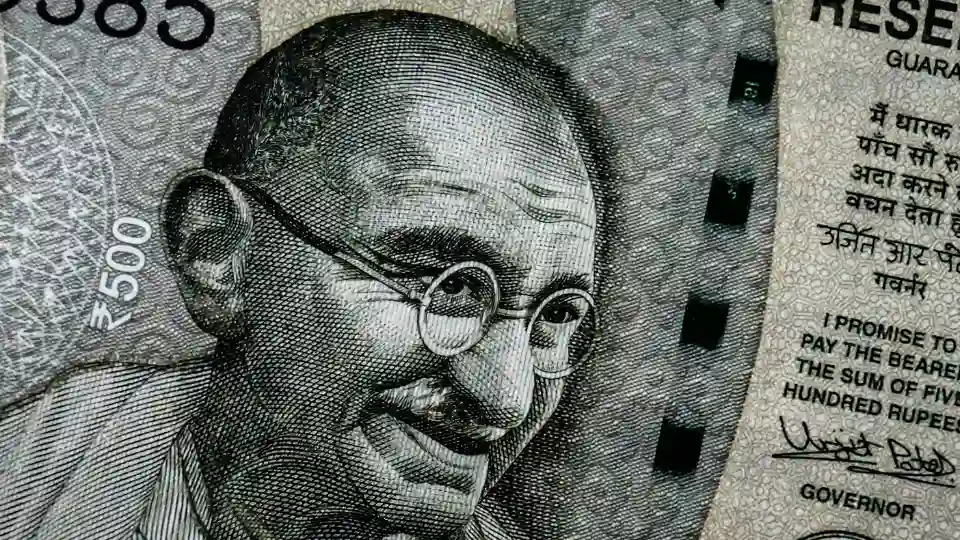

Rupee Slips to Historic Low Amid Global Uncertainty

The Indian rupee weakened further on September 25, 2025, hitting an all-time low against the U.S. dollar. The pressure on the currency stemmed from sustained foreign portfolio outflows and ongoing worries over U.S. visa policy changes and trade disruptions. Market analysts noted that the currency’s fall reflects investor unease about India’s exposure to global headwinds.

Stock Market Reaction: Flat but Fragile

Despite the rupee’s weakness, benchmark indices—the Sensex and Nifty—remained largely flat during Thursday’s trading session. This stability, however, masked underlying caution. Traders indicated that volumes were thin, and defensive sectors such as FMCG and healthcare gained modestly, while IT and financial stocks lagged due to concerns over overseas earnings and regulatory uncertainties.

Key Drivers Behind Investor Caution

- Foreign portfolio outflows: Global investors have pulled funds from emerging markets amid tighter U.S. policy signals.

- Visa and trade concerns: New U.S. visa rules and ongoing tariff debates are clouding business outlook for Indian IT and export-heavy firms.

- Global market signals: Weak U.S. manufacturing data and cautious remarks from the Federal Reserve added to investor unease.

Broader Economic Implications

The rupee’s depreciation raises concerns about imported inflation, particularly in fuel and essential commodities. Economists suggest that while the Reserve Bank of India (RBI) has room to intervene, any aggressive action could risk draining foreign exchange reserves.

Outlook for Investors

Market watchers advise that volatility may persist until clarity emerges on U.S. policy decisions and India’s upcoming earnings season. Long-term investors, however, are encouraged to view corrections as opportunities, particularly in domestic-driven sectors like infrastructure and consumer demand.

For now, the rupee’s slide and cautious equities underline the fragile balance between global uncertainty and India’s growth story.