Single-Leg Option Positions — The Building Blocks of Options Trading

A complete foundation guide to single-leg option positions. Learn what long calls, long puts, short calls, and short puts mean, how they shape risk/reward, and why they form the base of all options strategies.

Single-leg option positions are the fundamental atomic units from which all complex derivatives strategies are constructed. Mastery of these four core positions—long call, long put, short call, and short put—is non-negotiable for any serious trader. They provide the essential intuition for understanding risk-reward profiles, breakeven analysis, and the critical trade-offs between leverage, time decay, and volatility. Every multi-leg strategy, from a simple vertical spread to an intricate iron condor, is merely a combination of these basic building blocks, carefully arranged to express a specific market view and risk tolerance.

1. The Four Pillars: Defining Single-Leg Positions

A single-leg option position is an outright trade involving one option contract. It is the purest expression of a market view—bullish, bearish, or neutral—through options. There are four canonical positions, each with a distinct and clearly defined risk profile.

- Long Call: The purchase of a call option. The trader pays an upfront premium for the right to buy the underlying asset at a fixed strike price. This is a bullish strategy with limited risk and theoretically unlimited profit potential.

- Long Put: The purchase of a put option. The trader pays an upfront premium for the right to sell the underlying asset at a fixed strike price. This is a bearish or hedging strategy with limited risk and large, but capped, profit potential.

- Short Call (Naked Call): The sale of a call option. The trader receives an upfront premium but assumes the obligation to sell the underlying asset at the strike price if assigned. This is a neutral-to-bearish income strategy that carries theoretically unlimited risk.

- Short Put (Naked Put): The sale of a put option. The trader receives an upfront premium but assumes the obligation to buy the underlying asset at the strike price if assigned. This is a neutral-to-bullish income strategy that carries significant, though defined, risk.

2. The Mathematical Foundation: Payoff Formulas

The profit or loss of any option position at expiration can be precisely calculated using these formulas, where:

S = Spot price of the underlying asset at expiration

K = Strike price of the option

P = Premium paid or received per share

- Long Call: P&L =

max(0, S − K) − P - Long Put: P&L =

max(0, K − S) − P - Short Call: P&L =

−max(0, S − K) + P - Short Put: P&L =

−max(0, K − S) + P

The max() function ensures the intrinsic value is never negative, encapsulating the "option" aspect of the contract.

3. Core Characteristics and Strategic Implications

- Long Options (Buying Premium):

- Risk: Strictly limited to the premium paid (P).

- Reward: High leverage; uncapped upside for calls, large capped upside for puts.

- Greeks: Negative Theta (time decay hurts), Positive Vega (volatility increases help).

- Mindset: Speculative or protective. You are paying for convexity and defined risk. - Short Options (Selling Premium):

- Risk: Potentially unlimited for short calls, very large for short puts.

- Reward: Strictly limited to the premium received (P).

- Greeks: Positive Theta (time decay helps), Negative Vega (volatility increases hurt).

- Mindset: Income generation. You are selling insurance and collecting premium, but assuming tail risk. - Breakeven Analysis: A critical calculation that defines the required market move for profitability.

- Long Call Breakeven:BEP = Strike Price (K) + Premium Paid (P)

- Long Put Breakeven:BEP = Strike Price (K) - Premium Paid (P)

- Short positions break even at the same points, but from the seller's perspective.

