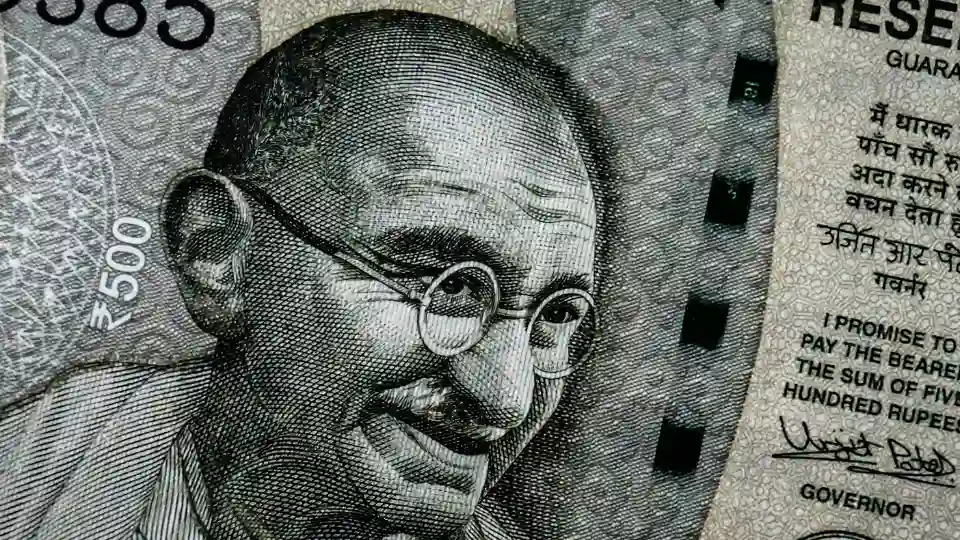

Indian Rupee Strengthens to ₹88/USD Amid Market Recovery

The Indian rupee recorded a modest but meaningful gain on September 2, appreciating by nearly 0.2% to close at ₹88 per U.S. dollar. The upward move was largely driven by improved equity market sentiment and offshore position adjustments, which eased pressure on the local currency.

Equity Market Rally Provides Support

Domestic stock markets staged a recovery after recent volatility, attracting fresh inflows from foreign investors. Analysts suggest that the positive movement in equities created a ripple effect on the currency market, with investors showing stronger confidence in the Indian growth story.

Offshore Position Cleanup Boosts INR

Another contributing factor was the unwinding of speculative positions in offshore markets. These corrections reduced selling pressure on the rupee and allowed it to stabilize against the dollar.

Why Offshore Markets Matter

Offshore non-deliverable forward (NDF) markets often influence the direction of the rupee. When large positions are squared off, it tends to align the onshore spot market with a stronger bias toward appreciation.

Global Context: Dollar Moves and Fed Uncertainty

The dollar index remained steady as investors weighed U.S. Federal Reserve signals on interest rates. A relatively stable greenback helped emerging market currencies, including the rupee, register gains. However, traders remain cautious as global uncertainty continues to loom.

Outlook: Can the Rupee Hold Its Ground?

Currency experts believe the rupee’s trajectory will depend on a mix of domestic fundamentals, global oil prices, and U.S. monetary policy. While the immediate sentiment looks positive, volatility cannot be ruled out.

- Crude oil price trends

- RBI’s intervention and forex reserves strategy

- Foreign portfolio investment flows

- Global risk appetite and U.S. inflation data

Conclusion

The rupee’s climb to ₹88 per dollar reflects a blend of market optimism, improved investor confidence, and technical corrections in offshore positions. While encouraging, experts caution that the currency may still face challenges if global headwinds intensify.