Pressure Builds After a Weak August Close

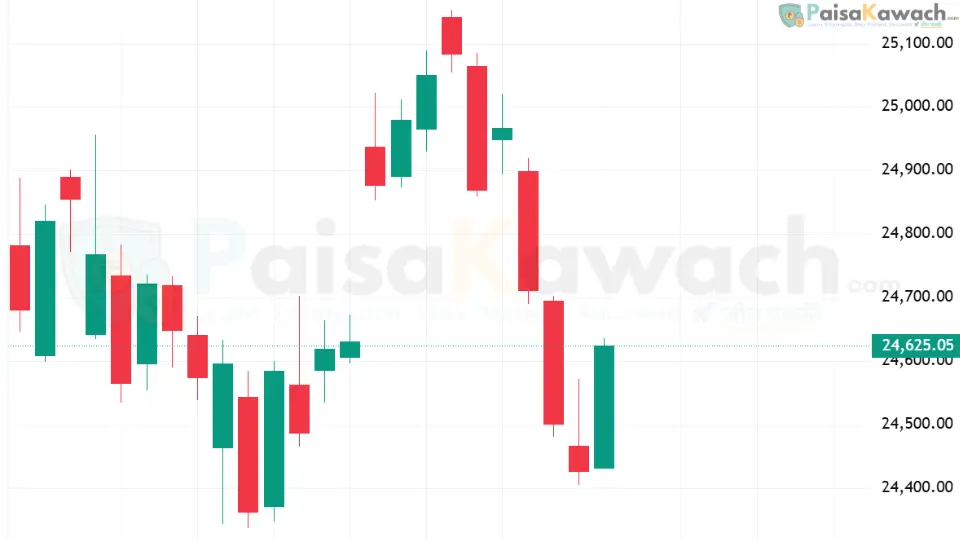

The Nifty 50 index enters September on the back of a shaky performance. On Friday, August 29, the benchmark closed at 24,426.85, slipping 74 points (-0.30%) and extending its losing streak to three consecutive sessions. For traders and investors alike, the big question is whether the index can stabilize above the 24,300 support zone or if the bearish momentum will carry further into the new month.

Recap of the Previous Trading Day

Friday’s session set the tone for caution. Nifty opened at 24,466.70, attempted an intraday high of 24,572.45, but soon lost steam. Selling pressure dragged it to a low of 24,404.70, and the close near the day’s bottom highlighted sustained bearish sentiment.

The candlestick pattern was a large bearish candle with only a minor lower shadow — a clear sign that sellers had control throughout the session, leaving little room for recovery attempts. This continuation pattern often hints at weakness spilling over to the next session unless countered by strong buying activity.

Technical Landscape: Where the Chart Stands

The technical outlook suggests a short-term downtrend. The index has consistently failed to hold above the 25,100–25,200 zone, which acted as a ceiling in August. With three back-to-back red candles, Nifty is displaying early signs of fatigue after its strong July rally.

- Immediate Support: 24,400 – already tested on Friday.

- Major Support: 24,300–24,330 zone – a decisive breakdown could open room toward 24,150–24,200.

- Immediate Resistance: 24,500–24,550 – where sellers have been active recently.

- Major Resistance: 24,650–24,700 – only a sustained move above this can turn sentiment bullish again.

Global Cues Add to the Uncertainty

While technicals set the stage, global market sentiment is providing the background music. Asian stocks slipped this morning amid caution ahead of the U.S. jobs report, which could influence the Federal Reserve’s rate cut decisions. Wall Street closed mixed last week, weighed down by AI chip competition headlines and the ongoing tariff debate in the U.S.

Oil prices softened, reflecting demand concerns, while gold edged higher as investors looked for safe-haven assets. Such risk-off signals suggest that global sentiment is tilted toward caution, which could spill over into Indian markets.

What to Expect in Today’s Session

The first session of September may open slightly weak, reflecting both global headwinds and domestic technical pressure. Much will depend on how the index reacts to the 24,300–24,330 support band.

Possible Scenarios

- Bullish Scenario: If 24,300 holds, expect a bounce back toward 24,500–24,550. Sustaining above 24,550 could trigger short-covering toward 24,650.

- Bearish Scenario: A clean break below 24,300 could see the index tumble quickly toward 24,150–24,200, with sentiment worsening for the week.

- Neutral Scenario: Sideways movement between 24,350–24,550, with traders awaiting clarity from global cues and domestic triggers.

Trader’s Takeaway and Strategy

For intraday traders, risk management will be crucial. The broader structure points to caution, and aggressive long positions may be avoided until Nifty shows signs of stability. Short trades could be considered below 24,300, but with strict stop-losses to avoid whipsaws.

Positional traders may watch for opportunities only above 24,650, as this level would indicate that bulls are back in control. Until then, the market tone remains tilted toward caution, with sellers holding the upper hand.

Conclusion: All Eyes on 24,300

The story of Nifty’s September debut will revolve around a single number: 24,300. This is the line in the sand that separates stability from further weakness. With global markets on edge and technical charts flashing warning signs, traders must stay alert and avoid over-committing on either side. Whether the bulls defend or the bears dominate, today’s session could set the tone for the weeks ahead.