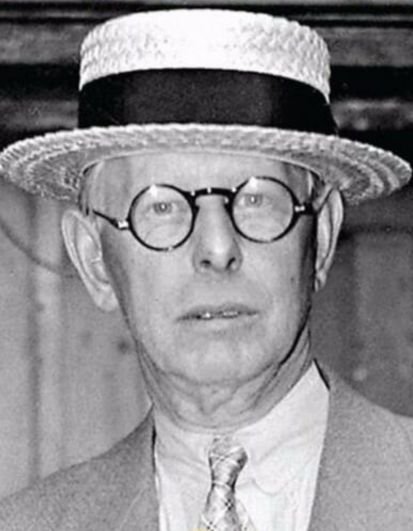

Jesse Lauriston Livermore was born on July 26, 1877, in Shrewsbury, Massachusetts, into a modest farming family. His father, a stern and hardworking man, expected Jesse to join the farm, while his mother quietly supported Jesse’s love for reading and learning. The contrast between his father’s discipline and his mother’s encouragement shaped much of Jesse’s early psychology. He grew up in an environment of frugality and discipline but was never content with a life limited to the farm. From a young age, he demonstrated unusual mathematical ability and a fascination with numbers, patterns, and probabilities.

Jesse’s father wanted him to leave school early and work full-time on the farm, but Jesse’s mother believed in his potential and secretly gave him her blessing to pursue education and city life. At just 14 years old, Jesse left home with only five dollars in his pocket and moved to Boston. It was a bold move for a teenager, but it reflected the self-confidence and independence that would later define his trading career.

Jesse’s first break came when he secured a job as a board boy at Paine Webber & Company, a Boston stockbrokerage firm. His job was simple: to write stock prices on a blackboard as they were transmitted via ticker tape. The ticker tape, a continuous paper strip recording stock transactions, was the lifeblood of trading in the late 19th century. For most clerks, this was a tedious task. For Jesse, it was a revelation. He began to notice that price movements often followed patterns. He wasn’t reading the news or company reports; he was reading the market itself.

By carefully observing the tape, Jesse developed what would become his lifelong edge: the ability to sense the rhythm of the market. He started jotting down patterns, such as how certain stocks tended to move before big changes or how volume preceded price action. These early insights gave him the confidence to test his ideas outside the brokerage house.

At around 15, Jesse began frequenting bucket shops—establishments where people could bet on stock price movements without actually owning the shares. These were considered disreputable gambling dens by many, but for Jesse, they were his true school of trading. Using the patterns he had observed as a board boy, he placed small bets with the few dollars he saved. To his amazement—and the amazement of others—he started winning consistently.

In bucket shops, traders did not need large amounts of capital; a small margin could control significant bets. This allowed Jesse to compound his money quickly. By the time he was 16, he had earned over $1,000—a substantial sum in the 1890s. His uncanny success earned him the nickname “Boy Plunger” because he seemed fearless in plunging into trades, often against the crowd, and coming out a winner.

The bucket shops taught Jesse invaluable lessons about speculation:

By the time he was in his late teens, Jesse Livermore had become something of a local legend. Bucket shops across Boston started banning him because he won too often. His ability to “read the tape” gave him an edge that shop owners couldn’t counter. Stories spread of the young man who could walk into a shop, place a bet, and leave with profits almost every time. Banned in Boston, he began traveling to nearby towns, disguising himself or using false names to gain entry into bucket shops. His reputation grew, and so did his bankroll.

Despite his success, Jesse realized that bucket shops were limited. They were designed to make customers lose, and his growing reputation made it increasingly difficult to place bets. Around age 20, he decided to move to New York City—the epicenter of American finance. It was here, on Wall Street, that his true career as a speculator would begin.

Leaving Boston behind, Jesse carried with him a bankroll of a few thousand dollars and a priceless education in speculation. The lessons of the bucket shops—reading price action, maintaining discipline, controlling risk—would stay with him for life. They were the foundation upon which he built both his greatest fortunes and his most devastating losses.

By the time Jesse Livermore reached New York City in the late 1890s, he was already a seasoned trader with a reputation for brilliance. He was not a graduate of universities or business schools; his education came from the ticker tape and the bucket shops. This unorthodox training gave him a street-smart edge that would make him one of the most legendary traders in history.