4. Detailed Analysis, Payoff Charts, and Worked Examples

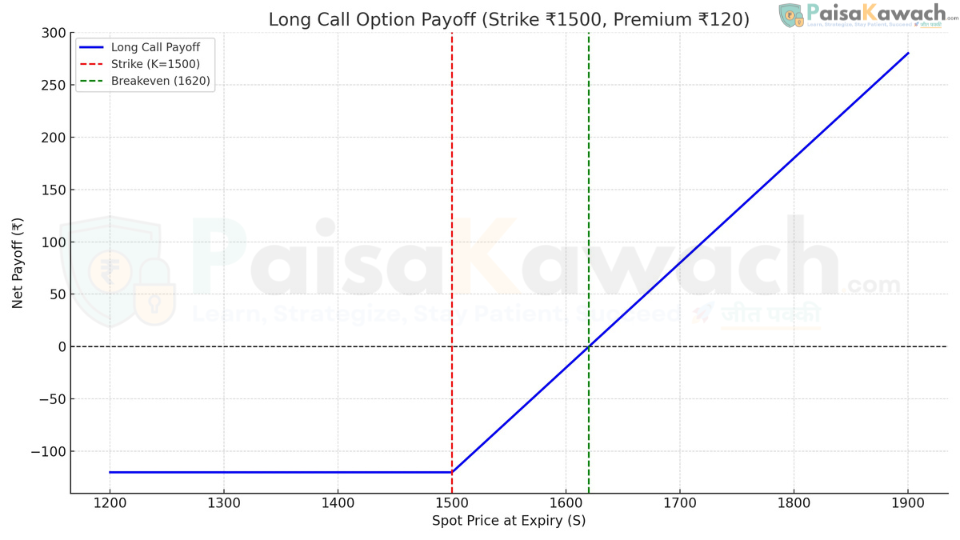

Visualizing the payoff profile is crucial for understanding the asymmetric risk of each position. The following charts and detailed numeric scenarios illustrate the P&L at expiration across various price points.

Long Call: The Leveraged Bull

The long call is a tool for capitalized bullish speculation. Its value lies in the leverage it provides; a small move in the underlying can lead to a large percentage return on the premium invested. However, it must overcome the headwinds of time decay and potentially expensive implied volatility.

Detailed Example (Equity Option, Lot Size = 100 shares)

- Underlying: XYZ Ltd.

- Strike Price (K): ₹1,500 (~$18.00)

- Premium Paid (P): ₹120 (~$1.44) per share

- Total Investment: ₹120 * 100 = ₹12,000 (~$144) (Maximum Loss)

Scenario Analysis at Expiration:

1. S = ₹1,400 (Bearish): Intrinsic Value = max(0, 1400-1500) = ₹0. Net Loss = ₹0 - ₹120 = -₹120/share → Total Loss = -₹12,000.

2. S = ₹1,500 (At Strike): Intrinsic Value = ₹0. Net Loss = -₹120/share → Total Loss = -₹12,000.

3. S = ₹1,620 (Breakeven): Intrinsic Value = 1620-1500 = ₹120. Net P&L = ₹120 - ₹120 = ₹0/share → Total P&L = ₹0.

4. S = ₹1,650 (Moderately Bullish): Intrinsic Value = ₹150. Net Profit = ₹150 - ₹120 = ₹30/share → Total Profit = ₹3,000 (~$36).

5. S = ₹1,900 (Very Bullish): Intrinsic Value = ₹400. Net Profit = ₹400 - ₹120 = ₹280/share → Total Profit = ₹28,000 (~$336).

Strategic Interpretation & Notes

- Breakeven Point (BEP): K + P = ₹1,500 + ₹120 = ₹1,620 (~$19.44).

- Maximum Loss: Limited to the premium paid: ₹12,000 (~$144).

- Maximum Profit: Theoretically unlimited. The profit increases linearly for every rupee the underlying moves above ₹1,620.

- Ideal Conditions: Strong bullish conviction, an event catalyst, and purchasing options when Implied Volatility (IV) is relatively low to avoid paying expensive time value.

- Key Risk: Time Decay (Theta). If the anticipated upward move is slow or delayed, the option's value will erode daily, consuming the investment.

