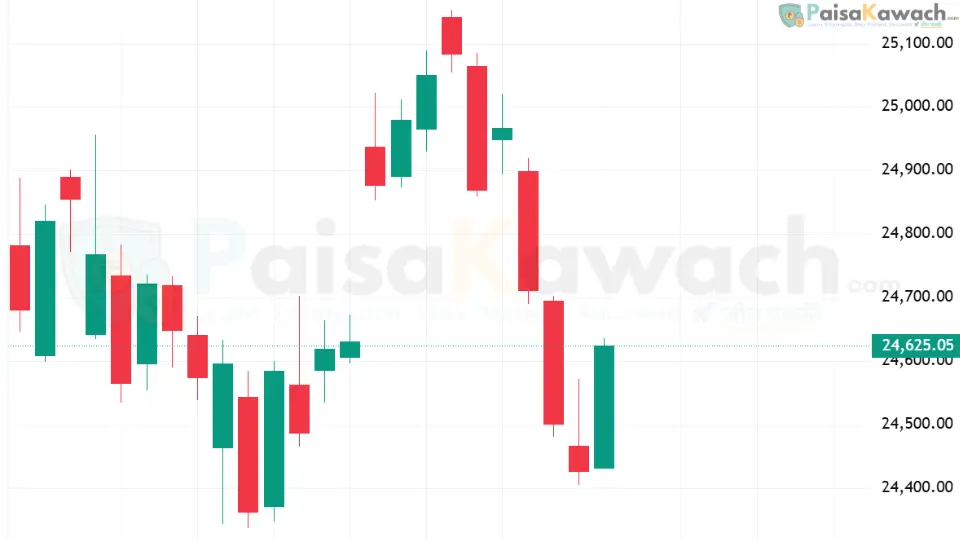

The Nifty 50 index witnessed a sharp decline on Tuesday, closing at 24,712.05, down by 255.70 points (-1.02%). The session was marked by heavier-than-usual volumes at 750M+, signaling strong institutional participation on the sell side. The index tested intraday lows of 24,689, wiping out the recent recovery seen earlier this month.

Key Market Drivers

Market analysts attributed the decline to a mix of global and domestic factors, including:

- Weak cues from US and Asian equity markets amid recession fears.

- Heavy profit booking in frontline stocks after a brief rally.

- Sharp sell-off in banking and IT sectors leading the fall.

- Rising bond yields and cautious stance ahead of macroeconomic data releases.

Forecast for August 28, 2025 Opening

Given the strong downside momentum and heavy volume-based selling, the Nifty 50 is expected to open flat to slightly lower on Thursday, August 28, 2025. The short-term trend appears cautious-to-bearish, with downside support seen near 24,600 levels, while resistance is expected around 24,950–25,000.

Levels to Watch on August 28

- Support Zone: 24,600 – 24,500

- Resistance Zone: 24,950 – 25,100

- Sentiment: Cautious with a bearish bias

Investor Outlook

For medium-term investors, analysts advise a selective approach, focusing on defensive sectors such as FMCG and pharma, while traders may look for opportunities in volatility through options strategies. With global markets on edge, domestic equities are likely to remain range-bound with a downside tilt in the near term.