Short Strangle Options Strategy: Income from Range-Bound Markets

The Short Strangle is a premium-selling strategy where traders sell an out-of-the-money Call and Put. It profits if the market stays in a range, but carries unlimited risk if prices move sharply in either direction.

Short Strangle Options Strategy: Generating Premium Income from Stability

The Short Strangle is an advanced, non-directional options premium-selling strategy employed by traders who anticipate that the underlying asset will experience low volatility and remain within a predictable price range until expiration. This strategy capitalizes on time decay (theta) and is ideally deployed when implied volatility is elevated but expected to compress. It involves simultaneously selling one Out-of-the-Money (OTM) Call and one Out-of-the-Money (OTM) Put on the same underlying asset with identical expiration dates. The trader's maximum gain is limited to the total net premium received from selling both options, while the potential losses are theoretically unlimited on the upside and substantial on the downside, making robust risk management protocols absolutely essential.

- Max Profit: Limited to the total net credit (premiums) received upon trade initiation.

- Max Loss: Unlimited to the upside (driven by the short call); very large (though technically limited to the underlying asset falling to zero) to the downside (driven by the short put).

- Market View: Extremely neutral. The trader expects minimal price movement and decreasing volatility.

- Risk Profile: Defined reward with undefined, high risk. Suitable for experienced traders with significant risk capital.

When to Use a Short Strangle: Ideal Market Conditions

The Short Strangle is a strategic choice under specific market parameters:

- Range-Bound Price Action: The underlying asset is oscillating within a well-defined support and resistance channel with no clear catalyst for a breakout.

- High Implied Volatility (IV): Options premiums are rich due to elevated IV, often after a news event or earnings. The trader expects this IV to collapse (volatility crush), rapidly eroding the value of the sold options.

- Capitalizing on Time Decay (Theta): The strategy is best deployed with 30-45 days to expiration, where the rate of time decay accelerates, working relentlessly in the seller's favor.

- Earnings or Event Plays: Sometimes used when a trader believes the market has overestimated the potential move from an upcoming binary event like an earnings report.

Setup Checklist: A Methodical Approach

- Underlying Asset Selection: Prioritize highly liquid underlying assets with tight bid-ask spreads to facilitate easy entry and exit. Broad-market indices like NIFTY 50 or Bank NIFTY in India, or SPY/QQQ in the US, are ideal candidates. Avoid illiquid stocks.

- Strike Selection: Sell calls and puts that are Out-of-The-Money (OTM), choosing strike prices that align with key technical support (for the put) and resistance (for the call) levels. The goal is to select strikes where you are confident the price will not breach by expiration.

- Expiry Cycle: Near-term monthly or weekly expiries (e.g., 21-45 days out) are preferred to maximize the benefits of accelerated time decay in the final weeks.

- Risk Capital & Margin: Ensure you have sufficient margin capital. Brokerage requirements for naked options can be substantial. Never allocate more than a small percentage of your portfolio to a single strangle position.

- Hedging Plan: Have a pre-defined adjustment plan. The most common is to convert the undefined-risk strangle into a defined-risk Iron Condor by buying further OTM options to cap potential losses if the market starts to move against you.

Entry Rules: Executing the Trade

- Sell 1 OTM Call Option: Choose a strike price above the current market price that you believe will act as strong resistance.

- Sell 1 OTM Put Option: Choose a strike price below the current market price that you believe will act as strong support. Ensure both options share the same expiration date.

- Net Credit: The total premiums received from selling the call and the put constitute your net credit. This is your maximum possible profit on the trade.

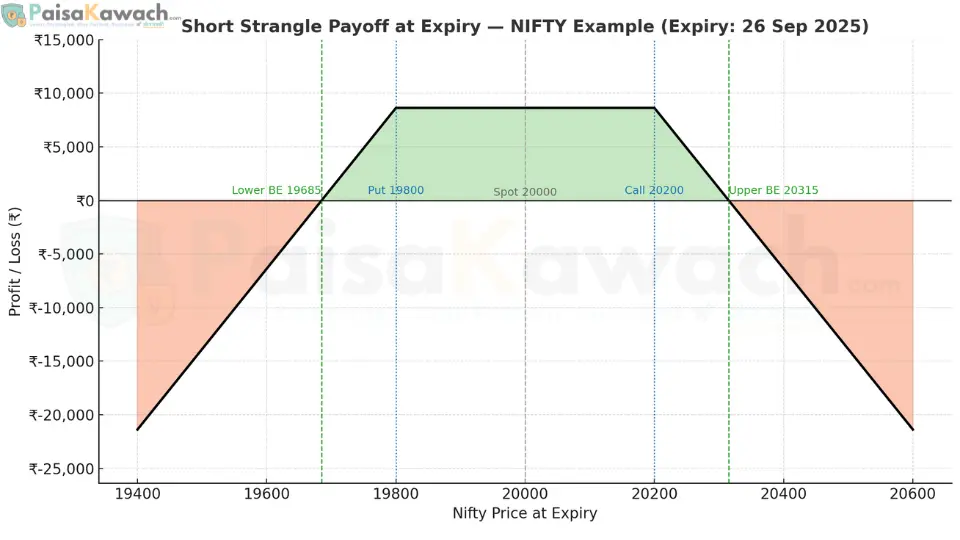

Detailed Example: NIFTY Short Strangle

Assume NIFTY 50 is currently trading at 20,000. It's the start of the September series, and the monthly expiry is on 26th September 2025. You identify strong resistance at 20,200 and strong support at 19,800.