In 1899, at the age of 22, Jesse Livermore arrived in New York City with a modest bankroll and an oversized ambition. Having been banned from most bucket shops in Boston, he saw Wall Street as the ultimate stage for speculation. Unlike the bucket shops, the New York Stock Exchange was the real arena—where fortunes were made and lost, and where his skills could be tested against the best in the business. He entered this world with confidence but quickly learned that the Wall Street game was far more complex and treacherous than the bucket shops.

Livermore’s first attempts at trading on Wall Street were disappointing. He quickly discovered that the real stock market behaved differently from the bucket shops. Bucket shops merely mirrored price movements from the exchange, but the exchange itself was influenced by far more factors—large operators, news events, rumors, and broader economic shifts. Jesse initially underestimated these complexities and lost a significant portion of his capital. It was a humbling lesson, but one that reinforced his belief in adaptability: the market was a teacher, and every loss was tuition.

Despite the setbacks, Jesse’s tape-reading skills soon began to shine in the real market as they had in the bucket shops. He rebuilt his capital by focusing on short-term price movements and keeping strict discipline. His sharp instincts earned him respect among brokers, who began to notice the young trader with an uncanny ability to predict short-term swings. By the early 1900s, Livermore had established himself as a notable independent trader in New York.

Livermore’s first big test came during the famous Northern Pacific Railway corner of 1901. When rival groups of financiers tried to corner the stock, its price skyrocketed from around $100 to over $1,000 in a single day. The panic that followed destroyed many traders, but Livermore, having anticipated the short squeeze, managed to profit. Though not yet one of the main operators, his successful navigation of this chaos boosted his reputation as someone who could thrive in volatile conditions.

Livermore’s breakthrough came during the Panic of 1907, one of the most severe financial crises of the early 20th century. The market collapsed as trust companies failed, and liquidity dried up. While most traders were being ruined, Livermore took massive short positions, betting against the market. His timing was impeccable. As stock prices plunged, he made an estimated $3 million—an astronomical sum at the time.

What made the 1907 episode legendary was not just the profits but the recognition he received. According to accounts, even J.P. Morgan, the most powerful financier of the era, asked Livermore to stop shorting stocks because his trades were exacerbating the panic. The idea that a young independent trader could influence markets to such an extent was extraordinary. From that moment, Jesse Livermore was no longer just the “Boy Plunger”—he was the “Great Bear of Wall Street.”

Flush with millions, Livermore began living lavishly. He purchased mansions, yachts, and tailored suits, and became a prominent figure in New York society. His success stories were featured in newspapers, which romanticized him as a daring speculator who thrived on risk. But with fame came pressure. He was constantly under the public eye, and his every trade was scrutinized. Still, he reveled in the spotlight, enjoying the reputation of being Wall Street’s boldest trader.

Livermore always emphasized that he was not an investor but a speculator. For him, investing meant holding companies for dividends and long-term appreciation, while speculation meant profiting from market swings. He made no apologies for this distinction. In his view, speculation was a legitimate profession—provided it was practiced with discipline, research, and respect for risk. This mindset distinguished him from conservative investors of his era and aligned him more with modern traders who rely on momentum and psychology.

One of the most discussed aspects of Livermore’s rise was his intuition. He often spoke about the “feel” of the market, a sense developed by years of watching the tape. While others relied heavily on news or insider tips, Jesse trusted his own judgment. This instinct was not mystical—it was the product of constant observation, pattern recognition, and psychological insight. He learned to sense when a market was being manipulated, when a trend was genuine, and when panic was about to set in.

Following his 1907 triumph, Livermore expanded his trading to include commodities such as cotton and wheat. He saw that speculative principles applied across markets. However, commodities also introduced new challenges, including government intervention and global supply shocks. In one famous instance, he attempted to corner the cotton market but was personally asked by President Theodore Roosevelt to stop, as it was causing political and economic distress. Reluctantly, Livermore complied, reinforcing his image as a speculator whose actions could move entire markets.

Despite his enormous winnings, Livermore also experienced spectacular losses during this period. By 1915, he had already declared bankruptcy more than once. His aggressive style meant he took on massive risks, and when trades went wrong, the losses were devastating. Yet, his resilience was remarkable. Each time he was wiped out, he managed to rebuild his fortune within a few years. This cycle of boom and bust became a defining pattern of his career—and a lesson in both the power and peril of speculation.

