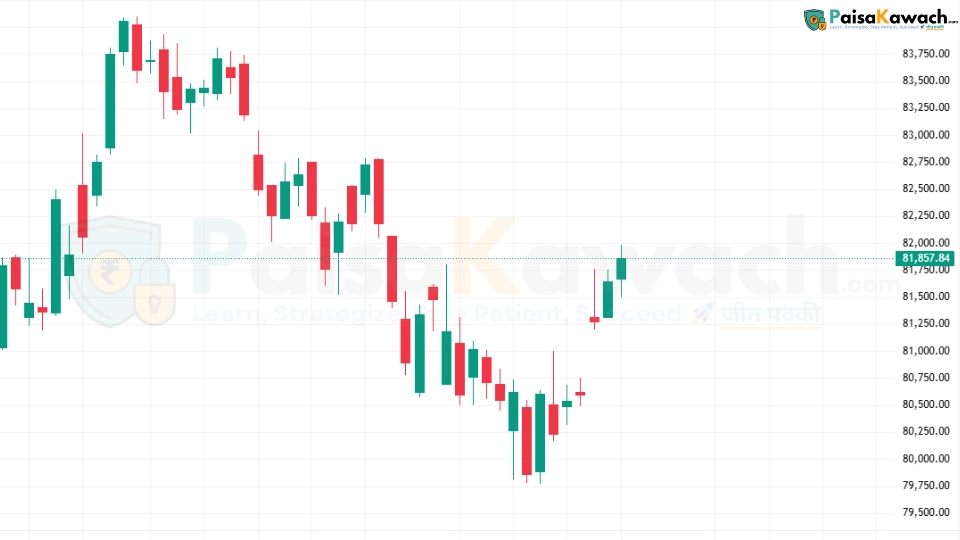

Global Context Sets the Tone for Indian Markets

Indian equity markets head into the January 19, 2026 session with a measured global backdrop. Overnight developments in the US and early trends across Asian markets point to restrained risk appetite rather than directional conviction. While volatility remains contained, the absence of strong global momentum keeps sentiment guarded.

US equities ended the previous session marginally lower, reflecting selective pressure from earnings-related flows and macro positioning. Bond markets and currency indicators remained largely stable, offering no clear directional signal for emerging markets such as India.

Global Market Snapshot

- US equities closed slightly lower with limited follow-through selling.

- US 10-year bond yields held steady near recent ranges.

- Dollar index softened modestly, easing external pressure on EM currencies.

- Asian markets opened mixed, with weakness in Japan and Hong Kong.

Overnight US Markets: Consolidation Dominates

Wall Street indices ended the session with mild declines, reflecting consolidation rather than broad-based risk aversion. The S&P 500 and Nasdaq hovered close to flat, while the Dow Jones Industrial Average saw marginal underperformance. Market participants appeared cautious ahead of further macro and earnings clarity.

Importantly, volatility indicators remained calm, suggesting that risk appetite has not deteriorated sharply despite headline uncertainties. This environment typically translates into selective participation rather than aggressive positioning in global equities.

Asian Markets: Mixed Signals in Early Trade

Early Asian sessions provided no uniform lead. Japan’s Nikkei traded on the back foot, while Hong Kong equities also showed early weakness. In contrast, mainland Chinese markets were relatively stable, supported by expectations of policy continuity.

For Indian markets, such divergence across Asia often results in a stock-specific approach, with domestic factors playing a larger role than regional momentum.

What This Means for Indian Markets

The current global setup suggests a cautious-to-neutral sentiment bias for Indian equities. Stable bond yields and a softer dollar are supportive on the margin, but the lack of strong global risk-on cues limits the scope for broad-based upside.

Market behavior is likely to remain range-bound, with intraday moves driven by sector-specific flows, corporate updates, and local institutional activity rather than global triggers alone.

Sector View: India Versus Global Peers

Compared with other Asian peers, Indian markets continue to display relative resilience, supported by domestic liquidity and structural growth expectations. However, in the absence of positive global confirmation, high-beta sectors may see restrained participation, while defensives and stock-specific themes could attract attention.

Key Global Trigger in Focus

Renewed global tariff-related rhetoric from the US has resurfaced as a macro overhang. While not directly India-specific at this stage, such developments tend to influence global risk sentiment and capital flows, making them relevant for emerging markets.

What to Watch Next

As the session unfolds, participants are likely to monitor global bond yield movements, currency stability, and any incremental cues from international markets. Upcoming macro data releases and ongoing corporate developments will also shape near-term market tone.