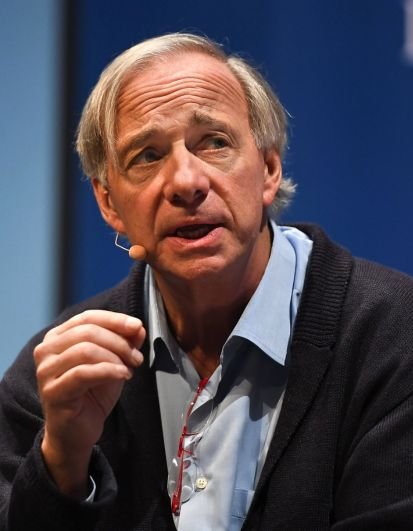

By Web Summit - HM1_7481, CC BY 2.0, Link

Ray Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund, managing over $150 billion in assets. Known for his principles-driven approach, Dalio transformed not just the way funds operate but also how organizations think about culture, decision-making, and radical transparency. Over his five-decade career, Dalio has shaped global finance, influenced economic thought, and inspired leaders across business, politics, and academia with his philosophy of life and work.

Raymond Thomas Dalio was born on August 8, 1949, in Jackson Heights, Queens, New York City. He grew up in a modest middle-class Italian-American family. His father, Marino Dallolio, was a professional jazz musician who played the clarinet and saxophone at famous Manhattan clubs, including the legendary Copacabana. His mother, Ann, was a homemaker who dedicated her life to raising Ray and his siblings. This blend of musical artistry and domestic stability shaped Dalio’s early values: discipline, hard work, and resilience.

Although his household was not wealthy, Dalio was surrounded by the cultural vibrancy of New York City in the 1950s. Growing up in Queens, he experienced a mix of ethnic communities and developed an awareness of social and economic differences. This environment sharpened his curiosity about how money, power, and opportunities worked in the real world.

Ray’s first encounter with the stock market came at just 12 years old. While working as a golf caddie at the Links Golf Club in Manhasset, Long Island, he saved up around $300. Many of the club’s members were Wall Street professionals, and conversations with them sparked his curiosity about investing. With his savings, Dalio bought shares of Northeast Airlines. To his surprise and delight, the investment tripled when the airline merged with another company. This early success left a lasting impression, cementing his belief that the markets could reward curiosity, research, and risk-taking.

Dalio continued working as a caddie during his teenage years, and this job became a gateway to invaluable connections. The golfers he assisted were brokers, traders, and investment managers who often shared their experiences and insights. Occasionally, they offered him summer jobs and internships at their firms, giving Dalio first-hand exposure to the world of finance long before most of his peers. He later credited this period as a crucial turning point in his life, as it taught him both the importance of building relationships and the basics of financial markets.

Dalio attended Herricks High School in New Hyde Park, Long Island. Unlike many of his peers who were focused on traditional academic paths, Ray was more interested in practical knowledge and real-world applications of finance. He was not a top student in the conventional sense, but he displayed a strong ability to think independently. His fascination with markets continued, and he often spent time reading about investments, commodities, and currencies.

After graduating high school, Dalio enrolled at Long Island University’s C.W. Post College, where he pursued a bachelor’s degree in finance. His time at LIU was marked by continued exploration of investment strategies and macroeconomic concepts. He often combined his classroom learning with hands-on market experiments, trading small amounts whenever possible. This blend of theory and practice became a hallmark of his later approach at Bridgewater Associates.

After completing his undergraduate degree, Dalio landed a job as a clerk on the New York Stock Exchange. There, he was introduced to futures, commodities, and currencies, broadening his understanding of how global markets operated. His exposure to commodity trading deepened his appreciation for the interconnectedness of world events, supply and demand cycles, and economic policy. These early professional experiences reinforced his belief that markets were systems governed by rules, cycles, and repeatable patterns.

In 1973, Dalio was admitted to Harvard Business School, one of the most competitive and prestigious MBA programs in the world. At Harvard, he sharpened his analytical and strategic skills while networking with future leaders in finance and business. Dalio later said that Harvard gave him not just technical knowledge but also the confidence to think big and challenge conventional wisdom.