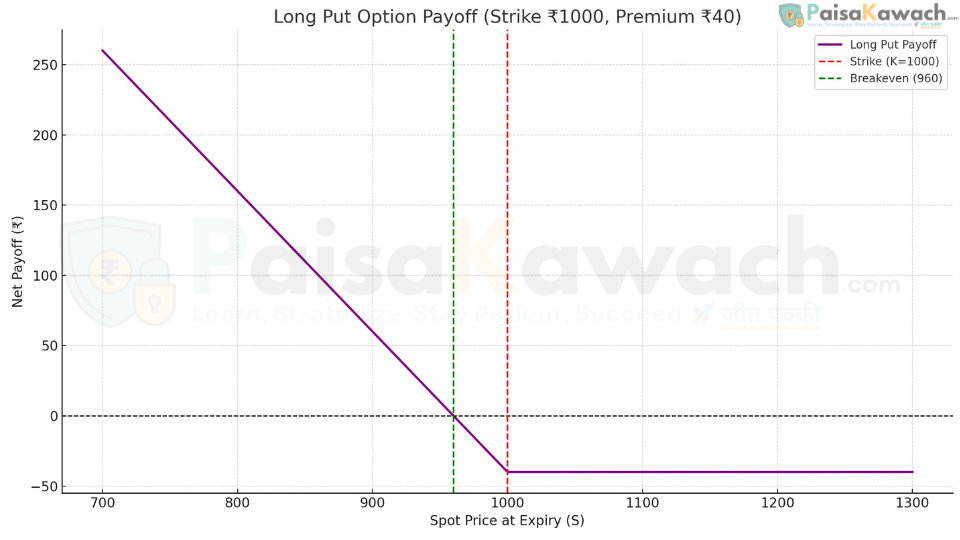

Long Put: The Bearish Hedge

The long put serves a dual purpose: as a direct bearish bet on an underlying's decline or as a protective "insurance policy" for an existing long stock position. It defines the maximum loss upfront while offering substantial downside payoff.

Detailed Example (Equity Option, Lot Size = 100 shares)

- Underlying: ABC Ltd.

- Strike Price (K): ₹1,000 (~$12.00)

- Premium Paid (P): ₹40 (~$0.48) per share

- Total Investment: ₹40 * 100 = ₹4,000 (~$48) (Maximum Loss)

Scenario Analysis at Expiration:

1. S = ₹1,100 (Bullish): Intrinsic Value = max(0, 1000-1100) = ₹0. Net Loss = ₹0 - ₹40 = -₹40/share → Total Loss = -₹4,000.

2. S = ₹1,000 (At Strike): Intrinsic Value = ₹0. Net Loss = -₹40/share → Total Loss = -₹4,000.

3. S = ₹960 (Breakeven): Intrinsic Value = 1000-960 = ₹40. Net P&L = ₹40 - ₹40 = ₹0/share → Total P&L = ₹0.

4. S = ₹900 (Moderately Bearish): Intrinsic Value = ₹100. Net Profit = ₹100 - ₹40 = ₹60/share → Total Profit = ₹6,000 (~$72).

5. S = ₹0 (Worst Case for Stock): Intrinsic Value = ₹1,000. Net Profit = ₹1000 - ₹40 = ₹960/share → Total Profit = ₹96,000 (~$1,152) (Maximum Possible Profit).

Strategic Interpretation & Notes

- Breakeven Point (BEP): K - P = ₹1,000 - ₹40 = ₹960 (~$11.52).

- Maximum Loss: Limited to the premium paid: ₹4,000 (~$48).

- Maximum Profit: Capped but substantial. Occurs if the underlying price falls to zero: (K - 0 - P) = ₹96,000 (~$1,152) per contract.

- Ideal Conditions: A anticipated sharp decline in the underlying or as a hedge for a stock portfolio during periods of high uncertainty. Most effective when IV is low before a volatility spike.

- Key Risk: Volatility Crush. If you buy a put ahead of an event and the stock drops only modestly, a subsequent collapse in IV can cause the put's value to fall even as the price moves in your favor.

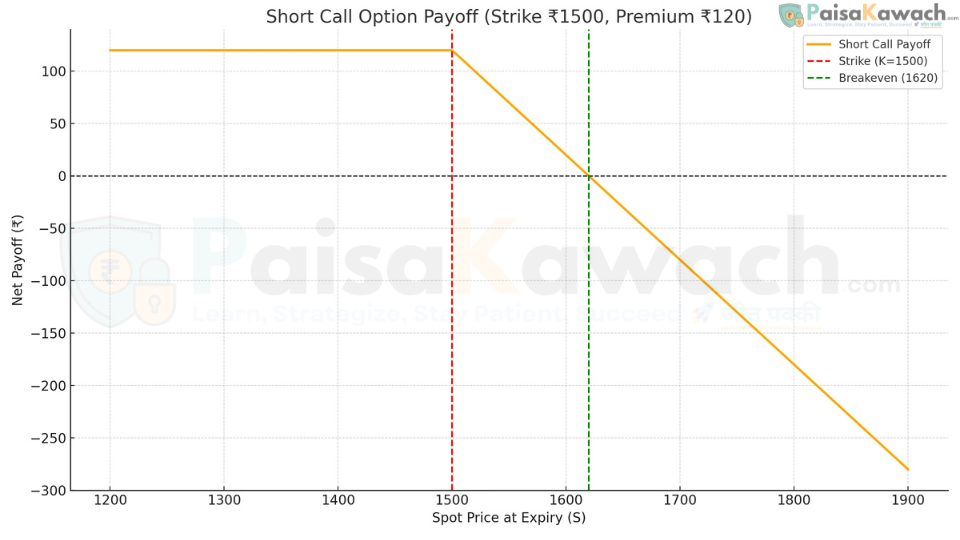

Short Call: The Unlimited Risk Income Play

Writing a naked call is a high-risk, premium-selling strategy. It should only be employed by experienced traders with strict risk management protocols, often as part of a defined spread strategy to cap risk. The most common and prudent use is in a covered call strategy, where the seller already owns the underlying shares.

