Pre-Market Context: Why Today’s Structure Matters

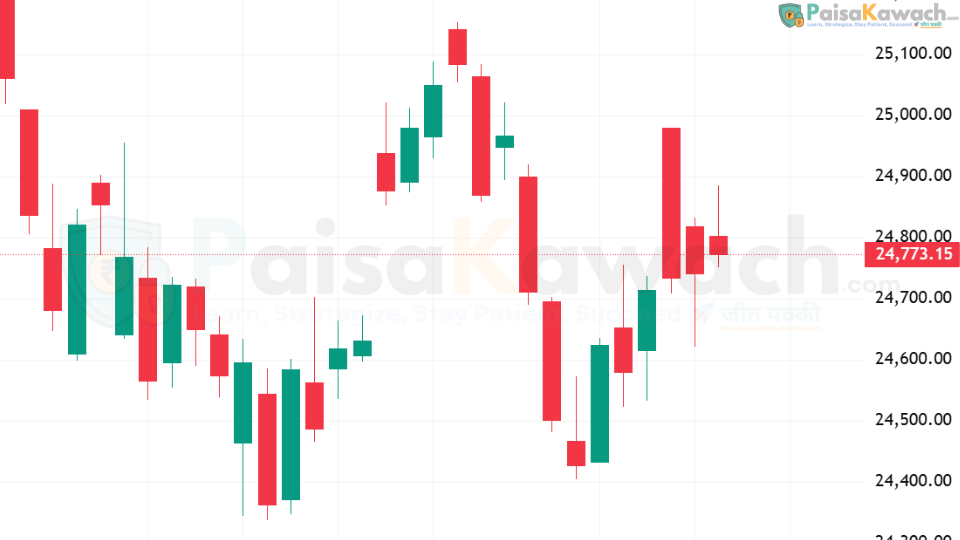

Indian equities enter the February 6, 2026 session with the NIFTY 50 reflecting a state of balance rather than directional conviction. Recent price action has transitioned from earlier momentum into rotational trade, highlighting a market focused on value assessment. This context is important as it frames expectations around volatility behavior, participation quality, and the nature of intraday moves.

Pre-Market Snapshot

- Market State: Balanced, range-oriented structure

- Volatility: Contained and stable

- Participation: Selective, stock-specific flows

- Bias: Neutral with acceptance-driven behavior

Market Structure and Price Behavior

The NIFTY 50’s recent sessions show clear signs of acceptance and rejection operating within a defined framework. Upside attempts have faced supply-led hesitation, while downside probes have attracted responsive participation without accelerating. This two-sided interaction reflects equilibrium rather than trend development.

Volatility and Acceptance Dynamics

Volatility has moderated compared to earlier phases, suggesting reduced urgency from institutional participants. Such conditions often accompany periods where larger players wait for clearer acceptance before reallocating risk.

What This Means for Market Participants

A balanced structure shifts emphasis away from directional assumptions. Market participants tend to focus more on execution quality, relative strength, and responsiveness around reference areas during such phases.

Sector and Peer Comparison

Compared with several global equity benchmarks, Indian markets continue to display relatively contained volatility. This contrasts with sharper fluctuations seen in select US technology indices, underscoring India’s comparatively stable structural posture in the near term.

Global Cues and External Backdrop

Overnight global markets delivered mixed signals, with cautious sentiment prevailing across major regions. According to Reuters, investors globally remain focused on growth sustainability and policy clarity, contributing to restrained risk-taking.

What to Watch Next

As the session unfolds, attention is likely to center on whether price continues to respect the established balance zone or begins to show signs of acceptance beyond it. Any shift in volatility or participation breadth may provide additional structural insight.

Market Insight: Balanced conditions often precede structural resolution, but until acceptance expands, price behavior remains evaluation-driven.