After Harvard, Dalio worked as Director of Commodities at Dominick & Dominick LLC and later as a trader at Shearson Hayden Stone. These jobs gave him the chance to apply his macroeconomic insights to real-world trading. However, his time at Shearson ended abruptly in 1974 after a heated altercation at a New Year’s Eve party, where he reportedly punched his boss while intoxicated. The incident led to his firing—a painful setback but also a turning point. Dalio realized that setbacks could be valuable lessons and that independence might be his best path forward.

In 1975, from his modest two-bedroom apartment in Manhattan, Dalio founded Bridgewater Associates. At the time, he had no clear vision of building the world’s largest hedge fund; instead, he was simply offering consulting and advisory services to clients who needed help managing risk. His first major breakthrough came when McDonald’s hired him to design a hedging system for chicken feed costs, which allowed the fast-food giant to stabilize prices for its new chicken McNuggets. This practical, problem-solving approach would become a hallmark of Bridgewater’s style.

This combination of real-world exposure, formal education, and early lessons in humility shaped Dalio’s worldview. By the time he launched Bridgewater, he had already developed the foundation of what would become a revolutionary approach to global macro investing.

In 1975, after leaving his role at Shearson Hayden Stone, Ray Dalio founded Bridgewater Associates from his two-bedroom Manhattan apartment. At the start, it was far from the financial powerhouse it would later become. Dalio began by offering consulting services to businesses, focusing on managing risks in currencies and commodities. He named the firm “Bridgewater” because he felt the name symbolized the bridging of gaps between ideas, markets, and people, while “water” conveyed adaptability and flow.

Bridgewater’s earliest clients were primarily corporate executives who needed strategies to hedge against volatile market conditions. Dalio combined his deep understanding of commodities with macroeconomic analysis to provide solutions that were both practical and innovative. This client-focused, research-driven model set Bridgewater apart from competitors even in its earliest years.

One of Bridgewater’s first major success stories came from a contract with McDonald’s. In the early 1980s, McDonald’s planned to launch its new menu item: Chicken McNuggets. The company faced a significant challenge—the cost of chicken feed was highly volatile and could disrupt profit margins. Dalio developed a hedging strategy using soybean meal futures to stabilize chicken feed prices. This solution not only secured McDonald’s supply chain but also demonstrated Bridgewater’s value as an advisory firm capable of applying macroeconomic thinking to real business challenges.

The McDonald’s deal was a turning point, bringing credibility and publicity to Bridgewater. It positioned Dalio as a problem solver who could connect global economic dynamics to real-world business needs. The success also allowed him to expand his client base and hire more staff, slowly transitioning Bridgewater from a one-man consultancy into a structured financial services firm.

During this early period, Dalio began publishing a research newsletter titled Daily Observations. Initially distributed to a handful of clients, it analyzed global economic trends, interest rates, currencies, and market risks. Over time, the newsletter became highly influential among institutional investors, central banks, and policymakers. Its popularity underscored Dalio’s reputation as a deep thinker capable of connecting dots across global events and market movements.

The newsletter helped Bridgewater grow beyond consultancy, attracting large-scale institutional clients such as pension funds and endowments. It also reinforced Dalio’s identity as both an investor and a thought leader in economics.

Despite early wins, Bridgewater faced major challenges in the 1980s. In 1982, during the Latin American debt crisis, Dalio publicly predicted a global depression after Mexico defaulted on its debt. He was convinced that the world economy would collapse, and he confidently shared his views with clients and the media. Instead, the U.S. government intervened, stabilizing the crisis. Dalio’s prediction was proven wrong, and Bridgewater suffered immense reputational and financial damage.

The consequences were devastating. Bridgewater nearly collapsed, and Dalio had to lay off all but one employee. He even borrowed $4,000 from his father to cover personal expenses. Dalio described the experience as one of the most painful but important lessons of his life. It taught him humility, the danger of overconfidence, and the importance of stress-testing ideas before making big bets. From this failure, Dalio began developing his philosophy of radical open-mindedness, which later became the cultural foundation of Bridgewater Associates.