By the end of the first decade of the 20th century, Jesse Livermore was one of the most famous traders in America. He had proven that with discipline, nerve, and a deep understanding of market psychology, it was possible to turn modest beginnings into millions. Yet, his journey was only beginning—the greatest triumphs and the darkest failures still lay ahead.

Jesse Livermore never saw himself as a gambler, though many outsiders accused him of being one. To him, speculation was a profession—a discipline requiring as much skill, study, and mental clarity as law or medicine. He argued that while gambling relied on luck, speculation required observation, logic, and patience. This belief gave him confidence to continue in the markets even after devastating losses. He viewed each failure not as proof of futility but as tuition paid to the greatest teacher of all: the market itself.

At the core of Livermore’s philosophy was tape reading—the art of interpreting price and volume from ticker tape. Long before charts and digital screens, he developed an instinct for how markets behaved. He believed prices revealed everything: insider knowledge, crowd psychology, and future trends were all embedded in price action. If one studied carefully, one could predict where the market was headed without needing external information. In his words: “Prices are never too high to begin buying or too low to begin selling.”

One of Livermore’s most famous principles was the discipline of cutting losses quickly. He insisted that the worst mistake a trader could make was to “average down” into a losing position. Instead, he advised selling immediately when a trade went wrong, preserving capital for the next opportunity. This idea—radical in his time—has since become a cornerstone of modern trading. He often said: “It was never my thinking that made me money; it was my sitting. Men who can both be right and sit tight are uncommon.”

In contrast to his strict rule about cutting losers, Livermore advised traders to let winners run. Many traders booked profits too early out of fear of losing gains, but Livermore believed that big profits came only from holding onto strong positions until the market itself signaled a reversal. He famously said: “It never was my thinking that made the big money for me. It always was my sitting.” This principle required immense patience and emotional control—qualities that distinguished him from average traders.

Another Livermore innovation was the practice of pyramiding: adding to winning positions gradually as the market moved in his favor. Unlike reckless doubling down on losers, pyramiding allowed him to maximize gains on trends while controlling risk. He would often enter small, test positions first. If the market confirmed his analysis, he would add more, building a pyramid of profits as the trend strengthened. This strategy enabled him to ride major moves like the Panic of 1907 and the Crash of 1929 with huge positions.

Livermore was a strong believer in trend following. He maintained that traders should never fight the tape: “The market is never wrong—opinions often are.” He taught that once a trend was established, it was best to go with it rather than attempt to predict reversals. Trying to call tops and bottoms was, in his words, “the most expensive exercise in Wall Street.” Instead, he entered when a clear direction emerged and stayed until the market signaled exhaustion.

Despite being famous and often surrounded by brokers, Jesse Livermore emphasized the need for independence in speculation. He warned against following tips, rumors, or the crowd. In his view, listening to others only clouded judgment. He once remarked: “Wall Street never changes, the pockets change, the stocks change, but Wall Street never changes, because human nature never changes.” His independence allowed him to stand against the crowd during panics and manias, reaping profits when others faltered.

Livermore stressed the importance of capital preservation. For him, survival was the first rule of trading. Even after going bankrupt multiple times, he always managed to return because he respected capital as his primary tool of business. He advised traders to avoid over-leveraging, to hold cash when uncertain, and to never risk ruin on a single bet. His maxim was: “There is only one side of the market; it is not the bull side or the bear side, but the right side.”

Perhaps the most profound part of Livermore’s philosophy concerned emotional control. He observed that most traders failed not because of poor analysis but because of fear, greed, and hope. Fear caused them to cut winners too early. Greed pushed them into reckless bets. Hope made them hold onto losers. Livermore’s solution was discipline: strict adherence to rules, avoidance of impulsive trades, and constant awareness of psychological traps. In his words: “The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, or the man who is emotionally unbalanced.”

Livermore’s principles were immortalized in Edwin Lefèvre’s classic book Reminiscences of a Stock Operator (1923), which, though fictionalized, was based closely on his life. The book remains one of the most influential works in trading literature, studied by investors and traders even a century later. His rules form the backbone of modern risk management and trend-following strategies. In many ways, Jesse Livermore’s philosophy laid the groundwork for systematic trading approaches that dominate today’s markets.

