Market Context: Where the Index Stands Ahead of the Session

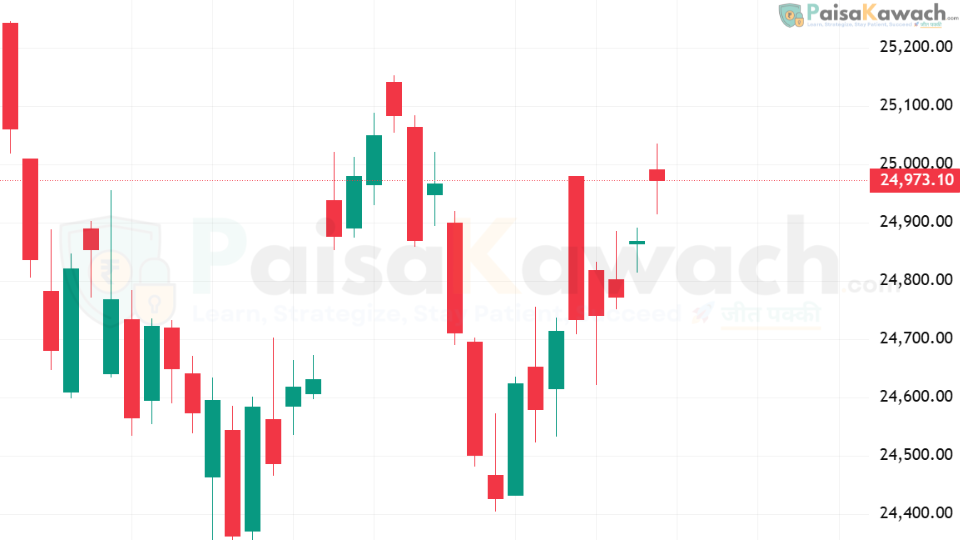

As the Indian equity market prepares for the next trading session, the NIFTY 50 is entering the day with a structurally balanced setup. Recent price behavior has been characterized by rotation rather than directional momentum, reflecting an environment where buyers and sellers remain actively engaged without establishing dominance.

Global cues remain largely neutral, offering limited directional influence. In this backdrop, domestic price action and internal participation are taking precedence, making market structure analysis particularly relevant for understanding short-term behavior.

NIFTY 50 Snapshot

- Market state: Balanced, non-trending structure

- Volatility: Contained with selective expansion

- Participation: Rotational and stock-specific

- Index behavior: Acceptance within a defined range

Understanding the Current Market Structure

From a structural perspective, the NIFTY 50 continues to trade within an established area of acceptance. Attempts to move away from this balance have so far met responsive activity, indicating that both sides of the market are willing to engage but reluctant to commit aggressively.

This type of structure is often associated with two-way trade, where price discovery is incremental and driven by short-term positioning rather than long-term conviction. The absence of sustained volatility expansion reinforces the view that the market is facilitating trade rather than trending.

What This Means for Market Participants

In a balanced environment, index-level movement may not fully reflect underlying activity. Instead, dispersion across sectors and stocks tends to increase, placing greater emphasis on participation quality and relative strength.

For informed participants, such conditions typically shift focus toward risk management and structural clarity rather than directional assumptions. Market behavior becomes more sensitive to acceptance and rejection signals, especially during intraday sessions.

Sectoral and Peer Market Comparison

Compared with other major Asian indices, which are also showing muted or mixed early-session behavior, the NIFTY 50 appears aligned with a broader regional theme of consolidation. Unlike phases of synchronized global momentum, current conditions highlight divergence and selective engagement.

Within the domestic market, sectoral performance has remained uneven, with leadership rotating rather than concentrating. This reinforces the broader narrative of balance at the index level.

What to Watch Next

Going forward, attention is likely to remain on how the index responds to attempts outside the current balance area. Changes in volatility behavior, participation breadth, or sustained acceptance away from recent ranges may offer early clues about structural transition.

According to Bloomberg, markets globally are navigating a phase where macro clarity is limited, increasing reliance on technical and structural signals rather than directional macro themes.

Conclusion

The NIFTY 50 begins the session with a neutral, balanced structure, shaped by rotational flows and controlled volatility. In the absence of strong external triggers, observable price behavior and participation dynamics remain the most reliable guides for understanding market conditions.