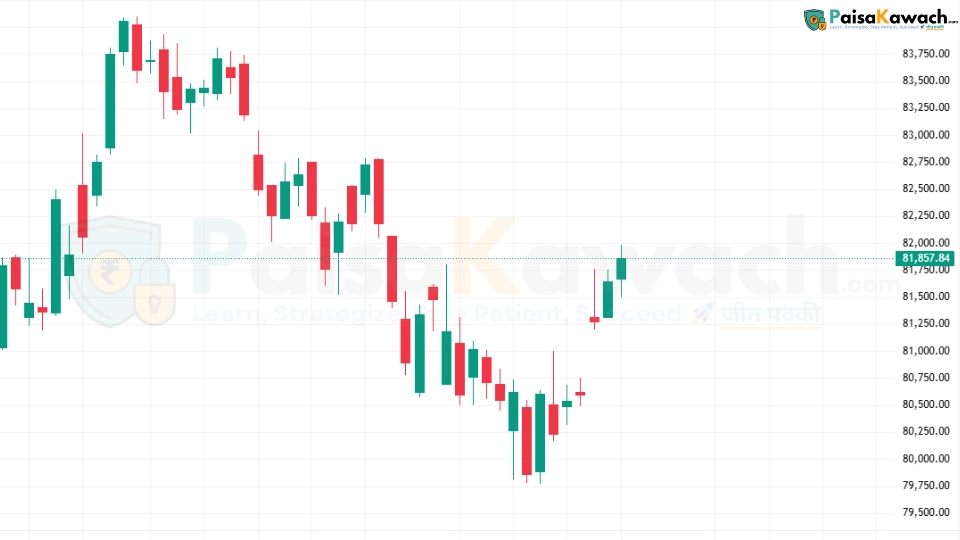

The BSE Sensex closed at approximately ₹82,000 on August 21, 2025, marking a gain of around 142 points (~0.17%) from the previous day. The index reflects continued buying interest amid sustained bullish sentiment as it marked its sixth consecutive day of gains.

Pre-Market Sentiment & Global Context

Early futures suggest a steady start for the Sensex today. The upward momentum is supported by positive domestic flows and broadly stable global cues. Nonetheless, traders remain watchful ahead of potential volatility from global central bank developments, particularly the Jackson Hole symposium.

Key Technical Levels to Watch

- Support zone: A floor near ₹81,800–₹81,900 appears critical to maintain short-term momentum.

- Resistance zone: Near-term resistance likely lies in the ₹82,100–₹82,300 band, where profit-taking may emerge.

Short-Term Technical Forecast

If the Sensex holds support near ₹81,900, it may attempt to challenge resistance in the ₹82,100–₹82,300 range. A successful breakout above ₹82,300 could add momentum toward the ₹82,500 zone. On the downside, a drop below ₹81,800 may invite consolidation or mild weakness around ₹81,600–₹81,500.

Outlook for August 22, 2025

Overall, the market tone suggests a cautiously bullish opening for the Sensex, buoyed by fresh buying interest. However, the index is likely to remain range-bound unless global cues or macro triggers influence sentiment. A wait-and-watch approach may serve traders well until more decisive moves emerge.

Trading Considerations

- Bullish traders: A clean move above ₹82,100 could be an opportunity to target ₹82,300–₹82,500, with a stop near ₹81,900.

- Conservative bears: A break below ₹81,800 may provide a short entry towards ₹81,600–₹81,500, with tight stops above ₹81,900.

- Stick close to global developments, especially from the U.S., alongside domestic bond yields and earnings momentum.

Conclusion

The Sensex appears set for another measured—but optimistic—session on August 22. Holding above ₹81,800 will be key to preserving the bullish bias, while a breakout above ₹82,100 may pave the path higher toward ₹82,500. Meanwhile, a breach of support could lead to a modest retracement in the mid-₹81,000s.