Through his principles, Jesse Livermore transformed speculation into an intellectual discipline. His rules—though born in the early 20th century—remain as relevant in today’s algorithm-driven markets as they were in the ticker-tape era. They reveal why he became not only one of the richest traders of his time but also one of the most influential thinkers in the history of markets.

By the early 1920s, Jesse Livermore had become one of the most famous traders in America. His daring moves during the Panic of 1907 had earned him millions, and he continued to build on his reputation by successfully navigating volatile markets. Newspapers frequently covered his trades, and he was seen as both a genius and a villain, depending on whether his short selling coincided with economic distress. Despite the controversies, Livermore’s ability to anticipate market movements brought him great wealth. At various points in his career, his fortune was estimated in the range of $100 million in today’s dollars—a staggering achievement for someone who started as a farm boy with $5 in his pocket.

The 1920s were a period of extraordinary economic growth and speculation in the United States. Following World War I, industrial expansion, easy credit, and technological innovations fueled a massive bull market. Stocks soared, and millions of ordinary Americans entered the market for the first time. For Jesse Livermore, this was both an opportunity and a warning. He had seen cycles of boom and bust before, and he knew the euphoria of the 1920s would not last forever. While many believed the market had entered a new era of permanent prosperity, Livermore remained cautious, studying the underlying currents beneath the optimism.

Livermore’s defining moment came in October 1929. Having studied the tape and sensed the growing instability, he built massive short positions across the market. While the majority of traders and investors were still buying aggressively, Livermore stood almost alone in betting that the market was about to collapse. When the crash began on Black Thursday (October 24, 1929) and accelerated into Black Monday and Black Tuesday (October 28–29), his positions paid off spectacularly. As panic swept Wall Street, Livermore’s fortune skyrocketed.

By the end of the crash, he was reported to have made an estimated $100 million—equivalent to billions today. The press labeled him the “Great Bear of Wall Street” once again, and he was both celebrated and vilified. To those who lost everything, he was a villain who had profited from misery. To others, he was a genius who had seen what few could see. Regardless of opinion, the 1929 crash cemented his reputation as one of the greatest speculators in history.

Ironically, Livermore’s greatest financial triumph also marked the beginning of his personal decline. The fortune he amassed in 1929 was immense, but it brought with it new pressures. His fame was at its peak, and he lived a lavish lifestyle with mansions, yachts, and an entourage. But beneath the surface, his personal life was unraveling. His marriage to his second wife, Dorothy, was stormy, marked by extravagance, conflict, and scandal. The pressures of wealth and fame weighed heavily on him, and his discipline in trading began to erode.

Despite making fortunes several times, Livermore also went bankrupt multiple times during his career. His aggressive style, reliance on leverage, and occasional disregard for his own rules often led to spectacular collapses. After the 1929 crash, instead of securing his wealth, he returned to trading with the same daring risk appetite. By the mid-1930s, he had lost much of his fortune once again. His cycle of rise, fall, and comeback became legendary but also tragic. While many admired his resilience, others saw in it a cautionary tale about the dangers of overconfidence and lack of moderation.

Livermore’s personal life was as turbulent as his trading career. His marriage to Dorothy ended in divorce, and he later married again. Family conflicts, public scandals, and emotional instability haunted him. Though he was admired for his brilliance in markets, he struggled with depression and isolation. Success in speculation did not translate into peace in personal life. The same intensity that drove him to greatness in trading also made it difficult for him to find balance and happiness outside the market.

On November 28, 1940, Jesse Livermore took his own life in New York City at the age of 63. He left behind a note to his wife, expressing feelings of failure and despair. Despite his legendary status and the millions he had made over his lifetime, at the time of his death he was financially and emotionally broken. His suicide shocked the financial world, and newspapers across the country mourned the passing of a man who had been both idolized and feared on Wall Street.

Jesse Livermore’s story is one of extremes. On the one hand, he was one of the most successful speculators in history, making and losing fortunes that dwarfed those of his contemporaries. His achievements in 1907 and 1929 stand as some of the greatest trades ever executed. His principles of speculation—cutting losses, letting profits run, following trends—remain foundational in modern trading. On the other hand, his repeated bankruptcies and tragic end reveal the dangers of unchecked risk-taking, emotional instability, and lack of balance.