By the late 1980s, Dalio had rebuilt Bridgewater with a renewed focus on rigorous research, diversified investment strategies, and systematic decision-making. His emphasis on analyzing debt cycles, monetary policy, and economic history became a core strength of the firm. Bridgewater’s disciplined macro approach attracted institutional investors seeking stability in increasingly complex markets.

In 1991, Dalio launched Pure Alpha, Bridgewater’s flagship hedge fund. The strategy was designed to generate positive returns across different market environments by making uncorrelated bets in multiple asset classes. Unlike many hedge funds that focused narrowly on equities, Pure Alpha integrated currencies, bonds, commodities, and global markets. Its success quickly attracted billions of dollars from pension funds, governments, and sovereign wealth funds.

In 1996, Bridgewater introduced another groundbreaking strategy: the All Weather Fund. Developed for Dalio’s trust for his family, the fund was based on the principle of “risk parity.” Instead of focusing primarily on equities, Dalio designed the fund to balance risk exposure across asset classes such as stocks, bonds, commodities, and inflation-linked securities. The goal was to create a portfolio that could perform well under various economic conditions, from inflation to deflation, from growth to recession.

This “All Weather” approach revolutionized institutional investing and was widely adopted by endowments, pension funds, and sovereign funds. It reinforced Bridgewater’s reputation for innovation and long-term thinking.

By the 2000s, Bridgewater had grown into one of the most influential hedge funds globally. Its success was not just based on investment performance but also on its distinctive culture of radical transparency and data-driven decision-making. The firm’s ability to anticipate and navigate global macroeconomic shifts made it indispensable to institutional clients managing trillions of dollars in assets.

Bridgewater’s role during the 2008 financial crisis cemented its legacy. While most firms struggled with massive losses, Bridgewater’s strategies protected capital and even generated profits. This performance attracted unprecedented flows of capital, pushing Bridgewater’s assets under management past $100 billion. By 2011, Bridgewater officially became the largest hedge fund in the world, a title it continues to hold.

The journey from a two-bedroom apartment startup to the largest hedge fund in history was marked by innovation, setbacks, resilience, and the relentless pursuit of better decision-making. Dalio’s leadership ensured that Bridgewater not only survived its early challenges but also redefined how institutional investors approached global markets.

One of Ray Dalio’s greatest contributions to management thinking is his concept of an idea meritocracy. At Bridgewater, Dalio believed the best decisions should be based not on hierarchy or seniority, but on the merit of ideas themselves. To achieve this, he created a workplace where debate, evidence, and logic carried more weight than titles or personal authority.

In practice, this meant encouraging employees to challenge each other’s assumptions openly, even if it meant questioning senior leadership. Dalio believed that organizations that silenced dissent were doomed to make costly mistakes. By contrast, he wanted Bridgewater to be a place where truth could emerge from radical honesty and constructive conflict.

Dalio institutionalized radical transparency as a defining feature of Bridgewater’s culture. Meetings were recorded and archived so employees could revisit discussions and understand how decisions were made. Critical feedback was shared directly, sometimes bluntly, and employees were expected to own both their strengths and weaknesses in full view of their peers.

This approach was controversial. Some outsiders described Bridgewater’s culture as harsh or cult-like, while insiders argued it was liberating because it removed politics and gossip. For Dalio, radical transparency was not about being cruel but about creating an environment where people could grow, mistakes could be studied, and the best ideas could win.

To support the idea meritocracy, Bridgewater implemented tools like the Dot Collector. In meetings, employees rated one another’s ideas and performance in real time using software that collected thousands of data points. Over time, the system built a profile of each person’s strengths, weaknesses, and credibility on different subjects.

For example, if an employee consistently demonstrated strong insights into economics, their views on macroeconomic topics would carry more weight in decision-making. Conversely, if someone had a poor track record in a specific area, their input would be discounted in that domain. This created a dynamic system where decisions were based on track records and logic rather than hierarchy.

