Nifty 50 Market Overview

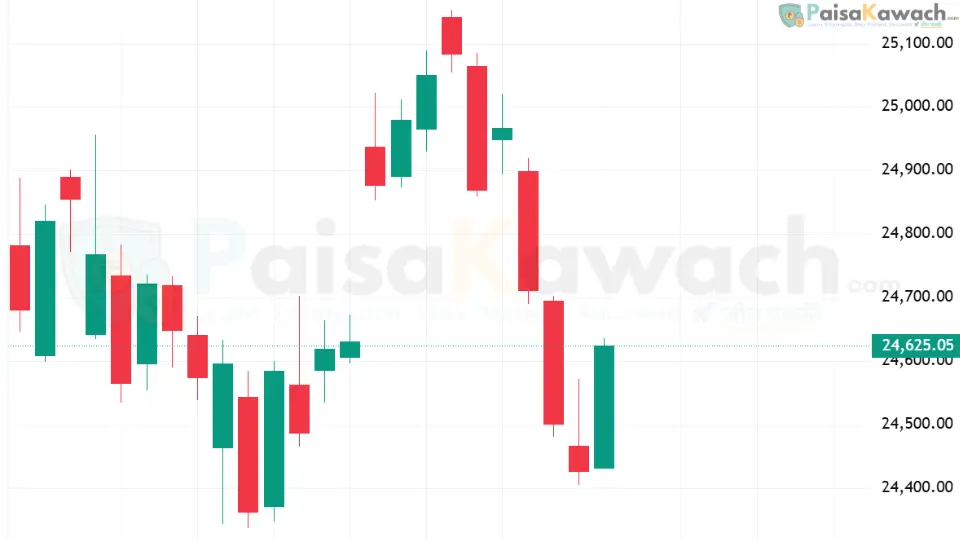

The Nifty 50 index staged a significant recovery on September 1, 2025, closing at 24,625.05, up by 198 points (+0.81%). After a sharp three-day decline that dragged the benchmark below 24,400, Monday’s session saw strong buying support at lower levels, signaling renewed interest from bulls.

Technical Analysis of Nifty 50

On the daily chart, Nifty formed a strong bullish candle, reversing from the critical support zone around 24,300–24,350. This bounce suggests that short-term sentiment has turned positive, at least for a pullback rally. The index now faces immediate resistance near 24,750–24,800, while support remains intact at 24,450.

Key Technical Levels for September 2, 2025

Support Zones:- 24,450 (immediate support)

- 24,300 (major support)

- 24,750 (near-term hurdle)

- 24,900 (supply zone)

Market Sentiment and Trading Outlook

The rebound in Nifty indicates a possible short-covering rally, combined with fresh buying interest. However, global market cues, crude oil movement, and foreign institutional investor (FII) activity will play a crucial role in sustaining this momentum.

If Nifty manages to hold above 24,450 today, traders can expect consolidation with a positive bias. On the flip side, any slip below this level may trigger renewed selling pressure, dragging the index back toward 24,300.

What Traders Should Do Today

For intraday traders, the strategy should focus on buying near dips towards 24,450 with a stop-loss around 24,300. Positional traders may look for opportunities if Nifty breaks and sustains above 24,750, aiming for 24,900 in the short run.