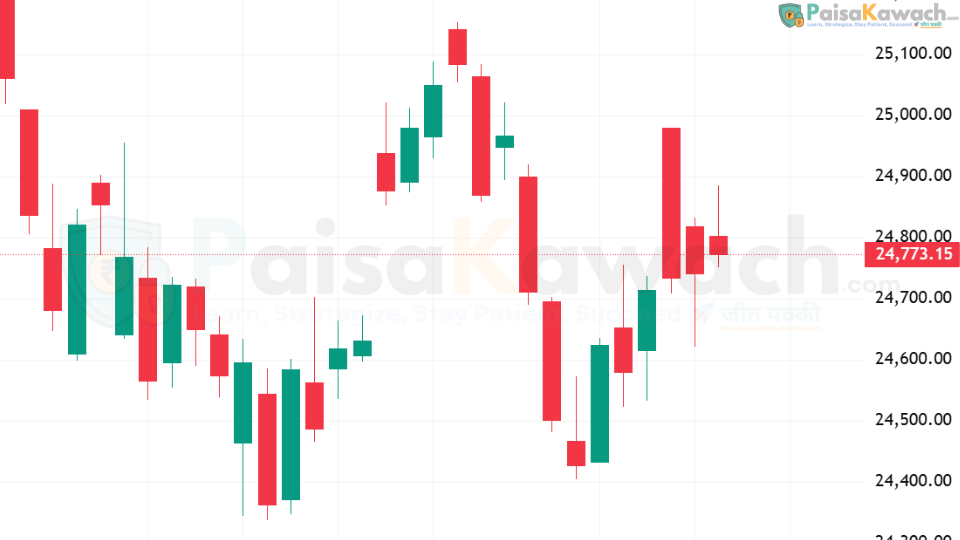

The Nifty 50 index closed modestly higher around 24,773, after staging a recovery from the crucial 24,400 support zone. This bounce has reinforced confidence that buyers are gradually returning at lower levels, helping the market establish a temporary base. Such price action often signals the start of a stabilisation phase where the index consolidates before choosing its next directional move. For traders, the current setup reflects a market trying to balance optimism from global cues with caution around domestic resistance levels, creating a tug-of-war that keeps volatility moderate.

Key Factors Shaping Today’s Trading Landscape

Global Cues & Rate Cut Optimism

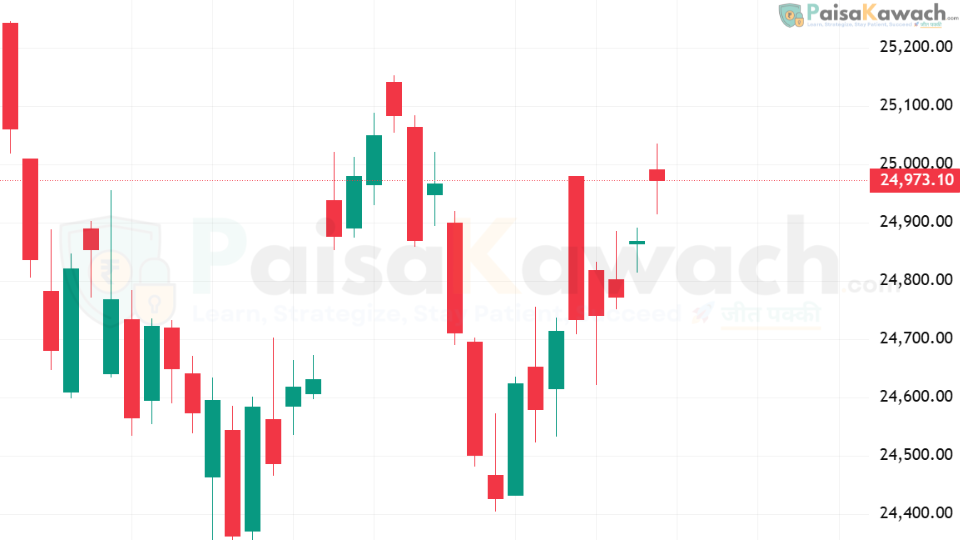

Investor sentiment continues to be influenced by expectations of a U.S. Federal Reserve rate cut, which has improved appetite for equities in emerging markets like India. GIFT Nifty futures were seen hovering near 24,950, pointing to a potentially upbeat start to the session. A supportive global backdrop—driven by easing U.S. bond yields and resilience in Asian peers—adds weight to the possibility of buyers attempting to retest higher levels in the Nifty. However, much will depend on whether foreign institutional investors (FIIs) sustain inflows in the coming sessions.

Range Bound Zone with Thick Resistance

While the recovery from 24,400 is a constructive signal, analysts are cautious about the index’s ability to cross the 25,000 mark convincingly. That round figure remains a strong resistance zone, where profit-booking and supply pressures have emerged in past attempts. Until a decisive breakout occurs, market participants expect the Nifty to remain confined to a tight trading band between 24,700 and 24,900. This kind of consolidation phase is common after a steep correction, as buyers and sellers battle for control before a new trend emerges.

Intraday Peaks Expected on September 10

Time-based market studies are hinting at September 10 as a potential high-momentum date for the index. Analysts believe intraday price swings could intensify on that day, offering trading opportunities for short-term participants. Such timing clusters are closely monitored by professional traders since they often coincide with shifts in liquidity, volatility spikes, or reactions to global economic data. A move beyond the consolidation range on or around this date could set the tone for the rest of the month.

Forecast: Probabilities & Trading Outlook

Based on current technical and global signals, the trading outlook for the Nifty 50 can be mapped into three broad scenarios:

- 50% probability: The index continues to consolidate in the 24,700–24,900 range as traders remain hesitant near resistance. This would imply subdued volatility and sideways movement.

- 30% probability: An upside breakout above 24,950 occurs, led by positive global sentiment, strong FIIs inflows, or domestic triggers. Such a breakout could quickly lift the index towards the 25,100–25,250 band.

- 20% probability: A downside slip back to 24,400 happens if negative macroeconomic data surfaces or if FIIs resume heavy selling. In such a case, sentiment may weaken again, though strong buying interest is expected near support.

Suggested Strategies for Traders

In a market that is leaning toward range-bound behaviour, options traders may find it effective to deploy a short strangle strategy. By selling out-of-the-money call and put options, traders can benefit from Theta decay as long as the index remains within the expected band. This strategy is best suited for low-volatility environments but should be managed with strict stop-losses in case of an unexpected breakout.

Stocks in Focus Today

Alongside index movements, several stock-specific developments are expected to influence sentiment:

- Infosys – The IT major is set to consider a share buyback on September 11. Any positive announcement may provide an uplift to the stock, with ripple effects on the overall IT index and Nifty weightage.

- RailTel – The company has secured a ₹2.62 billion contract from the Bihar Education Project Council, a development that could boost revenue visibility and attract fresh investor interest.

- TVS Motor – The automaker announced it will pass on GST rate cuts to customers starting September 22. This decision may drive stronger demand momentum in the two-wheeler segment during the festive season.

Conclusion

The Nifty 50 is currently in a phase of cautious stability, holding ground above its recent lows but struggling to breach upper resistance near 25,000. For traders, the immediate outlook points to consolidation with a watchful eye on September 10 as a potential turning point. Meanwhile, stock-specific news in Infosys, RailTel, and TVS Motor could provide selective opportunities even if the index trades sideways. Investors are advised to remain nimble, respect support and resistance zones, and prepare for a possible breakout if global momentum strengthens.