Dalio believed mistakes were essential for growth. At Bridgewater, errors were not hidden but analyzed in detail. When something went wrong, employees were encouraged to document it in “issue logs,” explore the root causes, and propose solutions to prevent recurrence. This practice created a culture where failure was seen not as an embarrassment but as an opportunity for progress.

Dalio himself often admitted his biggest mistakes publicly, including the 1982 debt crisis miscalculation that nearly destroyed Bridgewater. By sharing his errors openly, he modeled the humility and transparency he expected from his team. Over time, this approach turned Bridgewater into a learning organization, where improvement was continuous and systematic.

Dalio codified his philosophy in a set of Principles, guidelines that combined life lessons, management practices, and investment strategies. He initially wrote these principles as internal documents for Bridgewater employees, but they eventually became the foundation for his 2017 best-selling book, Principles: Life & Work.

The core message of Principles is that success comes from aligning reality with goals, making decisions through radical truth and radical transparency, and designing systems to handle recurring challenges. Dalio believed life could be approached like a machine, where feedback loops and clear cause-and-effect patterns lead to better outcomes.

By embedding these principles into the daily operations of Bridgewater, Dalio created a culture unlike any other in finance. Employees often said working at Bridgewater was challenging but transformative, forcing them to confront uncomfortable truths about themselves and others. The emphasis on meritocracy, transparency, and feedback produced strong investment results, but it also polarized opinions about whether Bridgewater’s culture was too extreme.

In 2017, Dalio published his book Principles: Life & Work, sharing his philosophy with the broader public. The book became an instant bestseller, translated into multiple languages, and widely adopted by entrepreneurs, managers, and policymakers. It not only outlined his investment philosophy but also offered personal development lessons applicable to anyone seeking success.

Dalio’s principles inspired leaders in technology, finance, and government. Silicon Valley executives admired his systems-driven approach, while business schools integrated his teachings into leadership curricula. The book positioned Dalio not only as a hedge fund titan but also as one of the world’s most influential management thinkers.

Despite its popularity, Dalio’s philosophy has not been without criticism. Some former employees argued that radical transparency could feel oppressive, while others questioned whether the system of rating and recording employees created unnecessary pressure. Nevertheless, even critics acknowledged that Dalio’s principles were groundbreaking in challenging traditional corporate norms.

By opening his internal philosophy to the world, Dalio sparked global debates on how organizations should operate, how leaders should manage, and how individuals can align themselves with reality to achieve success.

Ultimately, Bridgewater’s culture of radical transparency and Dalio’s Principles created a management revolution, influencing not only hedge funds but also companies across industries worldwide.

The 2008 global financial crisis was one of the defining moments of Ray Dalio’s career. While some of the world’s most prestigious banks and investment firms suffered devastating losses, Bridgewater Associates navigated the turmoil successfully. Its flagship fund, Pure Alpha, generated strong returns when many competitors collapsed. This performance solidified Bridgewater’s reputation as the most reliable hedge fund during times of extreme market stress.

Dalio attributed this success to decades of studying debt cycles and economic history. In his analysis, the 2008 crisis was not an unpredictable “black swan,” but rather a repeatable phenomenon that had occurred many times throughout history in different forms. By anticipating the impact of excessive leverage and understanding how central banks would respond, Bridgewater was able to position itself defensively while capitalizing on the market chaos.

After the crisis, Dalio’s voice carried more weight than ever. Policymakers, central bankers, and global leaders began consulting his insights. Bridgewater’s influence extended beyond its clients to shape broader economic discussions on debt restructuring, monetary policy, and long-term economic cycles.

By 2011, Bridgewater officially became the largest hedge fund in the world, managing over $120 billion in assets. The firm’s clients included pension funds, sovereign wealth funds, university endowments, and central banks. Dalio had built an institution that managed money for those responsible for the financial security of millions of people globally.

Bridgewater’s reputation was reinforced in the years following 2008. While markets recovered unevenly, Bridgewater maintained steady performance. Dalio became known not just as an investor but as an economic historian, someone who could connect present events to patterns of the past.