Detailed Example (Equity Option, Lot Size = 100 shares)

- Underlying: XYZ Ltd.

- Strike Price (K): ₹1,500 (~$18.00)

- Premium Received (P): ₹120 (~$1.44) per share

- Total Credit Received: ₹120 * 100 = ₹12,000 (~$144) (Maximum Gain)

Scenario Analysis at Expiration:

1. S = ₹1,400 (Favorable): Option expires worthless. Net Gain = +₹120/share → Total Profit = +₹12,000 (Keep full premium).

2. S = ₹1,500 (Favorable): Option expires worthless. Net Gain = +₹120/share → Total Profit = +₹12,000.

3. S = ₹1,620 (Breakeven): Intrinsic Value = 1620-1500 = ₹120. Net P&L = -₹120 + ₹120 = ₹0/share → Total P&L = ₹0.

4. S = ₹1,650 (Adverse Move): Intrinsic Value = ₹150. Net Loss = -₹150 + ₹120 = -₹30/share → Total Loss = -₹3,000 (~$36).

5. S = ₹2,000 (Large Adverse Move): Intrinsic Value = ₹500. Net Loss = -₹500 + ₹120 = -₹380/share → Total Loss = -₹38,000 (~$456).

Strategic Interpretation & Notes

- Breakeven Point (BEP): K + P = ₹1,500 + ₹120 = ₹1,620 (~$19.44) (Same as long call BEP).

- Maximum Gain: Limited to the premium received: ₹12,000 (~$144).

- Maximum Loss: Theoretically unlimited. The loss increases linearly for every rupee the underlying moves above ₹1,620.

- Ideal Conditions: A strong belief that the underlying will stagnate or fall. Never sell naked calls. Only use as part of a spread (e.g., bear call spread) or as a covered call where you own the shares.

- Key Risk: Unlimited loss potential, margin calls, and assignment risk. A sudden positive news event can cause a gap up in the stock price, leading to catastrophic losses overnight.

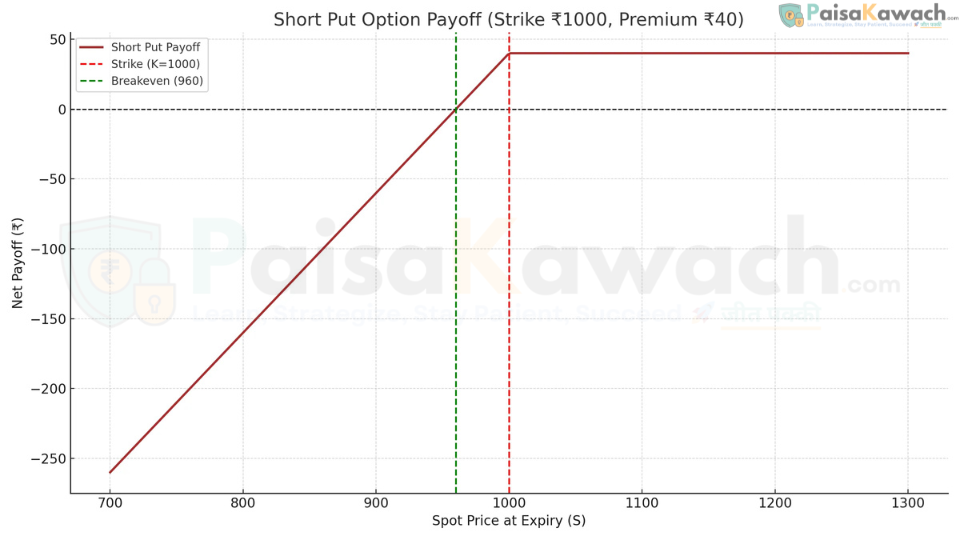

Short Put: The Assignment Risk Income Play

Selling cash-secured puts is a popular strategy for investors who are willing to purchase a stock at a predetermined, discounted price. The premium received provides a buffer, lowering the effective purchase price. The risk is that the stock falls significantly, forcing the investor to buy at the strike price, which may be far above the new market price.

