In a major regulatory shift, the Securities and Exchange Board of India (SEBI) is weighing the introduction of an “automatic window” for Foreign Portfolio Investors (FPIs). The proposed framework is designed to simplify registration, reduce compliance burdens, and attract much-needed overseas capital into Indian markets. For India, which is positioning itself as one of the world’s fastest-growing economies, this move could significantly strengthen its global investment appeal at a time when capital is becoming increasingly selective and competitive.

Why SEBI Is Considering This Move

Over the past year, foreign portfolio investment in India has seen a slowdown. According to market analysts, global uncertainty surrounding interest rate cycles, inflation, and geopolitical tensions has led to tighter capital flows. In addition, India’s multi-step compliance process and rigorous documentation requirements have discouraged many short- and medium-term foreign investors from entering its markets.

By proposing a smoother entry mechanism, SEBI is aiming to remove one of the biggest pain points for global investors: red tape. Simplified access would not only revive investor confidence but also ensure India remains competitive compared to other emerging markets such as Indonesia, Vietnam, and Brazil, all of which are aggressively seeking foreign inflows.

What the Automatic Window Means for FPIs

Simplified Registration

At present, registering as an FPI in India involves multiple stages — from local custodian engagement to KYC compliance and Reserve Bank of India approvals. This often results in long wait times before capital can actually be deployed. The proposed automatic window would digitize much of this process, enabling investors to gain access within days rather than weeks or months. For global funds that move billions of dollars daily across markets, this speed matters greatly in decision-making.

Reduced Compliance Pressure

Ongoing compliance has also been a stumbling block for many FPIs. Currently, periodic reporting and regulatory filings require significant time and manpower. The new framework could streamline these obligations, reducing repetitive tasks and allowing investors to focus on portfolio performance rather than paperwork. Importantly, while easing procedures, SEBI is also expected to maintain safeguards to prevent misuse and ensure transparency.

Impact on Indian Markets

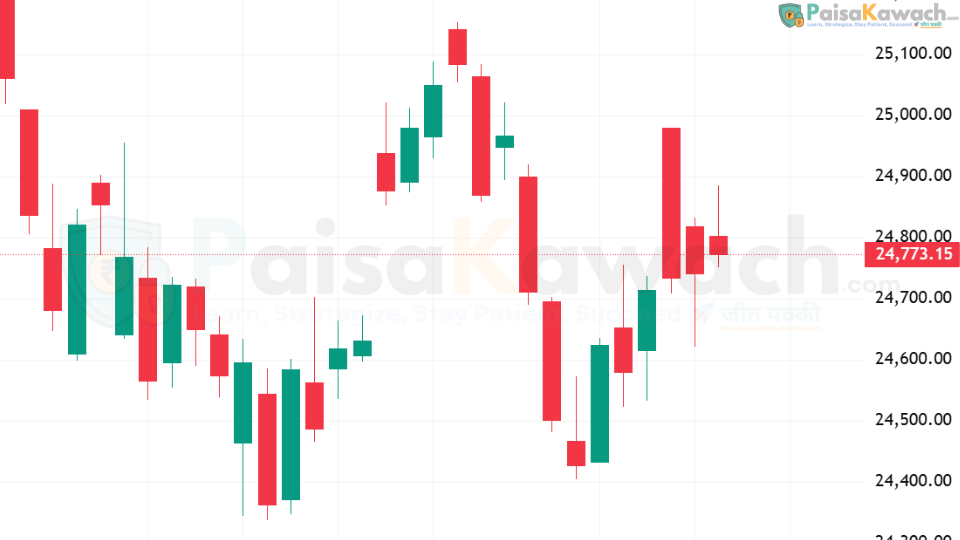

Analysts believe this reform could be a game-changer for liquidity in both equity and debt markets. Increased participation from FPIs would mean deeper order books, reduced volatility, and stronger price discovery. In the equity space, higher FPI inflows could lift mid-cap and small-cap stocks, which often struggle with thin volumes. On the debt side, easier access could support India’s ambitions to be included in global bond indices — a move that would unlock billions of dollars in passive fund flows.

For the Indian economy, higher FPI inflows would mean additional foreign exchange reserves, reduced external vulnerabilities, and stronger support for capital-intensive sectors like infrastructure, energy, and technology. This, in turn, would help finance India’s ambitious growth plans for the next decade.

Global Implications

From a global perspective, SEBI’s proposal reflects the shifting dynamics of cross-border capital. With developed markets like the U.S. and Europe offering lower yields due to anticipated interest rate cuts, international investors are actively seeking growth opportunities in emerging markets. By lowering entry barriers, India is signaling to global funds that it intends to be at the forefront of this capital reallocation.

For multinational funds, sovereign wealth funds, and global pension managers, India’s automatic FPI window could become a blueprint for how other emerging economies streamline foreign investment. If executed well, it could enhance India’s reputation as a stable and investor-friendly destination — critical in a world where global money managers constantly weigh risk against reward.

Looking Ahead

While SEBI has not yet provided a definitive timeline for implementation, the very fact that such a reform is on the table is already boosting market sentiment. Investors and market observers are watching closely to see how the balance between ease of access and regulatory safeguards is maintained.

If successful, this automatic window could become one of the most transformative reforms in India’s financial landscape, aligning domestic capital markets with global best practices and ensuring that the country remains a magnet for foreign capital in the years to come.