Protective Put 101 — Insurance Approach

Protect your holdings by buying put options as insurance on stocks you own. This beginner-friendly strategy is risk-aware, defines entries …

Welcome! During the launch period, access is free for all visitors.

Protect your holdings by buying put options as insurance on stocks you own. This beginner-friendly strategy is risk-aware, defines entries …

Generate steady income from stocks you already own by selling call options against your position. This beginner-friendly strategy is risk-a…

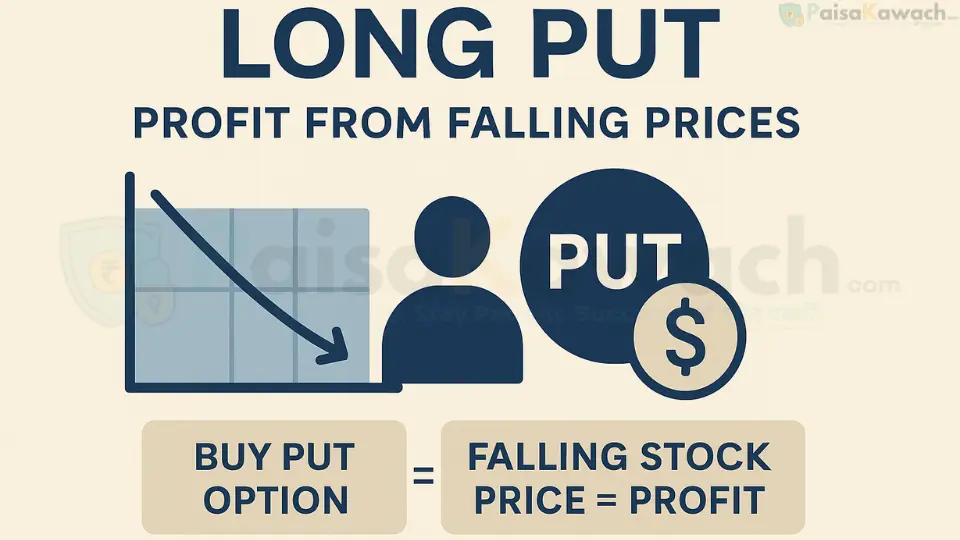

A Long Put is a simple bearish options strategy where you buy a put option to profit from falling stock prices. Risk is limited to the prem…

A Long Call is the simplest bullish options strategy where you buy a call option to profit from rising stock prices. Risk is limited to the…

A limited-risk bullish strategy created by buying a lower strike Call and selling a higher strike Call, ideal for moderately bullish market…

A defined-risk bearish strategy created by buying a higher strike Put and selling a lower strike Put, suitable for moderately bearish outlo…

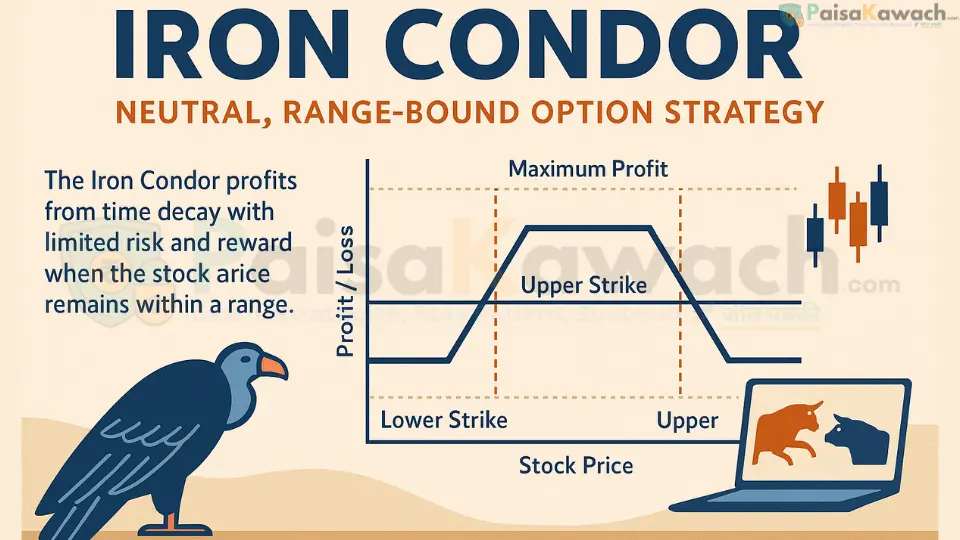

A non-directional strategy that profits from time decay if the market stays within a range, ideal for neutral outlooks.

