Where the Market Stands Before the Opening Bell

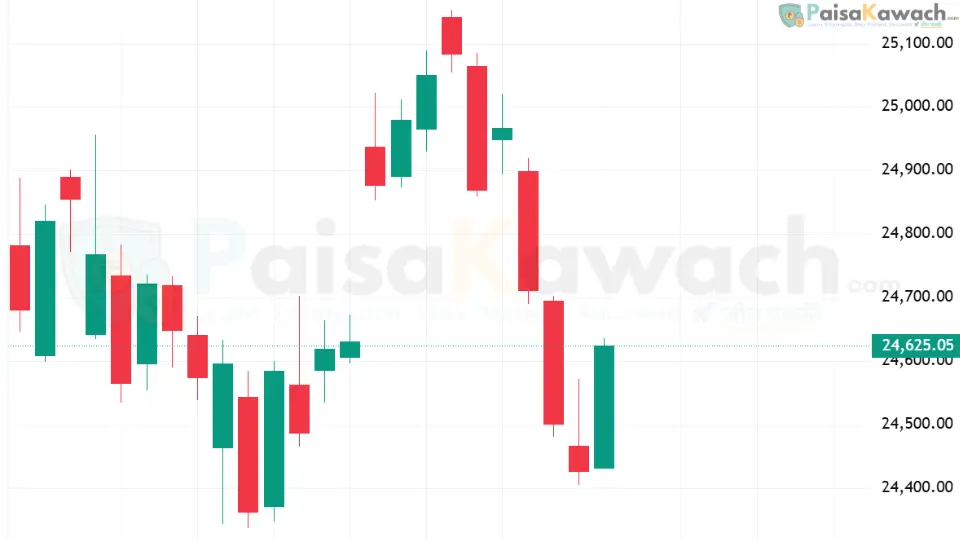

The Indian equity market approaches the February 4, 2026 trading session with the NIFTY 50 positioned in a phase of structural balance. Recent sessions have been defined by rotational price behavior rather than directional expansion, reflecting a market that is reassessing value after prior volatility. This context matters as it shapes expectations around participation quality, volatility behavior, and intraday responsiveness.

Market Snapshot

- Index State: Balanced, rotational price behavior

- Volatility: Contained relative to recent sessions

- Participation: Selective, stock-specific engagement

- Broader Tone: Cautious amid mixed global signals

For Detailed Analysis Visit Our Reasearch

OR

Stock Screener

Market Structure and Price Action Overview

From a structural standpoint, the NIFTY 50 has shifted away from impulsive movement into a range-bound environment. Acceptance at higher levels has been limited, while downside probes have attracted responsive activity without accelerating into distribution. This two-sided interaction suggests ongoing price discovery rather than trend resolution.

Volatility and Participation Dynamics

Volatility compression has been evident, indicating reduced urgency among larger participants. Such behavior often reflects institutional preference to observe acceptance and rejection at established reference areas before committing additional capital.

Impact on Market Participants

For market participants, the current setup emphasizes contextual awareness over directional bias. Sessions characterized by balance tend to reward disciplined execution and sensitivity to intraday shifts in participation, rather than assumptions of continuation.

Sector and Peer Context

Compared with recent performance in select global equity indices, Indian markets appear relatively stable, with less pronounced volatility expansion. This relative steadiness aligns with broader emerging market behavior observed in Asia, where cautious positioning has followed mixed cues from US equities.

Global Cues and External Influences

Overnight global markets presented a mixed picture, with US equities closing marginally lower and Asian markets opening without a unified directional bias. According to Reuters, investors globally continue to weigh growth signals against monetary policy expectations, contributing to subdued risk appetite.

What to Watch Next

As the session unfolds, attention is likely to remain on how price behaves around established balance areas, the evolution of intraday volatility, and whether participation broadens beyond select stocks. Any shift in acceptance dynamics could provide further structural clarity.

Key Insight: Balanced markets often precede expansion, but until participation confirms, price behavior remains context-driven rather than directional.