growth, innovation, and economic expansion. Time is what separates traders from true wealth builders.

From July 2015 to July 2025, the Nifty 50 index has delivered a consistent CAGR (Compound Annual Growth Rate) of around 10.2%. That may not sound glamorous, but the outcome is powerful. Compounding at this rate means your capital doubles roughly every 7 years. It outpaces inflation, beats fixed deposits, and protects your purchasing power.

This is with minimal effort. No constant analysis. No sleepless nights. Just letting money stay in the market.

For global investors, the S&P 500 is a gold standard. From 2015 to 2025, it has offered a CAGR of around 11.4%. A $10,000 investment made in July 2015 would now be worth over $28,000 (₹23,30,000). That’s nearly 3x growth, driven by American innovation — think Apple, Microsoft, Google, Tesla, and Nvidia.

Despite trade wars, political uncertainty, inflation fears, and a global pandemic, the U.S. market rewarded those who stayed invested. Trying to predict the perfect exit and entry points would have meant missing the rallies that followed each dip.

Beyond index funds, investing in fundamentally strong businesses amplifies long-term gains. HDFC Bank — one of India’s top private banks — grew from ₹1,050 in July 2015 to over ₹1,680 by 2025. Add dividends and compounding, and you get a CAGR close to 10%. Even in global markets, similar long-term stories exist: think of Microsoft, Visa, Johnson & Johnson, or Nestlé — these are long-term compounders with global footprints.

Let’s not sugarcoat it — the ride won’t be smooth. Long-term investing doesn’t mean avoiding risk. It means embracing volatility but refusing to panic. Along the way, you’ll face:

In March 2020, markets around the world crashed 30%–40% in just a few weeks. Investors who sold out locked in their losses. But those who held firm witnessed the fastest recovery in market history. The S&P 500 and Nifty 50 hit all-time highs within a year. Staying invested isn’t always comfortable, but it's profitable.

According to multiple studies, missing the 10 best days in the stock market over a decade can halve your total returns. Those days often come right after big drops. So, if you get scared and exit, you miss the rebound. That’s why timing the market rarely works. What works is time in the market.

Legendary investor Peter Lynch once said, “More money has been lost preparing for corrections than in the corrections themselves.”

Albert Einstein reportedly called compounding the 8th wonder of the world. Here's a simple example: a monthly SIP (Systematic Investment Plan) of ₹5,000 or $60 starting at age 25 and growing at 12% annually becomes over ₹1.5 crore ($180,000+) by age 55. Delay it by just 10 years and you end up with less than half the amount.

The earlier you start and the longer you stay invested, the more your money multiplies. Compounding is slow at first, but over decades, it becomes unstoppable — like a snowball rolling downhill, picking up speed and size.

The most successful investors — Warren Buffett, Rakesh Jhunjhunwala, Charlie Munger — didn’t get rich by flipping stocks. They treated shares like ownership in real businesses. This mental shift changes everything. When you invest in Apple, you’re investing in its future innovation, not just a ticker symbol. When you buy into Tesla, you buy a piece of the EV revolution.

In 1988, Buffett bought shares of Coca-Cola worth $1.3 billion. Today, those shares are worth over $25 billion and continue to pay him over $700 million annually in dividends. He didn’t get those returns by being smart once — he got them by being patient forever.

Set up automatic monthly contributions to your brokerage account or SIPs. When it becomes a habit, you won’t second-guess yourself during dips. Automation also reduces decision fatigue — a major cause of panic exits.

Track your portfolio quarterly or semi-annually. Daily tracking can lead to anxiety and impulsive decisions. Focus on the long-term trend, not short-term volatility. Ask: Are my goals on track?

Whether it’s global ETFs, tech companies, Indian blue chips, or sector-specific mutual funds — invest in businesses you understand. If you can’t explain what the company does to a 12-year-old, you probably shouldn’t own it. Understanding leads to conviction — and conviction builds patience.

The next 10 years could be even more rewarding. The U.S. continues to lead in innovation, India is on track to become a $7 trillion economy, and emerging markets are gaining traction with digital adoption and infrastructure development. Whether you invest in Indian IT, American tech, European green energy, or global healthcare — the world is expanding, and so is your opportunity to participate in it.

For international investors, diversification is easier than ever. You can own a piece of the U.S. stock market from India via mutual funds or ETFs. Similarly, global investors can tap into India’s growth through ADRs and ETFs like INDA or INDY.

Markets will rise. Markets will fall. But if you trust the process, ignore the noise, and stay invested — you’ll come out ahead. The longer your money remains invested, the less its performance depends on luck and the more it depends on discipline.

Whether you're 25 or 55, investing for the long term pays off. You don’t need to be a financial expert. You just need to be consistent, patient, and informed. The most important decision? To start — and to stay.

Because real wealth isn’t built in days or months — it’s built over decades.

Become a Partial Owner of the Brands You Love: How Stock Investing Turns Consumers into Capitalists

Next →

Become a Partial Owner of the Brands You Love: How Stock Investing Turns Consumers into Capitalists

Next →

Mastering Options Trading: How Global Market Trends Shape Your Strategy

Mastering Options Trading: How Global Market Trends Shape Your Strategy

No comments yet. Be the first to comment!