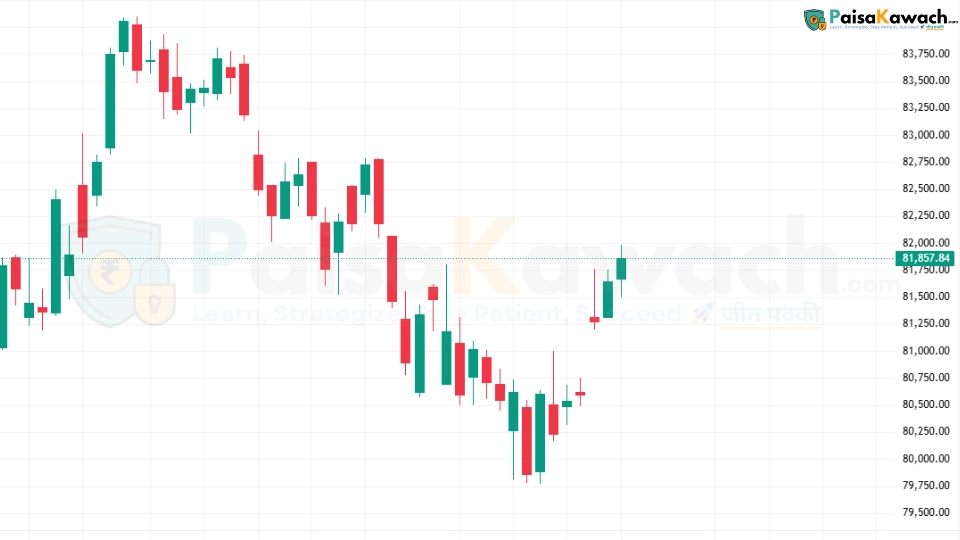

Following yesterday's trading session, the BSE Sensex closed at 81,857.84, marking a modest gain of +213 points (+0.26%). After a period of consolidation and minor corrections in early August, the index has shown signs of resilience, hinting at a potential continuation of the recovery trend today.

Market Overview

The Sensex experienced a series of red candles in the second half of July, reflecting selling pressure and profit-booking. However, recent green candles indicate that buyers are gradually returning, particularly in banking, IT, and consumer durable sectors. Analysts suggest that this recovery is supported by positive macroeconomic indicators and easing global cues.

Key Support and Resistance Levels

- Immediate support: 81,500 – a level where recent consolidation occurred.

- Immediate resistance: 82,000 – a psychological barrier that traders are watching closely.

- Major support: 81,000 – below this, the market may test lower consolidation zones.

Sectoral Insights

Banking and IT stocks have shown relative strength, contributing significantly to the index's upward momentum. Consumer durable stocks also recorded moderate gains as investor sentiment improves. Market participants are advised to monitor sector rotation for potential intraday opportunities.

Technical Outlook

From a technical perspective, the recent upward movement indicates that the Sensex might attempt to break past the 82,000 resistance if buying momentum sustains. Short-term traders may look for buying opportunities near the support zones of 81,500-81,600, with cautious stop-loss placement.

Investor Sentiment

Market sentiment remains cautiously optimistic. While domestic indices show resilience, global markets and macroeconomic developments may influence intraday volatility. Analysts recommend a balanced approach, focusing on fundamentally strong stocks while avoiding over-leveraged positions.