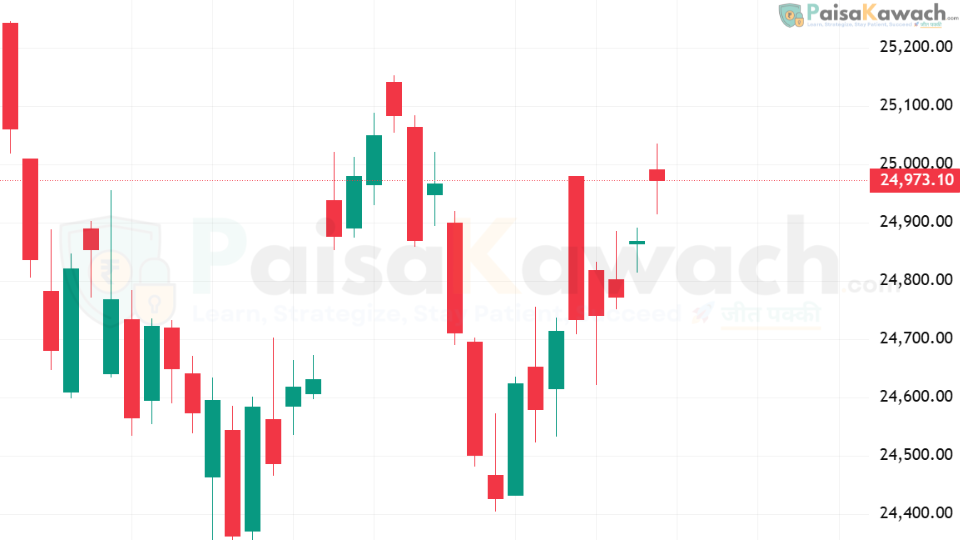

Snapshot — What happened on Monday (15 Sep 2025)

The benchmark Nifty 50 ended the Monday session in the red after short-term profit-taking, failing to hold recent intraday highs above the 25,100 area. Market breadth showed pockets of weakness in IT and cyclical names while some heavyweight financials and energy names were mixed. This left the index poised for a cautious opening on Tuesday, with traders parsing earnings whispers, macro cues and option-market positioning.

Key technical levels to watch for 16 Sep 2025

- Immediate resistance: 25,100–25,160 — recent intraday highs and the area where Monday’s advance stalled.

- Near support: 24,800–24,900 — prior consolidation zone and visible on daily price action as the next area buyers typically defend.

- Momentum trigger: A sustained reclaim of 25,200 on higher volume would favor continuation trades; failure to hold 24,800 increases the odds of a deeper pullback toward the mid-24,000s.

Macro and flow drivers traders should monitor

Global cues

Overnight global sentiment and U.S. futures will matter for the open; thinness in volumes after holiday cycles can exaggerate moves at the open, so watch global bond yields and U.S. equity futures for directional bias.

Domestic catalysts

- Option-market skew and open interest concentration in front-month strikes — heavy put or call accumulation near round numbers can create short-term magnet points for the index.

- Sector rotation: Monday saw profit-taking in IT and autos — a continuation would sap headline strength, while flows into banks, energy or cap goods can offset it.

Stock spotlights: what matters for 16 Sep 2025

Reliance Industries (RIL)

Reliance finished Monday with modest gains and remains a weighty influence on index moves. Short-term traders should watch any follow-through buying above recent intraday highs — RIL’s resilience could underpin the broader market.

- Intraday bias: Bullish above Monday’s high; fade weakness only if it breaks important intraday support on volume.

- Strategy idea: Momentum traders: look for a 1–2% breakout entry with tight stop-loss; swing traders: monitor weekly close for overweight decisions.

Tata Consultancy Services (TCS)

TCS underperformed on Monday, slipping after profit-booking and seeing more put option activity in the derivatives market — the latter can indicate increased hedging or bearish bets. If put flow continues into Tuesday, expect additional short-term pressure; conversely, lack of follow-through could make TCS a mean-reversion candidate.

- Intraday bias: Bearish to neutral — watch whether price holds above the last intra-day lows; supportive breadth is key before re-entering long trades.

- Strategy idea: For intraday traders, prefer short entries on lower-highs with stops above the preceding swing; long trades only after a clean reversal candle and volume confirmation.

HDFC Bank

HDFC Bank showed relative stability around the late-week and Monday session. While its daily moves were muted, bank names tend to lead when flows rotate into financials — a small strength here can support a broader market advance.

- Intraday bias: Neutral-bullish if it holds the 3–5 day moving average band; weakness below that band may invite shorting into lower support levels.

- Strategy idea: Use option-implied moves to size exposure — banks often gap but then mean-revert during low-volume opens.

Tata Technologies and other movers

Corporate actions and M&A headlines can create isolated volatility: Tata Tech’s acquisition news pushed the stock higher on Monday, and such stock-specific moves can briefly skew sector sentiment. Watch for headlines that can create single-stock drivers on Tuesday.

Option market and positioning — one more edge

Derivatives flows are worth watching: elevated put activity at specific strikes in big names (like TCS) can indicate hedging or directional bias and sometimes precedes near-term weakness. Conversely, concentrated call buying near upper round marks can compress the index toward those strikes. Traders should watch open interest changes and large lot trades in the first 30–45 minutes for clues.

Practical trade checklist for 16 Sep 2025

- Confirm opening range (first 15–30 minutes) before deploying significant capital.

- Respect the 24,800 support / 25,100 resistance band — trade breakouts with volume confirmation or fade with tight stops.

- If global futures are weak, bias toward protective positions and favor cash or low-beta names until clarity returns.

- Use options to hedge concentrated portfolios — short-dated instruments are cheaper for near-term risk control.

- Watch news flow for large corporate announcements (M&A, regulatory) that can skew single-stock moves.

What could change the thesis quickly?

- Unexpected macro prints (inflation, RBI commentary) or global risk events — these can flip intraday bias.

- Disproportionate options gamma rebalancing around key strikes — can exaggerate moves near expiry days.

- Breaking headlines around the heavyweight names (RIL, HDFC Bank, TCS) that change institutional positioning.