What Happened and Why It Matters

Shares of State Bank of India (SBI), the country’s largest public sector lender, moved sharply higher after the bank reported its strongest-ever quarterly profit, supported by robust loan growth and steady improvement in asset quality. The result reinforced confidence in India’s banking cycle at a time when investors are closely watching credit demand, margins, and balance-sheet strength.

The rally in SBI stock had a wider impact on Dalal Street, with public sector banks outperforming the broader market. As a heavyweight stock in benchmark indices, SBI’s performance often sets the tone for banking sentiment as a whole.

Key Performance Snapshot

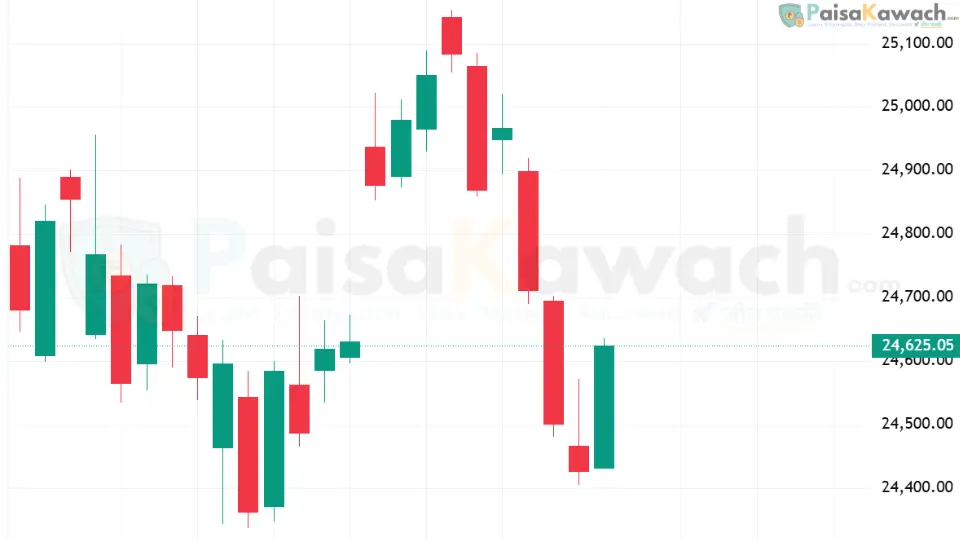

SBIN — Daily Price Chart

Last updated: 10 Feb 2026- Quarterly Profit: Record high for the bank

- Loan Growth: Strong year-on-year expansion across retail and corporate segments

- Asset Quality: Stable to improving, with controlled slippages

- Market Reaction: SBI shares surged, boosting PSU bank stocks

- Sector Impact: Banking index gained on improved sentiment

What Drove SBI’s Record Performance

Strong Credit Demand

SBI benefited from sustained loan growth across key segments, including retail, MSME, and corporate lending. Healthy demand from infrastructure-linked projects and consumer loans helped the bank maintain growth momentum despite a competitive interest-rate environment.

Operational Efficiency and Asset Quality

Improved recoveries, disciplined underwriting, and better control over fresh non-performing assets supported profitability. Stable net interest margins and controlled credit costs further strengthened earnings visibility.

Impact on Investors and Markets

The sharp rise in SBI shares had a ripple effect across public sector banks, many of which moved higher in tandem. For investors, SBI’s results reinforced the view that PSU banks are no longer just turnaround stories but are emerging as steady compounders with improving return ratios.

Because SBI carries significant weight in the Nifty Bank and broader indices, its rally also provided support to overall market sentiment during the session.

How SBI Compares With Peers

Compared with other large public sector lenders, SBI continues to enjoy scale advantages, diversified revenue streams, and stronger capital buffers. While several PSU banks have reported improving profits, SBI’s size and consistency set it apart.

Private sector banks remain strong competitors in terms of efficiency and margins, but SBI’s recent performance has narrowed the perception gap, particularly in asset quality and growth sustainability.

Outlook: What to Watch Next

Going ahead, investors will track SBI’s ability to sustain loan growth without compromising asset quality, especially if interest rates remain elevated or credit conditions tighten. Commentary on margins, deposit growth, and capital allocation will be closely watched in upcoming quarters.

Broader trends in government spending, infrastructure financing, and retail credit demand are also expected to influence SBI’s medium-term trajectory.

According to Reuters, the strong quarterly performance has renewed interest in PSU banking stocks, with analysts highlighting improved fundamentals and earnings visibility across the sector.