Markets End the Week Deep in Red

The Indian stock market closed the week of August 25–29, 2025, with its steepest losses in nearly five months. Benchmark indices Sensex and Nifty shed close to 2% amid a storm of global and domestic triggers. Foreign institutional investors (FIIs) pulled out nearly $2.66 billion, while overall market capitalization on the BSE contracted by an estimated ₹10 lakh crore.

Key Factors Driving the Decline

Three main triggers defined the week’s bearish trend:

- U.S. Tariffs: A surprise move by Washington to impose 50% tariffs on select Indian goods sent shockwaves across export-focused sectors.

- Rupee Weakness: The Indian currency hit a record low of ₹88.31 against the U.S. dollar, adding pressure on import-heavy industries.

- Reliance Drag: Reliance Industries (RIL) weighed heavily on benchmarks after its AGM failed to excite investors, with added concerns about global energy price volatility.

Day-by-Day Market Recap

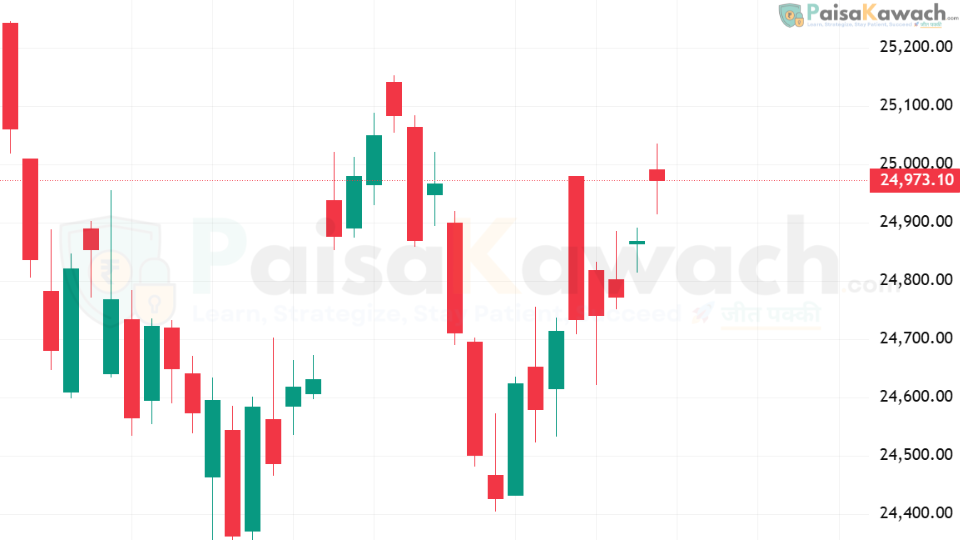

Monday (Aug 25): Cautious Start

The week opened with a cautious tone as markets digested weak global cues. Sensex hovered near 80,200, while Nifty remained stable around 24,700. Broader participation remained muted with IT and banking stocks facing mild selling pressure.

Tuesday (Aug 26): Tariff Shock Hits Midweek

The U.S. tariff announcement led to a broad-based sell-off. Export-oriented sectors—particularly textiles, gems & jewellery, and chemicals—faced heavy declines. Nifty futures indicated a sharp gap-down opening, sliding toward 24,650. FIIs turned net sellers aggressively.

Wednesday (Aug 27): Rupee Tumbles

By midweek, currency markets stole the spotlight as the rupee breached new lows. The RBI intervened cautiously, preventing excessive volatility, but analysts suggested the central bank allowed depreciation to support exporters in tariff-hit sectors.

Thursday (Aug 28): Nervous Consolidation

Equities attempted to stabilize but weak global signals from Wall Street and concerns over crude oil prices capped upside. Defensive buying was visible in ITC, HUL, and Dr. Reddy’s, but failed to offset declines in cyclicals.

Friday (Aug 29): Reliance Weighs Heavily

The week ended with a sharp fall as Sensex slipped by 270 points and Nifty breached 24,450. Reliance Industries, M&M, and financials led losses. Concerns over tariffs and muted AGM outlook dragged RIL shares, wiping billions from investor wealth.

Sector-Wise Performance

Autos: Mixed but Resilient

While Mahindra & Mahindra slumped 2.9% on volumes, Maruti Suzuki saw brokerages reiterate bullish calls, highlighting its EV pipeline and Gujarat expansion. Autos emerged as a relative safe haven despite overall volatility.

IT: Global Headwinds Persist

Indian IT stocks faced continued selling on concerns about U.S. policy shifts and currency pressures. Infosys and TCS remained underperformers, though HCL Tech showed resilience on deal wins.

Financials: Drag on Benchmarks

Banks and NBFCs were among the hardest hit, as rupee weakness and global fund outflows spooked investors. HDFC Bank and Kotak Bank recorded modest declines but retained longer-term investor confidence.

FMCG & Pharma: Defensive Bets

Consumer staples like ITC and Hindustan Unilever, along with pharma majors such as Sun Pharma and Dr. Reddy’s, attracted defensive buying. Analysts expect these sectors to provide near-term stability.

IPO Boom Brings Optimism

Amid the gloom, the IPO market provided some cheer. August saw over 40 IPOs hit Dalal Street, marking one of the busiest months in recent memory. Investor appetite remained robust, with Tata Capital among the most anticipated listings.

Macroeconomic Context

Beyond the market, India’s economic story continues to evolve:

- GST Rationalisation: Reforms promise medium-term growth, with brokerages forecasting Nifty at 28,000 by September 2026.

- Geopolitics: India’s balancing act with China and Russia gains importance in light of tariff shocks.

- Energy Prices: Crude volatility remains a risk factor for inflation and fiscal health.

Expert Commentary

Market experts remain cautious but not overly bearish. The consensus suggests that while near-term volatility will persist, India’s domestic fundamentals—driven by consumption, digitization, and reforms—remain intact.

Outlook for Next Week

Investors should brace for continued volatility in early September. Key factors to watch:

- RBI’s stance on further rupee weakness.

- Global cues from U.S. inflation and Fed commentary.

- IPO momentum and retail investor participation.

- Sectoral shifts toward defensives like FMCG and pharma.

Conclusion

The week of August 25–29, 2025, underscored how global shocks can amplify domestic challenges. Yet, India’s markets also displayed resilience through active IPO activity and selective sector strength. For long-term investors, the correction could offer attractive entry points—provided they tread cautiously in the near term.