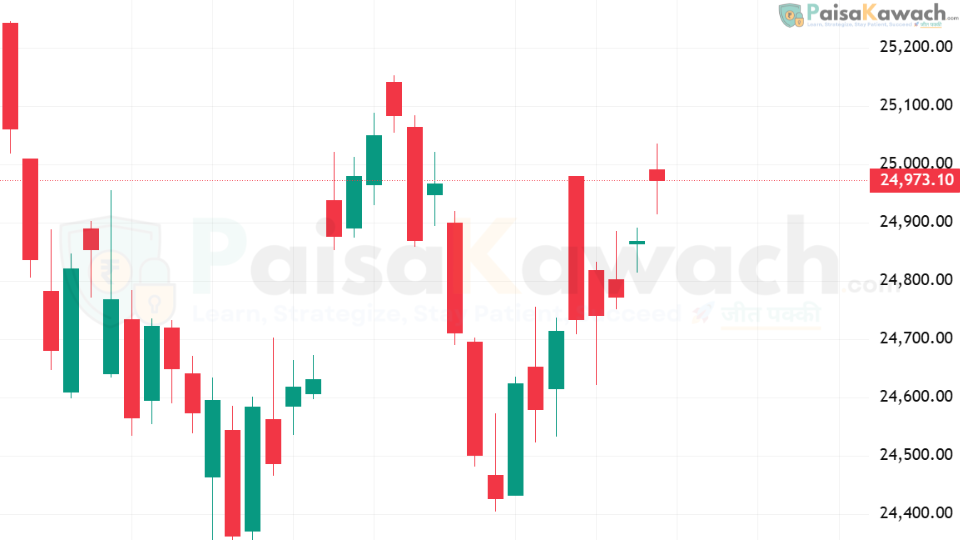

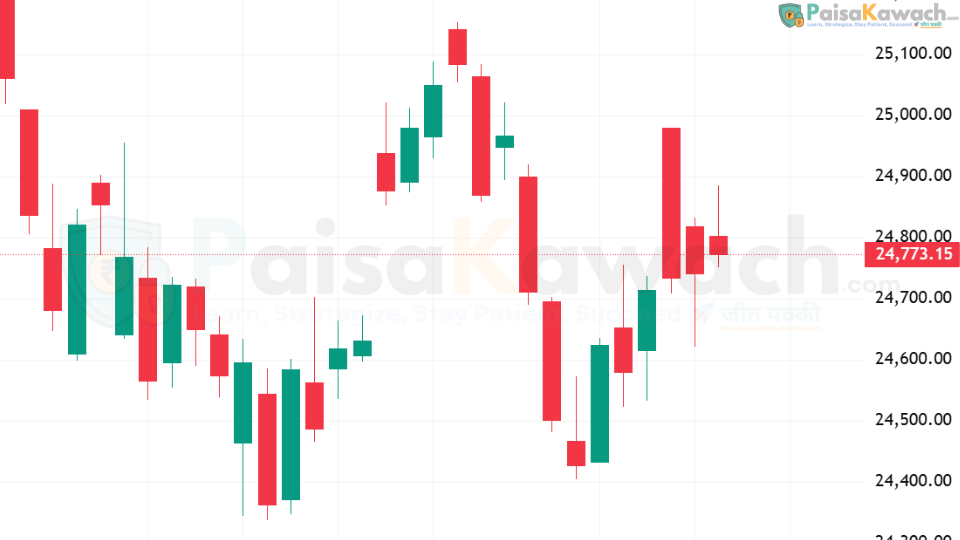

Nifty 50 Recap: September 18, 2025

The Nifty 50 index ended Thursday’s session on a firm note, settling at 25,423.60, up by 93.35 points (+0.37%). The market witnessed strong upward momentum for the fourth consecutive day, supported by buying in banking, IT, and FMCG stocks. The day’s range remained between 25,329.75 (low) and 25,448.95 (high), indicating a strong bullish grip ahead of the weekend session.

Global and Domestic Cues

- US markets ended mixed as traders remained cautious before the upcoming Federal Reserve commentary.

- Crude oil prices stabilized near $82 per barrel, reducing inflationary concerns for India.

- Rupee held steady against the dollar, boosting investor confidence in foreign inflows.

- FIIs turned net buyers, signaling renewed optimism in emerging markets.

Nifty 50 Forecast for September 19, 2025

Going into today’s session, Nifty is expected to open on a positive note with strong support from global stability. Technical charts indicate a bullish bias, though profit-booking at higher levels cannot be ruled out.

Key Levels to Watch

- Support Levels: 25,280 – 25,150

- Resistance Levels: 25,500 – 25,620

- Immediate Trend: Positive as long as Nifty trades above 25,280

Sectoral Outlook

Banking and IT may continue to lead the rally, while auto stocks could see mild consolidation. Midcap and smallcap indices are expected to remain volatile with stock-specific movements dominating.

Trading Strategy for the Day

- Buy on dips near 25,300 with a stop-loss below 25,150.

- Short-term traders may book partial profits near 25,500–25,600 levels.

- Long-term investors should continue to accumulate quality stocks as market breadth remains strong.