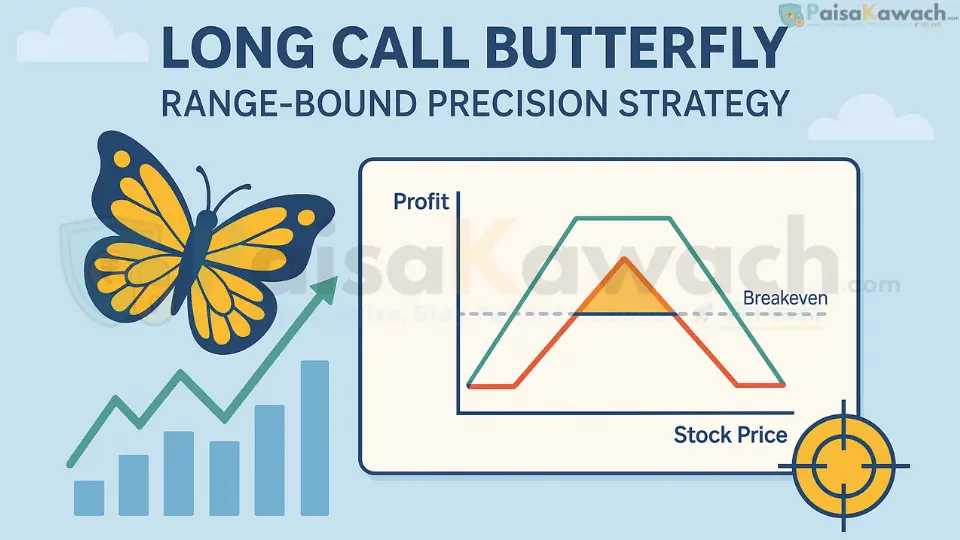

A precision expiry strategy with very low risk, where max profit occurs if the stock closes near the middle strike.

The Long Straddle is a volatility strategy where you buy a call and a put with the same strike and expiry. Risk is limited to premiums paid…

The Bull Put Spread is a moderately bullish options strategy where you sell a Put at a higher strike and buy another Put at a lower strike.…

The Bear Call Spread is a moderately bearish options strategy where you sell a Call at a lower strike and buy another Call at a higher stri…

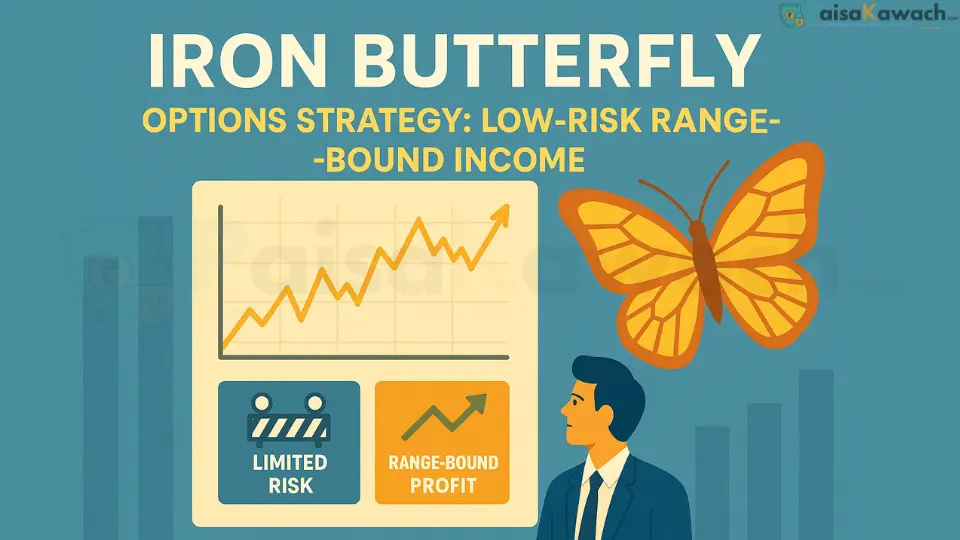

The Iron Butterfly is a defined-risk options strategy that combines a Short Straddle with protective wings. It profits when the market stay…

The Long Strangle is a volatility strategy where you buy an out-of-the-money Call and Put with the same expiry. It costs less than a Long S…

The Short Straddle is a premium-collecting options strategy where traders sell both a Call and a Put at the same strike. It profits in rang…

The Short Strangle is a premium-selling strategy where traders sell an out-of-the-money Call and Put. It profits if the market stays in a r…