As trading resumes on Monday, August 25, 2025, Indian equity benchmarks will open after a sharp decline in the previous session. Both the Nifty 50 and the Sensex faced heavy profit booking on Friday, leaving investors watchful of whether the new week begins with further selling or a consolidation attempt near critical supports.

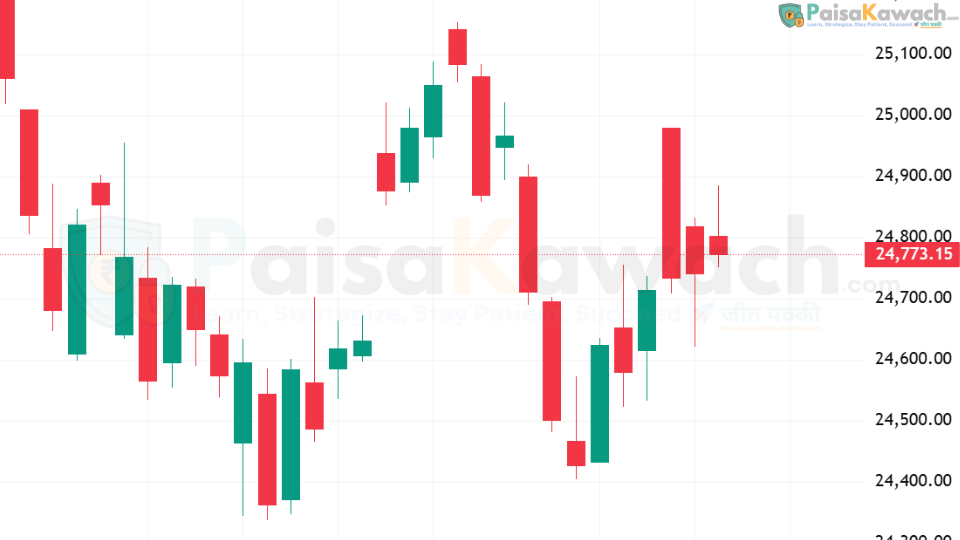

Nifty 50 Forecast Today

The Nifty 50 closed Friday at 24,870.10, slipping by 213 points or 0.85%. The index formed a strong bearish candle, rejecting levels above 25,000. For today’s session, traders will closely watch if Nifty can stabilize above the 24,700–24,500 zone.

Possible Scenarios for Nifty 50 on August 25

- If Nifty holds above 24,700, a recovery towards 25,000–25,100 is possible.

- Failure to defend 24,700 could drag the index towards 24,500 and even 24,350.

- Momentum indicators suggest sideways-to-weak bias unless bulls regain 25,200 decisively.

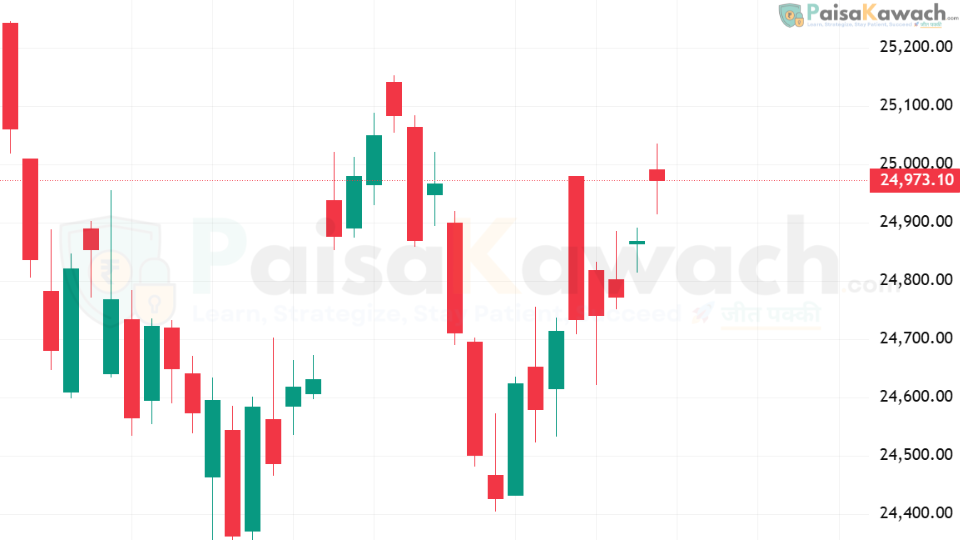

Sensex Forecast Today

The S&P BSE Sensex ended last week at 81,306.85, down 693 points or 0.85%. The index also posted a bearish reversal, with 82,000 emerging as a strong near-term barrier. Today, the focus will be on whether Sensex can maintain levels above 81,000.

Possible Scenarios for Sensex on August 25

- Above 81,000, Sensex could attempt a rebound towards 81,800–82,000.

- Below 81,000, weakness may extend to 80,500 and 80,250.

- Short-term trend remains cautious; fresh bullish momentum only above 82,500.

Market Sentiment for the Week

Global cues, crude oil swings, and foreign institutional investor (FII) flows will likely dictate early trade this week. After two weeks of gains, the correction seen on Friday suggests the market may consolidate in a range before attempting fresh highs. Traders should remain alert to volatility around key support zones.

Conclusion

For August 25, 2025, both the Nifty 50 and Sensex enter the day with a defensive outlook. Holding 24,700 on Nifty and 81,000 on Sensex will be vital for bulls to retain control. A slip below these levels could open the door for further profit booking, while stability above may encourage selective buying in large-cap stocks.