After a volatile session yesterday, Nifty 50 ended on a positive note, closing at 25,050.55, up 69.90 points (+0.28%). The index witnessed a strong rebound from its recent lows around 24,930, indicating early signs of recovery and short-term bullish momentum. Traders should focus on key technical levels and intraday market sentiment to navigate today’s trading session effectively.

Yesterday’s Market Recap

- The index opened at 24,965.80 and reached a high of 25,088.70 during the session.

- Despite early volatility, bulls regained control, pushing the index above the previous day’s closing levels.

- Trading volume remained moderate, with notable buying interest near support zones around 24,930–24,950.

- Several sectors, including IT and banking, contributed to the upward momentum.

Technical Analysis for Today

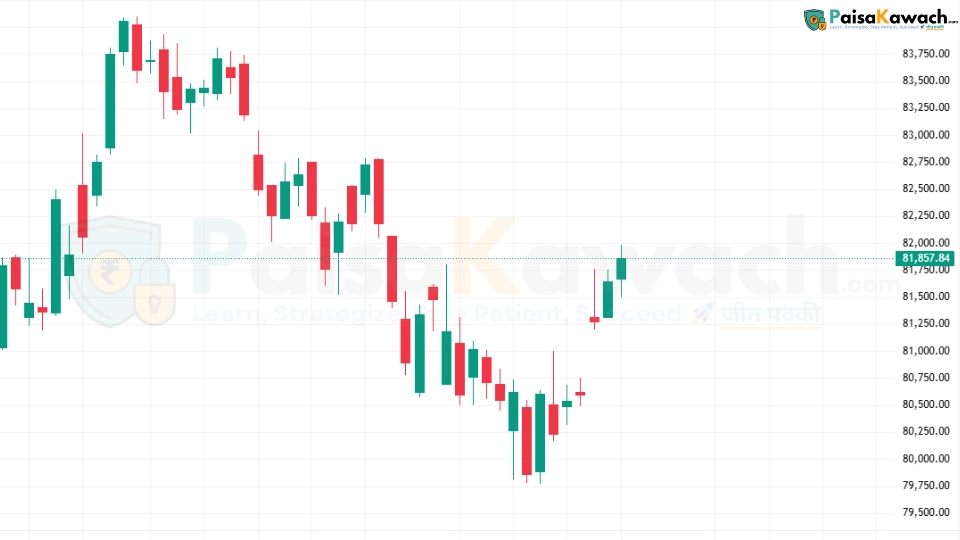

Based on yesterday’s candlestick pattern and recent price action, Nifty 50 shows potential for further upside while remaining cautious near key resistance zones.

- Support Levels: 24,930 (recent swing low), 24,850 (critical short-term support)

- Resistance Levels: 25,100 (intraday target), 25,200 (next key hurdle)

- Trend Analysis: The index shows a short-term bullish reversal after forming a series of higher lows since early August.

- Momentum Indicators: RSI and MACD signals suggest moderate bullish momentum, supporting potential intraday gains.

Trading Strategies for 21 August 2025

- Intraday traders can monitor 24,930–25,100 range for quick momentum trades.

- Swing traders may look for a breakout above 25,100 with volume confirmation to enter long positions targeting 25,200–25,250.

- Stop-loss levels should be kept below 24,930 to manage downside risk effectively.

- Conservative traders might wait for a clear trend confirmation before taking positions.

Conclusion

Nifty 50 shows early signs of recovery, suggesting a cautiously bullish day ahead. Key levels at 25,100 and 24,930 will determine market direction, and traders are advised to combine technical signals with volume trends for more precise entry and exit points.