India’s $224 billion IT export industry is facing a fresh challenge from Washington. The newly proposed U.S. HIRE Act (Halting International Relocation of Employment) aims to impose a 25% tax on outsourced services, directly impacting Indian IT firms that rely heavily on American clients. While the bill is still under discussion, its potential consequences are already sending shockwaves across boardrooms and trading floors in India.

What the HIRE Act Proposes

The draft legislation, introduced in the U.S. Senate, includes a bold provision: a 25% excise tax on payments made by U.S. companies to foreign entities for outsourced services. Importantly, these expenses will not qualify for tax deductions, making outsourcing significantly more expensive for U.S. corporations.

- Tax Rate: A flat 25% levy on outsourced service payments.

- Fund Allocation: Revenue directed to a Domestic Workforce Fund to support U.S. apprenticeships and skill programs.

- Scope: Applies to services outsourced abroad but consumed by U.S. customers.

Immediate Impact on Indian IT

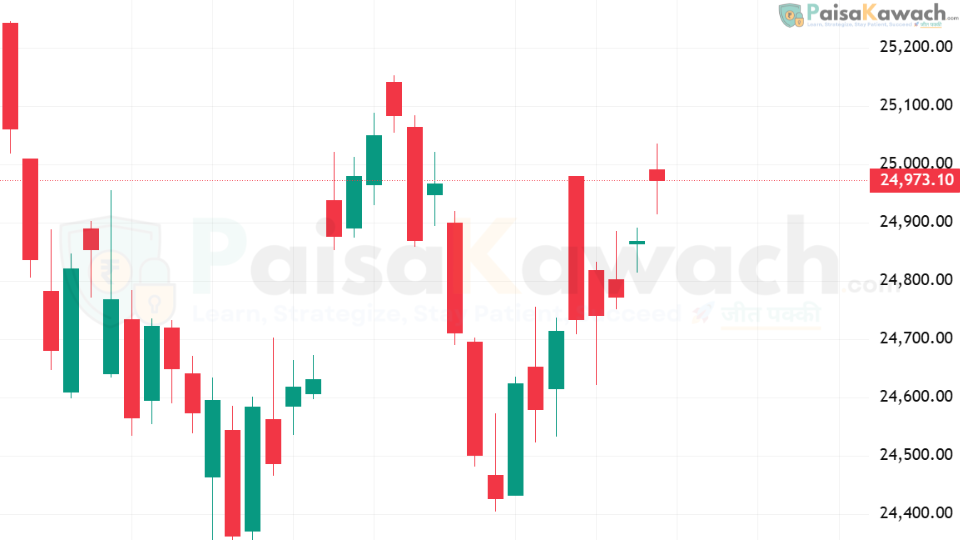

With nearly 60–62% of Indian IT revenue tied to the U.S. market, the sector faces serious margin pressures if the law passes. Analysts estimate outsourcing costs could rise by up to 58% due to the combined effect of the levy and loss of tax deductions. The Nifty IT index has already shown signs of nervousness, slipping close to 1% intraday after news of the proposal surfaced.

Industry Response and Strategy

Indian IT majors—TCS, Infosys, Wipro, and HCL Tech—are closely monitoring developments. Companies are expected to explore strategic options to cushion the impact:

- Contract Renegotiation: U.S. clients may push for reduced fees or shift contracts back onshore.

- Diversification: Firms are likely to accelerate expansion into Asia-Pacific, the Middle East, Australia, and Europe to reduce U.S. dependence.

- Value-Added Services: Greater focus on AI, cloud, cybersecurity, and consulting, which are less vulnerable to pure price competition.

Legislative Uncertainty

This is not the first time anti-outsourcing legislation has been floated in the U.S. Many such bills have failed to pass due to pushback from corporations reliant on global supply chains. Whether the HIRE Act gains traction remains uncertain, but its very introduction has already shifted client sentiment, with some firms delaying long-term contracts.

Conclusion

The proposed U.S. HIRE Act represents a potential turning point for India’s IT sector. If enacted, it would not only erode India’s cost advantage but also accelerate a shift toward higher-value services and market diversification. For now, uncertainty looms large, and both Indian firms and global investors are bracing for what could be one of the most significant policy-driven shocks to outsourcing in decades.