Asian equity markets delivered a mixed performance on July 4, 2025, as investor sentiment remained fragile in the face of looming global tariff decisions and reduced liquidity due to the U.S. Independence Day holiday. Major indexes across the region reacted cautiously to economic data and trade policy uncertainties, with some markets recovering from early losses, while others ended the day in the red.

Japan’s Nikkei Posts Mild Gains

The Nikkei 225 in Tokyo edged up by 0.3%, extending its weekly rebound despite a slightly stronger yen. Gains were largely led by industrial exporters and robotics firms, boosted by optimism around potential U.S.-Asia trade de-escalation next week.

Traders also welcomed dovish signals from the Bank of Japan (BoJ), which reiterated its commitment to ultra-loose monetary policy despite modest inflation growth.

Hang Seng Drops as Chinese Sentiment Weakens

Hong Kong’s Hang Seng Index fell 1.2% amid continued pressure on Chinese tech stocks and weak economic signals from the mainland. Investors reacted negatively to disappointing services PMI data, which showed slower growth in June.

- Alibaba and Tencent led declines in the tech sector.

- Property stocks extended losses amid fresh regulatory concerns in China.

- Market volume remained thin, reflecting investor caution.

Renewed uncertainty over Beijing’s next move in its regulatory crackdown weighed heavily on sentiment.

South Korea’s KOSPI Retreats Amid Export Fears

South Korea’s KOSPI dropped 1.3% following reports that U.S. tariffs could expand to include high-tech components from Korean firms. Semiconductors and display panel producers led the retreat.

SK Hynix and Samsung Electronics both slipped by more than 2%, as analysts raised concerns about the potential impact of U.S. policy changes due to take effect on July 9.

ASEAN Markets Remain Flat

Markets across Southeast Asia—particularly Singapore, Malaysia, and Thailand—remained mostly flat, with some minor losses. Low trading volumes and uncertainty ahead of the U.S. tariff deadline kept investors on the sidelines.

Global Trade Tensions Cloud Market Outlook

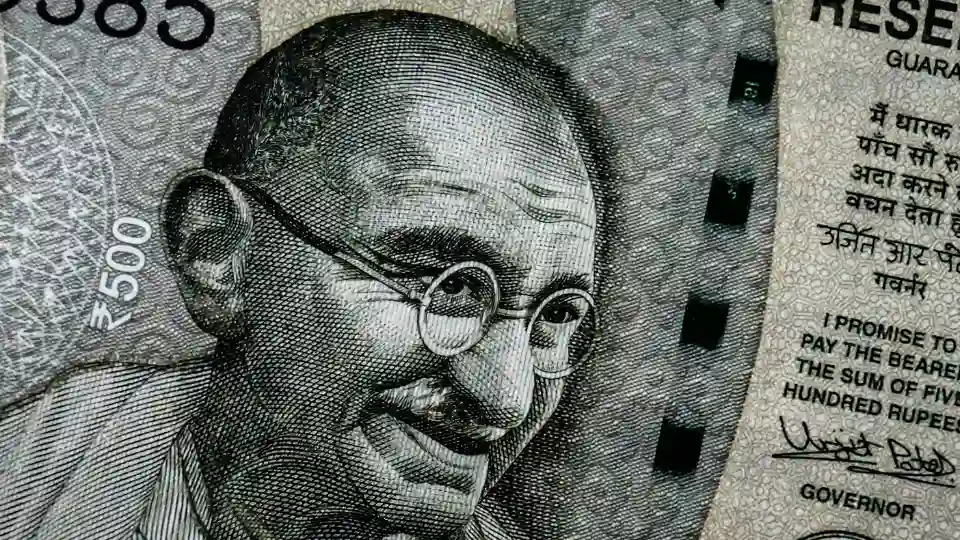

Investors across the region are watching the upcoming July 9 trade talks closely, as unresolved issues between the U.S., China, India, and ASEAN nations continue to raise the risk of supply chain disruptions.

While some analysts expect last-minute deals to avert harsh penalties, others warn that escalating tariffs could trigger a fresh wave of inflation and capital flight in emerging Asian economies.

U.S. Market Closure Dulls Regional Sentiment

With U.S. markets closed for the July 4 holiday, liquidity and risk appetite were both limited in Asian trading hours. Most institutional investors preferred to stay on the sidelines until Wall Street reopens on Monday.

Looking Ahead: Key Dates and Risks

- July 5: China’s central bank policy update

- July 8: U.S. non-farm payroll data (delayed due to holiday)

- July 9: Global tariff deadline affecting major Asian exporters

As the deadline approaches, volatility is expected to increase, especially in export-driven economies. Investors are advised to monitor official statements from the U.S. Trade Representative and regional central banks.