Introduction to Multi-Leg Option Strategies — Vertical Spreads

A complete beginner-friendly guide to multi-leg option strategies. Learn why traders combine options, starting with vertical spreads. Bull Call and Bear Put to manage risk and reward.

Multi-leg option strategies represent the evolution from basic directional bets to sophisticated risk-managed positions. By combining two or more single-leg options, traders can engineer payoffs that precisely match their market outlook and risk tolerance. While single calls and puts offer simplicity, they often come with significant drawbacks: unlimited risk for sellers and the relentless decay of time value for buyers. Vertical spreads, the simplest and most foundational multi-leg strategies, solve these problems by defining maximum risk and reward, reducing upfront cost, and optimizing for a specific range of price movement. This chapter focuses exclusively on these essential building blocks: bull call spreads and bear put spreads.

1. The Strategic Imperative: Why Use Multi-Leg Strategies?

Moving beyond single-leg positions is not just an advanced technique; it is a fundamental step towards disciplined, professional trading. Single options often present a poor risk-reward ratio or unacceptable tail risk. Multi-leg strategies allow traders to:

- Reduce Net Cost (Debit): The premium received from selling one option partially finances the purchase of another, lowering the initial capital outlay and the breakeven point.

- Define and Cap Risk: The worst-case scenario is known and quantified before entering the trade, eliminating the possibility of catastrophic, unlimited losses associated with naked short options.

- Express Nuanced Views: Instead of a binary bullish/bearish outlook, spreads allow traders to profit from a specific anticipated price range or a moderate move, not just an extreme one.

- Manage Greek Exposure: Spreads can be constructed to mitigate the negative effects of time decay (Theta) or to take a targeted view on volatility (Vega), creating a more balanced position.

2. Vertical Spreads: The Definition

A vertical spread is an options strategy involving two options of the same type (both calls or both puts), with the same expiration date, but at different strike prices. The term "vertical" comes from the way these strikes are listed on an options chain—one above the other. These are defined-risk, directional strategies.

- Bull Call Spread (Debit Spread): A moderately bullish strategy. It involves buying one call option at a lower strike price and simultaneously selling another call option at a higher strike price.

- Bear Put Spread (Debit Spread): A moderately bearish strategy. It involves buying one put option at a higher strike price and simultaneously selling another put option at a lower strike price.

Both strategies are initiated for a net debit, meaning the cost of the long option is greater than the premium received from the short option. This net debit is also the maximum possible loss.

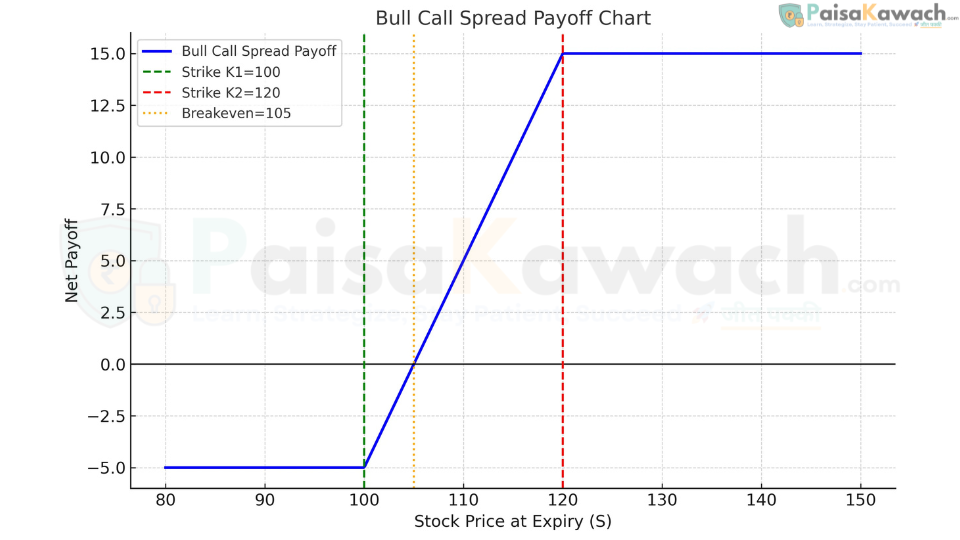

3. Bull Call Spread: The Cost-Effective Bull

The Bull Call Spread is the go-to strategy for a trader who is bullish but wants to reduce the cost and time decay inherent in a long call, while accepting a cap on maximum profits. It profits if the underlying price rises above the lower strike, with maximum profit achieved at or above the higher strike.