Jesse Livermore’s life embodies both the possibilities and perils of speculation. He achieved heights that few ever reached, yet he also suffered lows that revealed the fragility of human nature. His achievements made him immortal in the annals of Wall Street, while his failures made him a cautionary tale for all who dare to play the market’s most dangerous game.

More than eight decades after his death, Jesse Livermore’s trading rules remain some of the most quoted and respected in the financial world. Concepts like “cut your losses short, let your winners run” and “the market is never wrong; opinions often are” have become timeless mantras. His disciplined approach to speculation is echoed in modern trading methodologies, from trend-following systems to algorithmic strategies. The fact that his principles continue to guide traders in today’s high-speed, technology-driven markets is a testament to their universality.

Livermore’s enduring influence is largely thanks to the 1923 book Reminiscences of a Stock Operator by Edwin Lefèvre. Though fictionalized, it was based closely on Livermore’s life and trading career. The book has become one of the most celebrated works on trading, studied by investors, analysts, and even behavioral economists. Through colorful anecdotes, it revealed not only Livermore’s strategies but also his psychology—his struggles with discipline, his triumphs, and his failures. For many, it remains the “Bible of Speculation.”

Generations of traders have seen themselves in its pages. The temptations, the mistakes, the exhilaration of big wins, and the despair of crushing losses—all of these experiences resonated beyond Livermore’s era. It is no exaggeration to say that without Reminiscences, Livermore might have faded into history. Instead, the book immortalized him, ensuring that his lessons lived on.

From hedge fund managers to retail day traders, Livermore’s principles permeate modern markets. Many legendary investors, including Paul Tudor Jones and Ed Seykota, have acknowledged drawing inspiration from Livermore’s philosophy. His emphasis on trend-following, risk management, and psychological discipline directly informed the development of systematic trading in the late 20th century. Even algorithmic and quantitative traders, who rely on computer models, find that their strategies echo Livermore’s rules of momentum and capital preservation.

Perhaps Livermore’s most profound legacy lies in his recognition that markets are driven by human nature. He argued that greed, fear, and hope repeat themselves in every generation, and therefore the patterns of market behavior also repeat. This insight has been validated by modern behavioral finance, which studies how cognitive biases influence financial decisions. Livermore understood this intuitively a century ago, and he built his career around exploiting these predictable human errors.

While Livermore is celebrated as one of the greatest traders of all time, his story also serves as a cautionary tale. His repeated bankruptcies, lavish lifestyle, and tragic suicide remind us that financial success does not guarantee personal fulfillment or emotional stability. For every trader inspired by his courage and brilliance, there is also a lesson in humility: discipline is not just about markets but about life as a whole. His life underscores the importance of balance, moderation, and psychological resilience—qualities as vital as intelligence or skill.

Livermore viewed speculation not as gambling but as an art and science. He elevated it from mere betting to a disciplined pursuit, emphasizing rules, patterns, and probabilities. His approach helped legitimize speculation as a profession at a time when it was often dismissed as reckless. Today, trading floors, hedge funds, and investment banks reflect his belief that speculation, when practiced with rigor, is an essential part of modern finance.

Jesse Livermore’s wit and wisdom live on through his quotes, which continue to inspire and warn traders:

These words distill not only his trading principles but also his understanding of human psychology. They remain pinned on trading desks worldwide, reminding speculators of the eternal truths of markets.

Jesse Livermore’s legend continues to captivate because it embodies the extremes of speculation: colossal wealth, devastating losses, and the constant battle between discipline and temptation. He was the Boy Plunger who became the Great Bear of Wall Street, the man who outwitted markets but was undone by his own demons. His life story has been retold in countless articles, documentaries, and trading seminars. He symbolizes both the allure and the danger of chasing market fortune.

Jesse Livermore’s legacy is a paradox. He was both a hero and a cautionary tale, a master of markets and a victim of his own psychology. His genius for speculation made him immortal in the annals of Wall Street, yet his personal struggles remind us that wealth without balance can lead to tragedy. For traders and investors, his life is both an inspiration and a warning: the markets offer great opportunity, but they demand humility, discipline, and emotional strength.

In the end, Jesse Livermore’s story is not just about one man but about the eternal drama of speculation itself. His life reminds us that markets are reflections of human nature—complex, emotional, and cyclical. As long as people trade, his rules and lessons will remain relevant, ensuring that the Boy Plunger will never be forgotten.