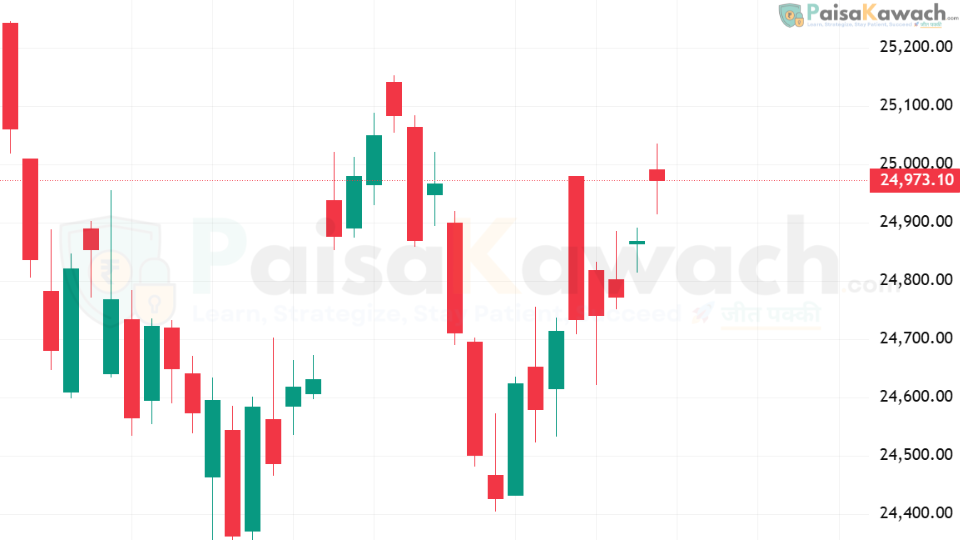

On Wednesday, September 10, the Nifty 50 managed to climb past the 25,000 mark for the first time this week, touching an intraday high of 25,035.70. However, the index could not sustain the breakout and slipped back to close at 24,973.10, up 104 points (+0.42%). The failure to hold above resistance highlights both the bullish attempt and the selling pressure lurking at this psychological level.

Technical Analysis: Resistance Holds Strong

The candlestick formed on 10 Sept suggests a classic “intraday breakout, but weak close” pattern. While buyers dominated the morning session, profit-taking emerged once the index touched 25,000. This price action offers a mixed outlook:

- Immediate Resistance: 25,000–25,050 remains the key hurdle. A close above this zone is essential for continuation toward 25,200–25,250.

- Support Levels: Initial support lies at 24,900, followed by a stronger base near 24,750–24,800. A break below these levels could drag the index back to 24,600.

- Momentum Indicators: Short-term trend is positive, but overbought signals near resistance suggest caution. Bulls need fresh strength from heavyweights in IT and banking to carry the rally forward.

Global & Domestic Market Drivers

Investor sentiment is being shaped by both international and domestic developments. Globally, concerns around the U.S. economic slowdown and Federal Reserve’s next policy move weigh on investor confidence. Domestically, Fitch’s revised India GDP forecast to 6.9% for FY26 has boosted optimism, while foreign institutional inflows continue to provide liquidity support.

Forecast for Today’s Session (11 Sept 2025)

For Thursday, the market’s behavior around 25,000 will be decisive. A sustained close above this level may open the path for a sharp rally toward 25,200–25,300. Conversely, failure to break through could trigger profit booking, pushing the index back toward 24,800 levels.

Intraday Trading Strategy

- Watch for a decisive breakout above 25,050 for long entries with targets of 25,200 and 25,250.

- Maintain a stop-loss below 24,900 for positional longs.

- If Nifty fails at resistance and slips under 24,900, expect consolidation toward 24,750.

- Key sectors in focus: IT, Banking, and FMCG.

Conclusion

The Nifty 50 remains in an uptrend but faces a stern test at the 25,000 mark. While bulls showed strength by crossing the barrier intraday, the inability to sustain raises caution. Today’s session (11 September 2025) could either confirm a breakout toward higher levels or signal a temporary consolidation phase. Traders should stay alert to volatility and track global cues closely.