Dalio’s principles-based philosophy was particularly important during times of crisis. His belief that organizations should embrace reality and deal with it resonated strongly in a post-crisis world. Leaders across industries began adopting his approaches to stress-testing ideas, identifying root causes, and designing solutions to complex problems.

Beyond investing, Ray Dalio has become a major philanthropist. Through Dalio Philanthropies, he and his family have donated billions of dollars to causes ranging from education to healthcare to ocean exploration. His giving reflects his belief in using wealth to address systemic issues and improve humanity’s long-term future.

One of Dalio’s core philanthropic focuses has been education. He has funded programs that expand access to high-quality schooling, particularly for underserved communities. Dalio has supported charter schools, public school reforms, and initiatives aimed at reducing inequality in education. His approach emphasizes not just providing resources but also designing systems that can deliver sustainable impact.

Dalio and his family have donated to numerous healthcare causes, including medical research and hospital infrastructure. One notable contribution was a $100 million gift to support medical care in Connecticut, the state where Bridgewater is headquartered. His healthcare giving often targets systemic improvements, ensuring that resources have a long-term impact.

Dalio has a personal passion for oceanography. Through his foundation, he funded OceanX, a research initiative that combines scientific exploration with cutting-edge technology to study the world’s oceans. Dalio believes that understanding and protecting the oceans is critical for the planet’s survival. OceanX has partnered with institutions such as the BBC and National Geographic to raise awareness about marine ecosystems and environmental challenges.

In 2011, Dalio and his wife Barbara signed the Giving Pledge, a commitment by the world’s wealthiest individuals to donate the majority of their wealth to philanthropic causes. This aligned Dalio with other major philanthropists like Warren Buffett and Bill Gates. For Dalio, the pledge represented not just a financial commitment but a responsibility to address some of the world’s most pressing challenges.

Dalio’s influence extends beyond markets and philanthropy. He is a widely respected thought leader whose writings on debt crises, economic cycles, and leadership are studied by investors, academics, and policymakers. His 2018 book Principles for Navigating Big Debt Crises analyzed 48 historical debt crises and provided a framework for understanding financial instability. Central banks and governments frequently reference this work in policy discussions.

Dalio has become a prominent public commentator on economic issues. He frequently shares insights on income inequality, capitalism’s strengths and flaws, and geopolitical risks. While he has immense respect for capitalism, he has warned about its shortcomings, particularly the widening wealth gap in the United States. Dalio has advocated for reforms that balance efficiency with fairness, arguing that extreme inequality poses risks to social stability and economic growth.

Ray Dalio has been recognized by numerous organizations for his contributions to finance, philanthropy, and thought leadership. His books and interviews reach millions worldwide, and his economic models are used in universities and policy institutions. His reputation as both a hedge fund titan and a philosopher of practical life principles makes him unique among financial leaders.

Dalio’s legacy is not only defined by his investment success but also by his efforts to rethink how organizations operate, how leaders lead, and how wealth can be used to improve society.

Ray Dalio is perhaps best known outside of Bridgewater for his research on long-term debt cycles. He believes economies move in repeatable patterns, particularly due to how societies manage debt. Dalio categorizes debt cycles into short-term (5–10 years, linked to business cycles) and long-term (75–100 years, often leading to major restructuring or collapse).

In his book Principles for Navigating Big Debt Crises, Dalio analyzed 48 debt crises across history, from the Great Depression of the 1930s to Japan’s asset bubble in the 1990s. He argued that while every crisis has unique details, the underlying mechanisms—excessive leverage, unsustainable debt burdens, government responses—follow similar paths. His framework is now used by policymakers and investors to anticipate and manage financial instability.

In recent years, Dalio has spoken openly about the shortcomings of modern capitalism. While he credits capitalism for generating prosperity, innovation, and rising standards of living, he warns that inequality has reached dangerous levels in the United States. He has highlighted how wealth and opportunity gaps lead to polarization, weakening social cohesion and threatening democracy itself.