Mechanics and Formulas:

- Construction: Buy 1 ITM or ATM Call (Strike K1) + Sell 1 OTM Call (Strike K2), where K1 < K2.

- Net Debit (Max Loss): Premium Paid for Long Call - Premium Received for Short Call.

- Maximum Profit: (K2 - K1) - Net Debit.

- Breakeven Point at Expiry: K1 + Net Debit.

Detailed Example: NIFTY Bull Call Spread

- Underlying: NIFTY 50 Index

- Action: Buy 1 NIFTY 20,000 Call @ ₹200 | Sell 1 NIFTY 20,500 Call @ ₹80

- Net Debit (Max Loss): ₹200 - ₹80 = ₹120 per share.

- Spread Width: 20,500 - 20,000 = 500 points.

- Max Profit: 500 - 120 = ₹380 per share.

- Breakeven: 20,000 + 120 = 20,120.

Scenario Analysis (Lot Size = 50 units for NIFTY):

1. NIFTY expires at 19,800 (Below K1): Both calls expire worthless. Total Loss = Net Debit * Lot Size = ₹120 * 50 = ₹6,000.

2. NIFTY expires at 20,120 (Breakeven): Long call intrinsic value = 120. Net P&L = 120 ( intrinsic) - 120 (debit) = ₹0.

3. NIFTY expires at 20,400 (Between Strikes): Long call intrinsic value = 400. Short call is OTM. Net P&L = 400 - 120 = ₹280 profit per share → ₹14,000 Total Profit.

4. NIFTY expires at 20,600 (Above K2): Long call intrinsic value = 600. Short call intrinsic value = -100. Net P&L = (600 - 100) - 120 = ₹380 profit per share → ₹19,000 Total Profit (Max Gain).

Strategic Interpretation & Notes

- Purpose: To finance a bullish bet. You sacrifice potential profit above K2 in exchange for a lower cost and a higher probability of profit compared to a naked long call.

- Greek Profile: The short call reduces the position's negative Theta (time decay) compared to a long call alone, making it less susceptible to time erosion. It also reduces the net Delta, making it a more moderate bullish bet.

- Ideal Conditions: A moderately bullish outlook where you expect the underlying to rise to, but not necessarily far above, the short strike price before expiration.

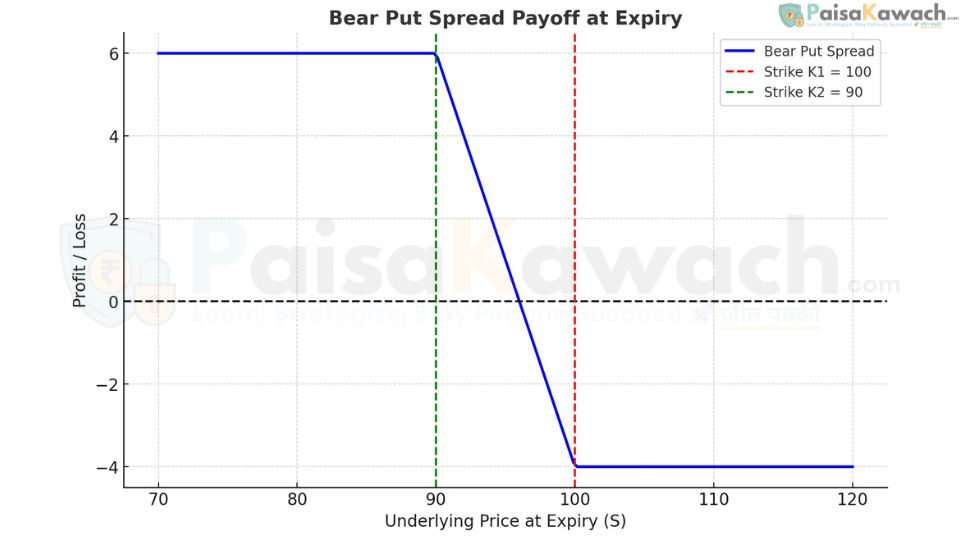

4. Bear Put Spread: The Defined-Risk Bear

The Bear Put Spread is the bearish equivalent of the Bull Call Spread. It is used when a trader expects a moderate decline in the underlying's price. It offers a less expensive alternative to a long put by financing it with the sale of a further OTM put, at the cost of capping the maximum profit.

