Every month, one data point quietly carries more weight than most headlines combined. Today, that data point is India's flash Purchasing Managers' Index (PMI) for February 2026 — the earliest available snapshot of how the economy is performing in real time. Released on February 20, 2026, the flash PMI arrives at a moment when investors, businesses, and policymakers are all asking the same question: is India's growth story still intact, or are cracks beginning to appear?

The timing could not be more significant. January's PMI readings, while still comfortably in expansion territory, carried an undercurrent of caution. Manufacturing activity grew, services remained strong, but business confidence quietly slipped to its lowest level in three and a half years. That combination — growth without conviction — is precisely what makes today's February flash data so closely watched.

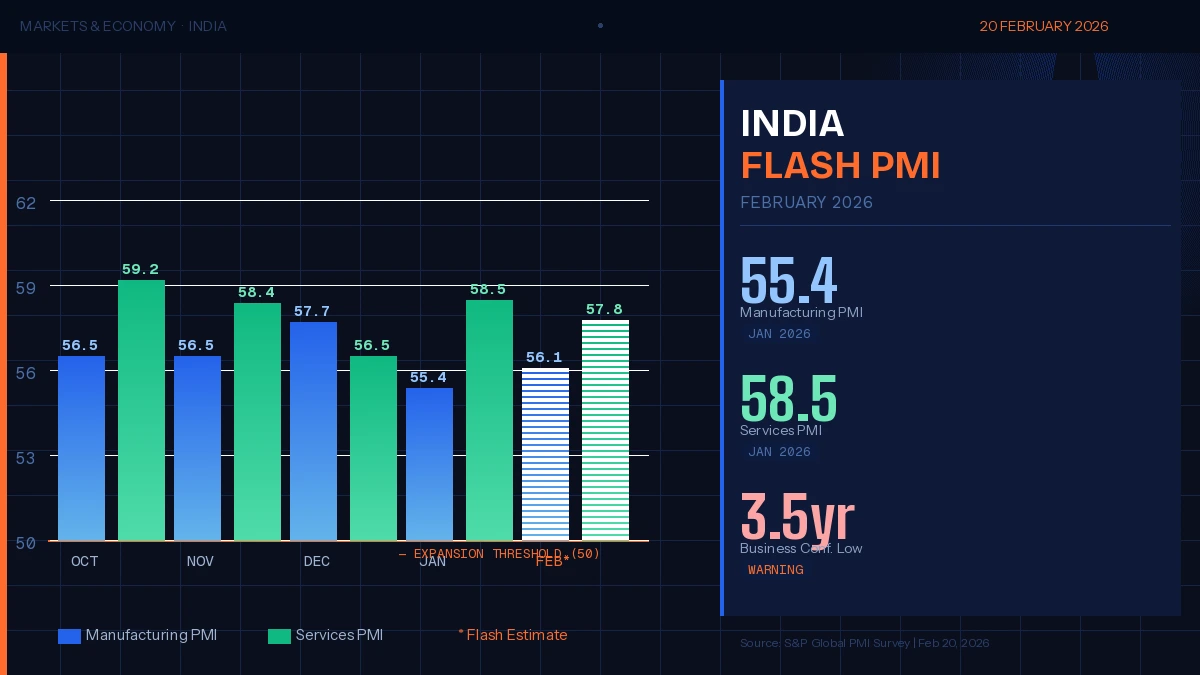

📊 Key Facts Snapshot — India PMI, February 2026

- January Manufacturing PMI (Final): 55.4 (revised down from flash 56.8)

- January Services PMI (Final): 58.5 (revised down from flash 59.3)

- Business Confidence: Hit a 3.5-year low in January 2026

- Expansion Threshold: Any reading above 50 signals growth

- Today's Release: February 2026 Flash PMI — first look at month's activity

- Key Watch: Whether manufacturing holds above 55 and services sustain near 58+

What January's PMI Was Really Telling Us

On the surface, January looked fine. A manufacturing PMI of 55.4 and a services PMI of 58.5 are numbers most economies would envy. Both figures sit well above the 50-point threshold that separates expansion from contraction, and India has now maintained a consistent streak of above-50 readings for well over two years.

But beneath those headline numbers, a softer story was unfolding. Both the manufacturing and services readings came in lower than their initial flash estimates — manufacturing was revised down from 56.8, and services from 59.3. More telling still was the sharp drop in forward-looking business confidence, which fell to a level not seen since mid-2022. Only 15% of firms expected output growth over the year ahead — a figure that signals hesitation, not pessimism, but hesitation nonetheless.

Economists have attributed this confidence dip to a mix of factors: global trade uncertainty following renewed US tariff actions, moderating urban consumption, and a period of wait-and-watch as businesses digest the Union Budget 2026–27 announcements made on February 1.

Why Today's Flash PMI Matters More Than Usual

The flash PMI is not a final number — it is an early estimate based on approximately 85–90% of monthly survey responses. But markets treat it as gospel in real time, because it is the first hard data point available for the current month. By the time final PMI numbers arrive two weeks later, markets have largely moved on.

Today's release is also landing alongside the RBI Monetary Policy Committee (MPC) meeting minutes — another major data release scheduled for February 20. The combination of PMI data and MPC minutes in a single session creates a high-information day for traders and analysts, with potential for meaningful market movement depending on what both sets of data reveal.

What This Means for Investors and Markets

For equity markets, PMI data feeds directly into earnings expectations. Strong services activity supports IT, BFSI, and consumer discretionary sectors. Robust manufacturing numbers bolster auto, industrials, and capital goods. With Nifty50 already under pressure — down 365 points on Thursday alone — investors are hoping today's PMI can provide a fundamental anchor to stabilise sentiment.

For the bond market, the PMI reading intersects with the RBI's rate trajectory. India's CPI inflation came in at 2.75% in January — within the RBI's 2–4% target band for the first time since August 2025. A softer PMI today could strengthen the case for further rate cuts, which would be positive for bond prices and rate-sensitive stocks like real estate and NBFCs.

Foreign institutional investors (FIIs), who have been net sellers of Indian IT stocks to the tune of ₹10,956 crore in early February, will also scrutinise the services PMI closely. A strong reading could slow that outflow trend.

India vs. Peers — How Does the PMI Compare Globally?

India's PMI performance continues to stand out in a global context. While major economies like Germany and Japan have been struggling to stay above the 50-mark, and China's recovery has remained uneven, India has delivered some of the strongest consistent PMI readings among major emerging markets over the past 18 months.

According to S&P Global, which compiles India's PMI surveys, the country's services sector in particular has been a standout performer, driven by domestic demand, digital adoption, and a growing export base in business process services. The February flash reading will test whether that outperformance is durable or beginning to normalise.

What to Watch Next

Beyond today's flash release, the final February PMI will be published in the first week of March, offering a more complete picture. In parallel, investors will track:

- RBI MPC minutes (released today alongside PMI) for rate cut signals

- Q3 FY26 corporate earnings — now in their final stretch — for demand confirmation

- February trade data, due mid-March, to assess export resilience

- Global PMI flash readings from the US and Eurozone, also released today, for cross-market context

- Rupee movement — currently stabilising near ₹90.67/USD — as a proxy for FII sentiment

The broader narrative for India's economy in 2026 remains one of cautious optimism. Growth is real, services are humming, and inflation is finally cooperating. But business confidence needs to recover, and today's PMI is the next test of whether it is.