Why Infosys’ Earnings Matter to Global Markets

Infosys delivered a strong earnings performance in its latest quarterly results, accompanied by an upward revision to its revenue growth guidance. The announcement immediately lifted sentiment across technology stocks, as investors interpreted the improved outlook as a sign of stabilising global IT spending after a prolonged period of caution.

As one of the world’s largest IT services companies, Infosys is widely seen as a bellwether for enterprise technology demand. Its earnings are closely tracked not only in India but also by global investors seeking insight into corporate spending trends in the United States, Europe, and other key markets.

Earnings Snapshot

- Performance: Better-than-expected quarterly earnings

- Guidance: Revenue forecast revised upward

- Market Reaction: Positive sentiment across IT stocks

- Key Signal: Improving client demand visibility

- Broader Impact: Global tech services outlook strengthened

Stronger Results Signal Improving Demand Environment

The improved earnings performance reflects stabilising client budgets, particularly in key markets such as North America and Europe. After several quarters of cautious discretionary spending, enterprises appear more willing to resume technology investments, especially in areas linked to efficiency, automation, and digital transformation.

Management commentary pointing to better deal pipelines and improved execution added to investor confidence. The revised revenue outlook suggests that demand conditions, while still selective, are no longer deteriorating and may be entering a gradual recovery phase.

Impact on Technology Stocks and Market Sentiment

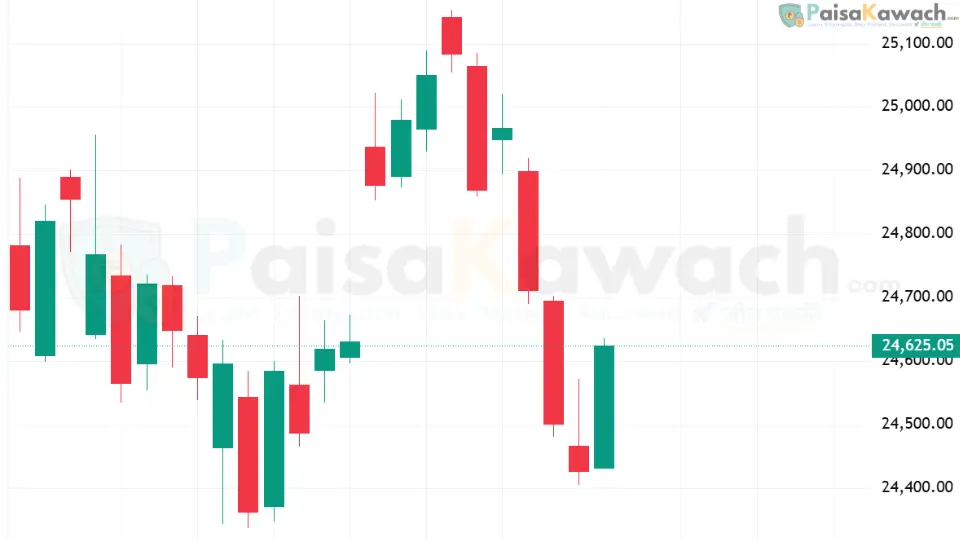

Technology stocks responded positively following the results, with IT services companies gaining as investors reassessed earnings risk across the sector. Infosys’ guidance upgrade helped ease concerns about prolonged weakness in outsourcing demand and margin pressure.

For global markets, the earnings update reinforced the view that large-cap technology services firms are better positioned to navigate uncertain macro conditions due to diversified client bases and long-term contracts.

How Infosys Compares With Global IT Peers

Compared with several global peers, Infosys’ results stood out for their clarity on demand visibility. While some international IT firms continue to signal cautious outlooks, the revised forecast suggests relatively stronger execution and resilience.

This divergence highlights the competitive advantage of firms with strong exposure to cost-optimization deals and long-term digital programs, which remain priorities for global enterprises even in a high-interest-rate environment.

What This Means for Investors

For investors, the earnings update provides reassurance that the worst of the earnings downgrade cycle in IT services may be over. Improved guidance supports valuations and reduces downside risk, particularly for large-cap technology stocks.

However, analysts continue to advise selectivity, noting that while demand is stabilising, growth is likely to remain uneven across geographies and service lines.

What to Watch Next

Market participants will closely track earnings from other global and Indian IT majors to see whether the positive trend is sector-wide. Key factors to watch include client spending commentary, margin trends, and the pace of deal conversions.

According to BBC, technology spending remains a critical indicator of broader business confidence, making upcoming earnings reports across the sector particularly important for global markets.

For now, Infosys’ performance has provided a timely boost to technology stocks, supporting the narrative of gradual recovery rather than prolonged slowdown.