Mechanics and Formulas:

- Construction: Buy 1 ITM or ATM Put (Strike K2) + Sell 1 OTM Put (Strike K1), where K2 > K1.

- Net Debit (Max Loss): Premium Paid for Long Put - Premium Received for Short Put.

- Maximum Profit: (K2 - K1) - Net Debit.

- Breakeven Point at Expiry: K2 - Net Debit.

Detailed Example: Equity Bear Put Spread

- Underlying: XYZ Stock

- Action: Buy 1 XYZ ₹1,000 Put @ ₹60 | Sell 1 XYZ ₹950 Put @ ₹20

- Net Debit (Max Loss): ₹60 - ₹20 = ₹40 per share.

- Spread Width: 1,000 - 950 = ₹50 per share.

- Max Profit: 50 - 40 = ₹10 per share.

- Breakeven: 1,000 - 40 = ₹960.

Scenario Analysis (Lot Size = 100 shares):

1. Stock expires at ₹1,050 (Above K2): Both puts expire worthless. Total Loss = Net Debit * Lot Size = ₹40 * 100 = ₹4,000.

2. Stock expires at ₹960 (Breakeven): Long put intrinsic value = 40. Net P&L = 40 - 40 = ₹0.

3. Stock expires at ₹920 (Between Strikes): Long put intrinsic value = 80. Short put intrinsic value = -30. Net P&L = (80 - 30) - 40 = ₹10 profit per share → ₹1,000 Total Profit.

4. Stock expires at ₹900 (Below K1): Long put intrinsic value = 100. Short put intrinsic value = -50. Net P&L = (100 - 50) - 40 = ₹10 profit per share → ₹1,000 Total Profit (Max Gain).

Strategic Interpretation & Notes

- Purpose: To profit from a expected decline while reducing the cost of the long put. The maximum profit is achieved if the underlying falls to or below the lower strike (K1).

- Greek Profile: Similar to the bull call spread, the short put reduces the net cost and thus the negative Theta, making the position decay more slowly than a lone long put.

- Ideal Conditions: A bearish outlook where a decline is expected, but a collapse is not anticipated. It's often a more capital-efficient way to express a bearish view than shorting stock.

5. Comparative Advantages of Vertical Spreads

- Defined Risk-Reward Profile: The maximum loss is known and limited to the net debit paid. The maximum gain is known and limited by the width of the strikes minus the debit.

- Lower Capital Outlay: Significantly cheaper than buying a single long option outright, allowing for better portfolio diversification.

- Higher Probability of Profit: Compared to a naked long option, the breakeven point is closer to the current price because of the premium received from the short leg.

- Favorable Theta Profile: The sold option collects time value, partially offsetting the time decay of the purchased option, making the spread less sensitive to the passage of time than a lone long option.

6. Common Mistakes and How to Avoid Them

- Misunderstanding the Profit Cap: New traders sometimes forget that spreads cap their upside. Avoid this by always calculating max profit before entering the trade. Don't use a spread if you expect a massive, unlimited move.

- Poor Strike Selection: Choosing strikes that are too close together results in a very low max profit that may not justify the risk. Choosing strikes too far apart makes the trade behave more like a naked long option, defeating the purpose of the spread. Select strikes based on your realistic price target and risk/reward tolerance.

- Ignoring Breakeven: A spread can still be a losing trade if the underlying doesn't move beyond the breakeven point. Always calculate the BEP and ensure your market view supports a move beyond that level.

- Overlooking Commissions: While spreads define risk, they involve two commissions. For small, low-profit spreads, commissions can eat significantly into returns. Ensure the potential profit justifies the transaction costs.

7. Summary: The Gateway to Advanced Trading

Vertical spreads are the indispensable gateway to the world of advanced options trading. They teach the critical skill of trading risk for reward—using a short option to finance a long one, thereby lowering cost and defining risk at the expense of capping gains. Mastering the bull call spread and bear put spread provides a template for understanding all other defined-risk strategies. The logic of buying one option and selling another to create a specific, bounded payoff is the core principle behind more complex structures like iron condors, butterflies, and calendar spreads. By internalizing the mechanics, payoffs, and strategic applications of vertical spreads, a trader builds a solid foundation for constructing sophisticated, multi-leg portfolios tailored to any market environment.