The Nifty 50 closed at 24,715.05 on 3 September 2025, ending higher by 135 points (+0.55%). The momentum came on the back of broad sectoral gains and optimism after the GST Council announced sweeping tax changes. With GIFT Nifty futures trading nearly 150 points higher in pre-market, analysts expect a positive start for the session on 4 September 2025.

Key Drivers of Today’s Rally

GST Rate Cuts Spark Optimism

The government’s decision to restructure the GST slabs has triggered a wave of optimism in equities. Essential goods such as toiletries saw their tax rate cut from 18% to 5%, while small cars, televisions, and air conditioners dropped from 28% to 18%. Health and life insurance were exempted from GST altogether. On the other hand, high-end luxury goods were placed under a 40% tax slab. These changes are expected to boost consumption and add momentum to GDP growth in the coming quarters.

Pre-Market Trends

Pre-market indicators show a strong upside bias, with futures pointing to a gap-up opening. Market participants are focusing on sectors such as auto, consumer durables, FMCG, and metals, which stand to benefit directly from the GST reforms. Broader investor sentiment remains upbeat heading into the festive season.

Domestic Strength Offsets FPI Outflows

Despite continuous selling by foreign portfolio investors, domestic institutions and retail participants are providing stability. This resilience reflects the growing maturity of India’s capital markets, reducing their dependence on overseas flows for direction.

Technical Levels to Watch

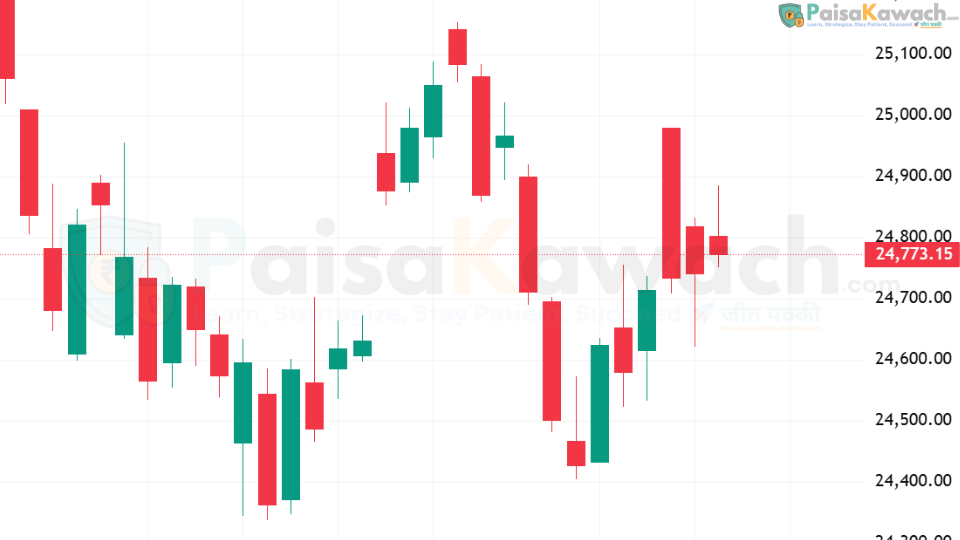

- Immediate Resistance: 24,750; a breakout above this level may open the way toward 24,850–24,900.

- Support Zone: 24,600–24,500; any fall below this range could push the index down toward 24,400.

- Broader Range: Analysts expect Nifty to trade between 24,500 and 24,900 during the session.

Trading Playbook for 4 September 2025

Conclusion

On 4 September 2025, the Nifty 50 is poised for a bullish continuation. Tax reforms, stronger domestic participation, and favorable pre-market signals are supporting investor sentiment. While 24,600 remains a crucial support zone, resistance around 24,850–24,900 will be closely watched. A sustained breakout above these levels could take the index toward the landmark 25,000 mark, cementing India’s equity market strength during a key festive period.