U.S. Stock Market Recap – July 19, 2025

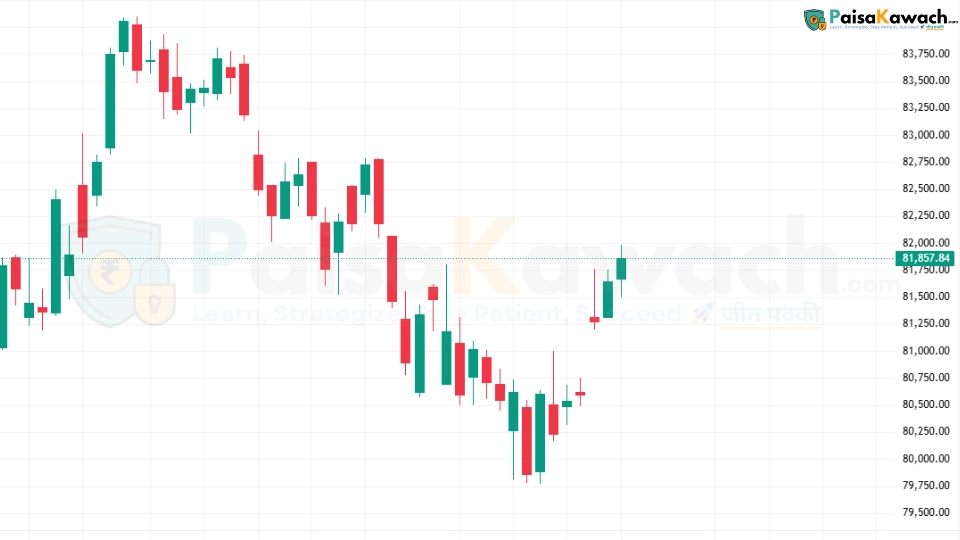

The U.S. stock market wrapped up the week on a cautious note, with the S&P 500 and Dow Jones Industrial Average hovering near record highs. Despite strong retail sales data and steady jobless claims, investors remain wary due to global trade tensions and interest rate concerns.

According to Reuters, the Federal Reserve hinted at maintaining higher interest rates for an extended period, citing persistent inflationary pressures. This has led to short-term pullbacks in growth stocks, particularly within the technology sector.

Global Trends Shaping Wall Street

While the U.S. markets dominate headlines, global events continue to influence Wall Street. Several international companies and policy developments had a notable impact on U.S. investors this week.

Alibaba ADRs Gain Momentum

Alibaba's U.S.-listed ADRs (BABA) saw a boost following positive GDP growth data from China and improved regulatory clarity for tech companies. This rally also supported the Nasdaq, as global tech optimism spilled into U.S. markets.

Defense and Energy Stocks

European defense contractor Saab surged 16% after NATO member states increased defense budgets, a trend that indirectly benefits U.S. defense companies like Lockheed Martin (LMT) and Raytheon (RTX). Additionally, energy giant Chevron (CVX) secured its $53 billion acquisition of Hess, unlocking access to massive oil reserves in Guyana and fueling investor interest in the energy sector.

Tariff Concerns: A Potential Game Changer

Former U.S. President Donald Trump's proposal of a 15–20% minimum tariff on all EU imports—with certain goods facing up to 30%—has caused ripples in global trade discussions. While the proposal is still under debate, U.S. exporters could face retaliatory tariffs, impacting industries like aviation, manufacturing, and automobiles.

- Boeing (BA) and Caterpillar (CAT) are among the companies that could be hit by retaliatory measures.

- Auto manufacturers, including Tesla (TSLA) and Ford (F), may face rising costs if tariffs increase raw material expenses.

- Consumer prices could climb, potentially affecting inflation readings and Federal Reserve policy.

Sector Highlights in the U.S.

Technology Stocks

Tech giants like Apple (AAPL) and Nvidia (NVDA) saw slight corrections this week as the sector consolidates after strong year-to-date gains. Earnings reports from Microsoft (MSFT) and Alphabet (GOOGL) next week are expected to set the tone for the Nasdaq.

Energy and Oil Markets

Crude oil prices remain volatile, hovering around $80 per barrel. U.S. energy companies are well-positioned to benefit from global supply constraints, with ExxonMobil (XOM) and Chevron leading gains.

Investment Insights for Beginners

For new investors, this week’s events underline the importance of watching both U.S. and global signals. A diversified portfolio that includes companies with international exposure can help balance market volatility.

- Track global earnings reports—Alibaba’s performance affected U.S.-listed ADRs and tech ETFs.

- Follow policy shifts—tariff changes can influence entire sectors overnight.

- Use market dips as learning opportunities to spot undervalued U.S. stocks with strong fundamentals.

What’s Next for the U.S. Stock Market?

Looking ahead, corporate earnings from Tesla, Microsoft, and Alphabet will likely dominate market sentiment next week. Investors will also monitor upcoming Federal Reserve speeches for hints on interest rate adjustments. The U.S.–EU trade negotiations remain a key risk factor to watch.