Dalio has argued that without reform, capitalism risks undermining its own foundation. He suggests that government and business leaders must work together to ensure opportunity is more widely distributed. His warnings carry significant weight because they come not from an academic critic of capitalism but from one of its most successful practitioners.

Another area of Dalio’s focus has been geopolitics. He has studied the rise and fall of great empires, comparing current U.S.–China relations to historical power shifts such as the British Empire’s decline and America’s rise in the 20th century. Dalio warns that geopolitical conflicts, especially between rising and established powers, are a recurring risk in global history.

His 2021 book, The Changing World Order: Why Nations Succeed and Fail, explored these themes in depth. In it, Dalio examined the dynamics that make empires thrive—such as strong education systems, innovation, and financial discipline—and the factors that lead to decline, such as debt crises, internal conflict, and loss of competitiveness. He emphasized that the 21st century will likely be defined by how the United States and China manage their rivalry.

Dalio often summarizes his philosophy of life and work in what he calls the Five-Step Process. This framework reflects the way he approaches both personal growth and business decision-making:

According to Dalio, repeating this cycle continuously leads to growth and improvement. He sees life as a constant feedback loop where mistakes and failures are not setbacks but essential steps in progress.

One of Dalio’s most emphasized personal lessons is the importance of radical open-mindedness. He believes that humans are naturally limited by ego and blind spots, which prevent us from seeing reality clearly. By welcoming dissenting opinions and actively seeking out perspectives different from our own, Dalio argues that we move closer to the truth and make better decisions.

Dalio has often said that his failures were more valuable than his successes. The 1982 debt crisis miscalculation, which nearly destroyed Bridgewater, was one of the most painful moments of his life but also the most instructive. He learned humility, the dangers of overconfidence, and the need for rigorous testing of ideas. This philosophy of “failing well” became a core part of Bridgewater’s DNA.

Dalio is married to Barbara Dalio, with whom he has four sons. His family plays an active role in philanthropy, particularly through Dalio Philanthropies. Barbara has been especially involved in educational initiatives in Connecticut and beyond. Despite his global fame, Dalio has always described family as the most important foundation in his life.

Outside of finance and philanthropy, Dalio is deeply passionate about ocean exploration. He co-founded OceanX, which combines marine research with media storytelling to inspire interest in the oceans. Dalio has often said that exploring the oceans feels similar to exploring markets—both require curiosity, data-driven methods, and a willingness to embrace the unknown.

Ray Dalio’s impact on the world of investing is unparalleled. By founding and leading Bridgewater Associates, he created not only the largest hedge fund in the world but also one of the most innovative. His contributions to risk parity, global macro strategies, and the integration of systematic decision-making reshaped institutional investing forever.

Dalio’s principles have influenced far beyond finance. His insistence on radical transparency, idea meritocracy, and open-mindedness has challenged how organizations in every industry think about culture and decision-making. Whether admired or criticized, his ideas have sparked global debates about the future of work and leadership.

Through his books, essays, and interviews, Dalio has become a public intellectual whose ideas on economics, inequality, and global order resonate across disciplines. His writings on debt cycles and empire dynamics provide a framework for understanding the world’s most pressing challenges.

Dalio’s philanthropy reflects his belief in giving back. From education to healthcare to ocean exploration, his billions in donations have sought to improve human well-being and preserve the planet for future generations. His commitment to the Giving Pledge underscores his long-term vision of using wealth responsibly.

Ray Dalio’s journey—from a 12-year-old buying his first stock to the founder of the world’s largest hedge fund—is a story of curiosity, resilience, and disciplined thinking. His successes and failures alike shaped his philosophy that life, like markets, follows repeatable patterns. By codifying his lessons into principles, he offered the world more than just an investment strategy—he provided a framework for living, working, and learning.

Ray Dalio’s legacy lies not only in the trillions of dollars he has influenced but in the timeless principles he shared. His life’s work continues to inspire investors, leaders, and individuals to think differently, embrace reality, and pursue progress with humility and courage.