Detailed Example (Equity Option, Lot Size = 100 shares)

- Underlying: ABC Ltd.

- Strike Price (K): ₹1,000 (~$12.00)

- Premium Received (P): ₹40 (~$0.48) per share

- Total Credit Received: ₹40 * 100 = ₹4,000 (~$48) (Maximum Gain)

- Cash Secured Requirement: ₹1,000 * 100 = ₹100,000 (~$1,200) must be set aside to fulfill the obligation if assigned.

Scenario Analysis at Expiration:

1. S = ₹1,100 (Favorable): Option expires worthless. Net Gain = +₹40/share → Total Profit = +₹4,000 (Keep full premium).

2. S = ₹1,000 (Favorable): Option expires worthless. Net Gain = +₹40/share → Total Profit = +₹4,000.

3. S = ₹960 (Breakeven): Intrinsic Value = 1000-960 = ₹40. Net P&L = -₹40 + ₹40 = ₹0/share → Total P&L = ₹0.

4. S = ₹900 (Adverse Move): Intrinsic Value = ₹100. Net Loss = -₹100 + ₹40 = -₹60/share → Total Loss = -₹6,000 (~$72).

5. S = ₹0 (Worst Case): Intrinsic Value = ₹1,000. Net Loss = -₹1000 + ₹40 = -₹960/share → Total Loss = -₹96,000 (~$1,152) (Maximum Possible Loss).

Strategic Interpretation & Notes

- Breakeven Point (BEP): K - P = ₹1,000 - ₹40 = ₹960 (~$11.52) (Same as long put BEP).

- Maximum Gain: Limited to the premium received: ₹4,000 (~$48).

- Maximum Loss: Defined but large. Occurs if the underlying price falls to zero: (K - 0 - P) = ₹96,000 (~$1,152) loss per contract.

- Ideal Conditions: A neutral-to-bullish outlook on a quality stock you wouldn't mind owning. The goal is to generate income or acquire shares at an effective price of (Strike - Premium).

- Key Risk: Capital commitment and significant loss potential if the underlying company faces fundamental deterioration. Always ensure you have the capital and desire to buy the shares at the strike price.

5. Practical Applications and Strategic Context

- Long Call/Put (Directional Speculation): Use when you have a high-conviction view on direction and need leveraged exposure with defined risk. Ideal for event-driven trades (earnings, product launches).

- Long Put (Hedging/Insurance): Invaluable for protecting existing long stock portfolios from Black Swan events or anticipated downturns. The cost of the premium is the insurance fee.

- Short Call (Covered Call for Income): A conservative strategy for enhancing returns on a long stock position you plan to hold. You sacrifice upside potential above the strike for immediate premium income.

- Short Put (Cash-Secured for Acquisition/Income): A strategic tool for disciplined investors to enter a stock position at a discount or generate yield on cash reserves in a sideways or bullish market.

6. Common Beginner Pitfalls to Avoid

- Ignoring the "Greeks": Buying options without considering Theta (time decay) and Vega (volatility) is a recipe for loss. The underlying must move enough, quickly enough, to overcome these costs.

- Underestimating Seller Risk: Selling naked options is not "free money." The limited premium is insignificant compared to the potential catastrophic losses. Always define your risk with spreads.

- Failing to Calculate Breakeven: Not knowing the exact price the underlying must reach by expiration is like driving blindfolded. Always calculate BEP before entering a trade.

- Poor Position Sizing: Allocating too much capital to a single option trade can lead to a total loss of that capital. Risk only a small percentage of your portfolio on speculative long options.

7. Summary: The Bedrock of Options Trading

These four single-leg positions are the essential alphabet of the options language. A deep, intuitive understanding of their payoff structures, breakevens, maximum risks, and strategic applications is the absolute prerequisite for all advanced trading. They teach the fundamental forces of options: leverage, time decay, volatility, and the asymmetry between buyer and seller. Before combining these legs into spreads, straddles, or condors, a trader must be able to look at any single option and instantly visualize its risk graph and understand the conditions under which it will profit or fail. This mastery transforms options from a complex mystery into a versatile toolkit for expressing market views and managing portfolio risk.