Global Gold Rally Breaks Records

Gold surged above $3,600 per ounce for the first time in history, setting a new benchmark in commodity markets. Softer U.S. job data has raised expectations of imminent Federal Reserve rate cuts, while a weaker dollar and falling bond yields further supported the metal’s momentum. In 2025, gold has already gained over 35%, continuing its upward trend from last year.

India’s Bullion Market at Unprecedented Levels

In India, domestic gold prices surged alongside global markets. Rates have crossed ₹1.08 lakh per 10 grams nationally, with Ahmedabad seeing peaks of ₹1.12 lakh. A depreciating rupee magnified the dollar-denominated rally, making bullion significantly more expensive in local terms.

While jewellery demand may soften ahead of the festive season due to high prices, investment flows into gold ETFs and sovereign gold bonds remain strong, as households and institutions seek safety amid volatility.

Key Drivers Behind the Surge

Safe-Haven Appeal

Investors worldwide are turning to gold as an inflation hedge and risk-averse asset. In India, where gold carries deep cultural and financial significance, this appeal is particularly strong.

RBI’s Reserve Diversification

The Reserve Bank of India has increased gold holdings while cutting exposure to U.S. Treasuries. This strategy mirrors a global trend of central banks diversifying away from dollar-based assets.

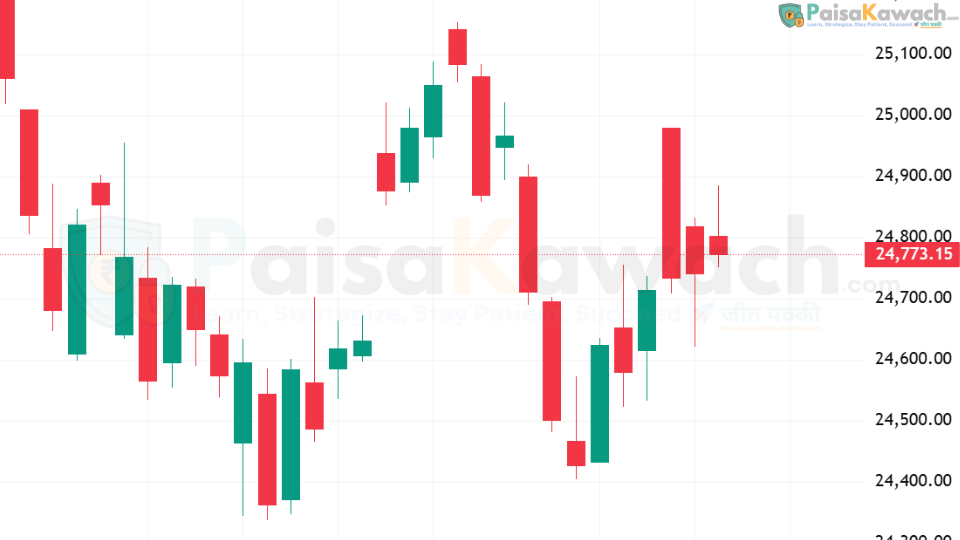

Technical Momentum

On the MCX, gold shows strong support between ₹1,05,000–₹1,06,000 and resistance around ₹1,09,000–₹1,10,000. Analysts recommend a “buy on dips” approach, citing bullish signals from RSI and MACD indicators.

Festive Demand and Consumer Sentiment

The surge in prices may curb jewellery buying during weddings and Diwali, but long-term demand is unlikely to vanish. Instead, families may delay purchases, while investors maintain steady exposure through paper-gold avenues.

Conclusion

Gold’s historic rally highlights its resilience as a safe-haven asset. For Indian investors, record-high prices pose challenges for consumers but opportunities for long-term wealth preservation. With Fed rate cuts on the horizon, gold is expected to stay in focus for both global and domestic portfolios.