- Sell 1 lot of 20,200 Strike Call Option (CE) @ ₹60 premium

- Sell 1 lot of 19,800 Strike Put Option (PE) @ ₹55 premium

- NIFTY Lot Size: 75 units

Total Premium Received (Net Credit): (₹60 + ₹55) = ₹115 per share.

Total Credit per Lot: ₹115 × 75 = ₹8,625 (This is your Maximum Profit)

Breakeven Points Calculation:

The breakeven points are calculated by adding the total premium to the call strike and subtracting it from the put strike.

- Upper Breakeven (UBE): Call Strike (20,200) + Total Premium (115) = 20,315

- Lower Breakeven (LBE): Put Strike (19,800) - Total Premium (115) = 19,685

Your trade is profitable at expiration if NIFTY closes anywhere between 19,685 and 20,315.

Payoff Scenarios at Expiry:

- Ideal Scenario (Max Profit): NIFTY expires between 19,800 and 20,200. Both options expire worthless. You keep the entire ₹8,625 premium.

- Breakeven Scenario: NIFTY expires exactly at 20,315 or 19,685. The loss on one leg exactly offsets the premium collected from both legs, resulting in a net-zero P&L.

- Adverse Scenario (Loss):

- If NIFTY rallies to 20,500, the 20,200 Call is ITM by 300 points. Loss on Call: (20,500 - 20,200) * 75 = ₹22,500. Net P&L: Premium (₹8,625) - Loss (₹22,500) = Net Loss of ₹13,875.

- If NIFTY crashes to 19,500, the 19,800 Put is ITM by 300 points. Loss on Put: (19,800 - 19,500) * 75 = ₹22,500. Net P&L: Premium (₹8,625) - Loss (₹22,500) = Net Loss of ₹13,875.

Risk & Management: The Greeks and Adjustments

- Max Profit: Capped at the net premium received (₹8,625 in our example).

- Max Loss: Effectively unlimited. The call loss increases indefinitely as the underlying price rises. The put loss increases as the underlying falls to zero.

- Theta (Time Decay): Positive. This is the trader's ally. Each day that passes, all else equal, erodes the value of the short options, pushing the position toward profitability.

- Vega (Volatility Risk): Negative. An increase in Implied Volatility (IV) will increase the value of the options you sold, causing an unrealized mark-to-market loss. A decrease in IV (vol crush) will benefit the position.

- Delta (Directional Risk): Initially near zero (neutral). As the market moves, the delta of the position will change, making it sensitive to further moves in that direction.

- Primary Adjustment: If the underlying price approaches one of your short strikes, you can convert to an Iron Condor by buying a further OTM option on the threatened side. For example, if NIFTY rallies toward 20,200, buy a 20,400 Call to cap your upside loss. This defines your risk but also reduces your maximum potential profit.

Exit Rules: Securing Gains and Limiting Losses

- Profit-Taking: Exit the position for a buy-to-close order if you capture 50-80% of the maximum profit well before expiry. Don't greedily hold for the last few pennies of premium.

- Stop-Loss (Absolute): Exit the entire trade immediately if the unrealized loss reaches a predetermined threshold (e.g., 1.5x the premium received).

- Stop-Loss (Technical): Exit if the underlying price closes decisively above the call strike or below the put strike on a daily chart, indicating a breakout.

- Volatility Stop: Close the position if implied volatility spikes dramatically against you, increasing the cost to buy back the options.

- Rolling: You can "roll" the threatened leg out to a further expiry and/or a different strike to collect more premium and give the trade more room to work. This is complex and increases margin requirements.

Advantages

- Premium Income: Generates immediate cash flow from the sale of time value.

- High Probability of Profit: Benefits from the statistical edge that most assets spend more time consolidating than trending.

- Wider Profit Zone: Offers a wider breakeven range compared to a Short Straddle (which uses ATM options), providing a larger margin for error.

- Benefits from Time Decay and Volatility Crush: Double benefit from the passage of time and falling volatility.

Disadvantages

- Unlimited Risk Potential: The most significant drawback. A large, unexpected gap move can lead to losses many times greater than the premium collected.

- Large Margin Requirements: Selling naked options requires substantial brokerage margin, tying up significant capital.

- Vulnerability to "Black Swan" Events: Sudden, sharp market moves (e.g., flash crashes, unexpected news) can cause rapid, significant losses.

- Active Management Required: Not a "set-and-forget" strategy. It demands constant monitoring and a disciplined approach to risk management.

Comparison: Short Strangle vs. Short Straddle

| Factor | Short Straddle | Short Strangle |

|---|---|---|

| Strike Selection | ATM Call + ATM Put | OTM Call + OTM Put |

| Premium Collected | Higher (more premium income) | Lower (less premium income) |

| Breakeven Range | Narrower (higher risk of loss) | Wider (lower risk of loss) |

| Probability of Profit | Lower | Higher |

| Risk Profile | Unlimited on both sides | Unlimited on both sides |

| Capital/Margin Required | Very High | High (but often slightly less than a straddle) |

The Short Strangle is a powerful, advanced options strategy for generating income in stagnant, low-volatility environments. Its success is not solely dependent on predicting direction but on accurately forecasting a period of market quietude. While the potential returns can be attractive, the asymmetric risk profile demands extreme discipline, sophisticated risk management, and a thorough understanding of options Greeks. It is unequivocally a strategy for experienced traders with significant risk capital.