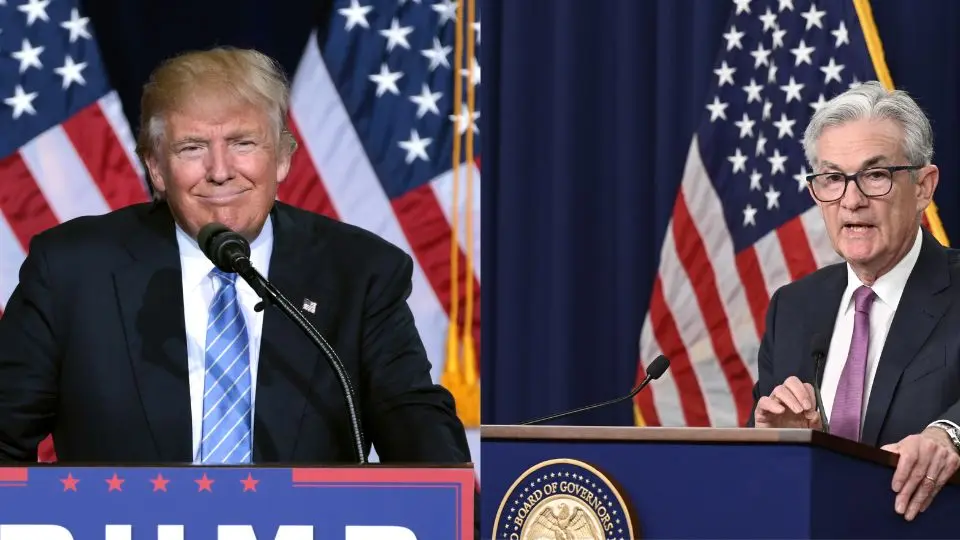

In a move that stunned Washington and Wall Street, President Donald Trump attempted to fire Federal Reserve Governor Lisa Cook earlier this week. The decision, immediately challenged by Cook and her legal team, has sparked a storm of controversy over the independence of the U.S. central bank.

Markets reacted with caution, as investors weighed the potential fallout of political interference in monetary policy. Analysts warn that undermining the Fed’s autonomy could lead to heightened volatility in bonds, equities, and currency markets worldwide.

Why This Matters for Global Investors

The Federal Reserve plays a critical role in shaping U.S. interest rates, inflation policy, and global capital flows. Any threat to its independence is seen as a direct risk to financial stability.

- Bond Markets: Yields may spike if investors fear political control over monetary policy.

- U.S. Dollar: Dollar weakness could follow if credibility in the Fed erodes.

- Stock Markets: Investor confidence may falter, particularly in sectors sensitive to rate policy.

Lisa Cook’s Response

Governor Lisa Cook, a respected economist appointed in 2022, has rejected the dismissal outright, calling it “unlawful and politically motivated.” Her legal team has announced plans to challenge the President’s move in court.

If Cook prevails, the case could establish a historic precedent reinforcing the legal protections around central bank governance. If she loses, however, future administrations may have greater leverage to shape monetary policy for political purposes.

Historical Context

While U.S. presidents have clashed with the Fed before—most famously Richard Nixon pressuring then-Chair Arthur Burns—no sitting president has successfully fired a governor. This makes the Trump–Cook standoff a test case with enormous stakes.

Comparisons Abroad

Experts point out that similar challenges to central bank independence in countries like Turkey and Argentina triggered currency collapses and inflation spirals. While the U.S. economy is far larger and more resilient, the signal it sends could undermine global confidence in American institutions.

What Happens Next?

Legal battles will likely stretch for months, but the immediate question is how markets will react in the coming days. With the Federal Reserve expected to announce its policy outlook in September, investors will be closely watching for signs of internal disruption.

According to Reuters, Wall Street insiders are already preparing for heightened volatility, with some hedge funds hedging against a potential dollar slide.

Bottom Line

Trump’s unprecedented move against the Federal Reserve is more than a political battle—it is a direct challenge to the credibility of U.S. monetary policy. The outcome could reshape not just America’s economic trajectory, but also global trust in its financial leadership.